Australia launched new laws. It requires monetary licenses for crypto platforms. This tightens oversight for the rising sector.

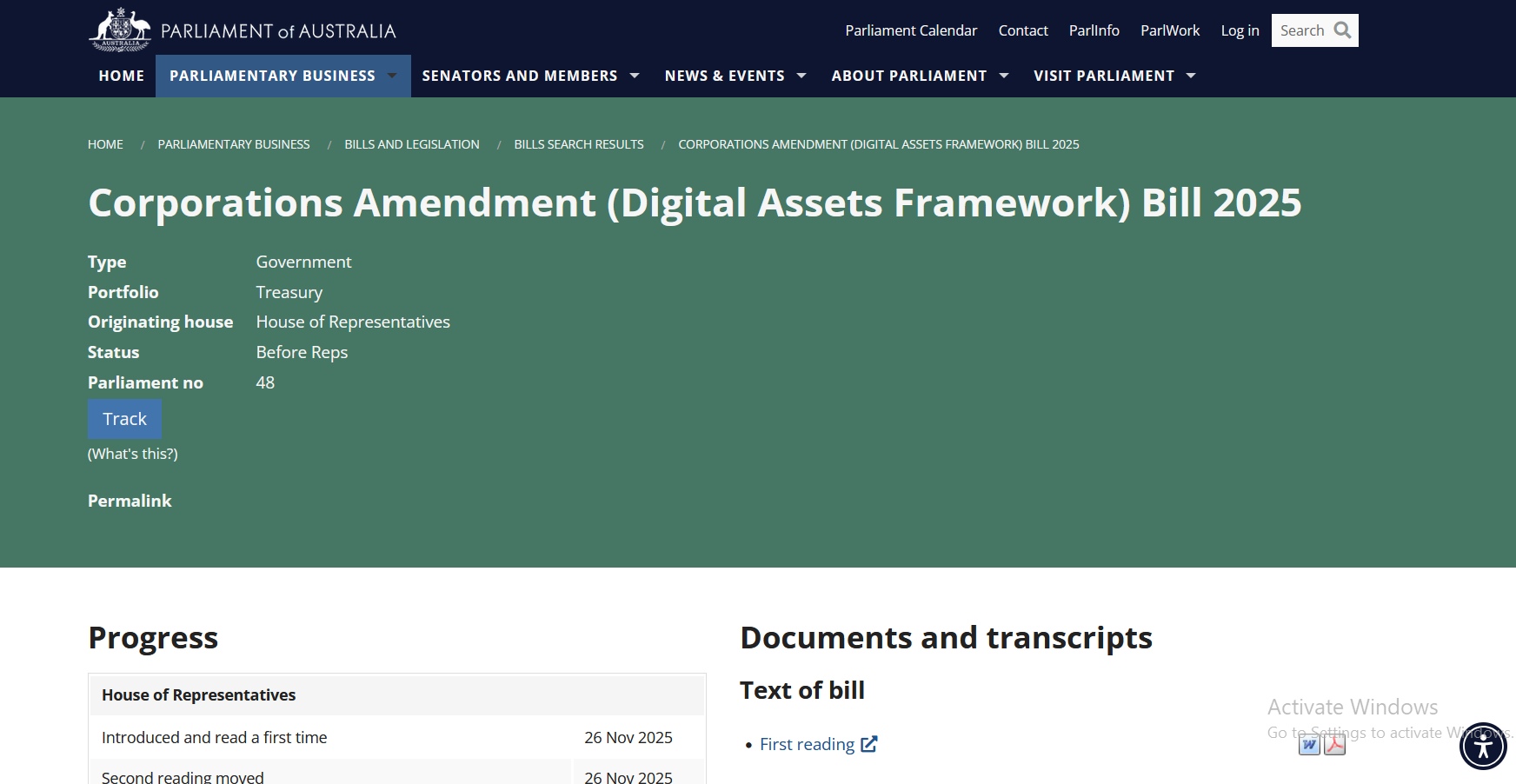

The Australian authorities has launched new laws. It could require monetary licenses for crypto platforms. This offers a firmer grip on the booming trade. The Treasury submitted the Firms Modification (Digital Belongings Framework) Invoice 2025. This was despatched off on Wednesday to the parliament. It was adopted by the circulation of the draft invoice. This was throughout its session in September.

Australia’s Crypto Invoice Advances to Second Studying

The SEC’s new tips goal to streamline the approval course of and enhance readability. Furthermore, they sign constructive information for crypto ETFs. Moreover, the company accredited generic itemizing requirements for commodity belief shares. The federal government says the proposed reforms might unlock as a lot as $24 billion in elevated annual productiveness good points. Additionally they improve protections for Australians. These safeguards assist to guard the individuals who belief digital belongings to non-public platforms.

Treasurer Jim Chalmers and Minister for Monetary Companies Daniel Mulino introduced the Firms Modification (Digital Belongings Framework) Invoice 2025 on Wednesday. This invoice units up the primary full regulatory framework within the nation. This is applicable to corporations that retailer crypto for his or her prospects.

Associated Studying: Crypto Information: Australia Wants To Transfer Quick And Undertake RWAs, Authorities Exec Says | Reside Bitcoin Information

Australia’s Crypto Invoice passes second studying in Parliament. The invoice acquired its first studying in Parliament. It instantly went on to a second studying. This introduced the talk on the ideas of it earlier than an in depth examination.

They’re critical about Australia’s crypto trade, the ministers mentioned in a joint assertion. They added that blockchain and digital belongings signify huge alternatives for our financial system, our monetary sector, and companies.

Australia proposed the Firms Modification (Digital Belongings Framework) Invoice 2025 to the Parliament on November 26, 2025. This can imply that crypto platforms and tokenized custody suppliers should acquire an Australian Monetary Companies Licence (AFSL).

The brand new laws will deliver these companies underneath the management of the Australian Securities and Investments Fee (ASIC). That is similar to the normal monetary establishments. The aim of the invoice is to safeguard shoppers and create confidence out there.

Key Particulars of New Crypto Laws Revealed

All digital asset platforms (DAPs) and tokenized custody platforms (TCPs) will want an Australian Monetary Companies Licence (AFSL). That is to function legally. ASIC oversight: ASIC would be the predominant regulator. It can implement requirements of custody, settlement, and safety of consumers.

There are exemptions for smaller platforms which are much less dangerous. These platforms are usually not topic to full licensing. These exemptions apply to platforms that home lower than $5,000 per buyer. Additionally they apply to platforms with an annual transaction quantity of lower than $10 million.

Penalties for non-compliance are excessive. The invoice offers for the introduction of fines as much as AUD 16.5 million. Or, a proportion of annual turnover may be fined. Compliance timelines: Crypto companies which are at the moment working can have six months by which to start registration. They may have 12 months to completely license. This timeline begins following the date the coverage goes into impact.

The brand new guidelines put crypto actions inside the current legal guidelines governing monetary providers. This offers for constant laws on comparable actions. The trade response has been cautiously supportive. Many hope the transfer will assist to draw funding. Additionally they hope that it’ll legitimize the sector. Nevertheless, smaller gamers concern the price of compliance.

This legislative shift places Australia on par with avant-garde international locations. They search to manage the digital asset area comprehensively. The framework is meant to strike a steadiness between innovation and investor safety. This technique could promote market stability.