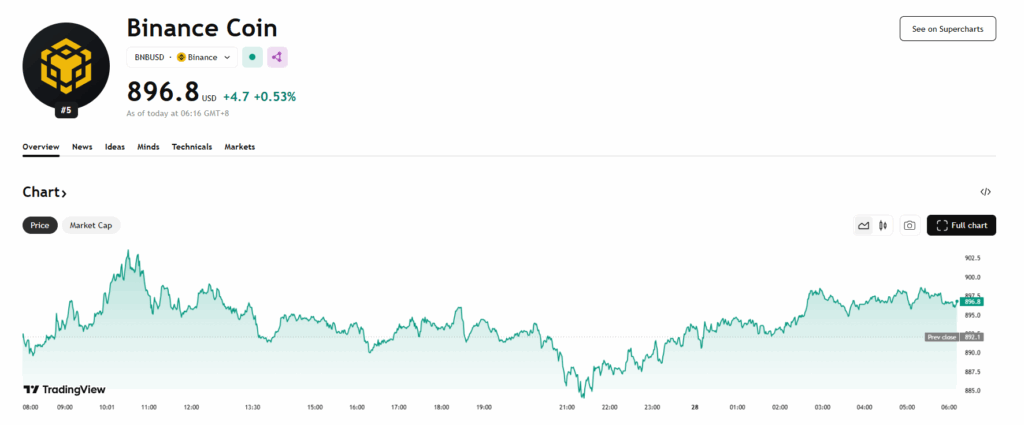

- BNB rose 4.25% to $891 regardless of a significant drop in community exercise.

- Whales could also be quietly repositioning as value consolidates beneath $900.

- Roadmap upgrades, ETF overview, and ongoing burns help long-term confidence.

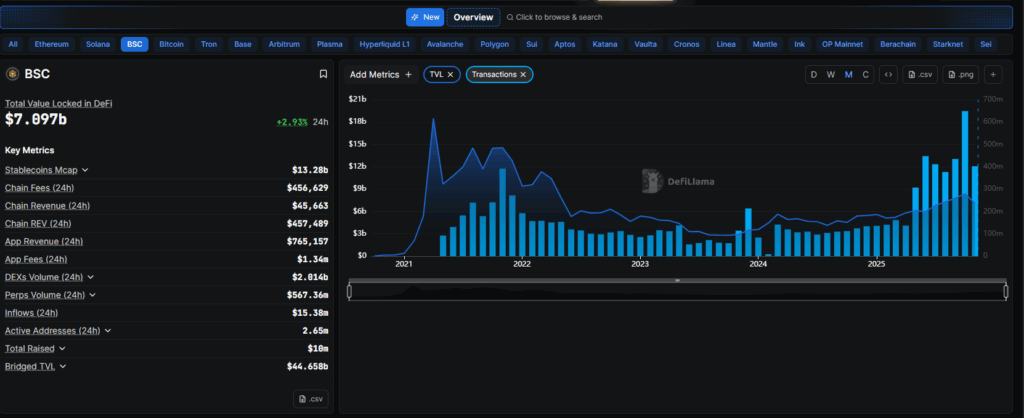

BNB managed to rise 4.25% up to now 24 hours, climbing to round $891—whilst its underlying blockchain is displaying one among its weakest utilization durations of the 12 months. Based on new information from DeFiLlama, BNB Chain day by day transactions have fallen almost 50% this month to simply 15.1 million. Community utilization has dipped to 19%, and decentralized change volumes have dropped by over $5 billion. This slowdown displays the fading memecoin buying and selling frenzy and the broader crypto pullback that noticed Bitcoin briefly dip towards the $82,000 stage.

Market Reveals Stability as Giant Holders Reposition

Regardless of weaker fundamentals, BNB’s value has held surprisingly agency. The token is consolidating proper beneath the $900 zone, with tight buying and selling ranges and progressively declining quantity suggesting whales could also be quietly repositioning. Earlier in November, BNB slipped below $1,000 throughout the wider market downturn, however robust fingers look like defending present ranges. The CoinDesk Analysis technical mannequin flags this stability as an indication that merchants anticipate catalysts on the horizon—even when short-term exercise stays in decline.

Roadmap Upgrades and ETF Assessment Assist Longer-Time period Outlook

BNB’s 2025–2026 roadmap continues to position heavy deal with scaling upgrades designed for institutional-grade DeFi, high-throughput buying and selling programs, and rising AI-driven purposes. These commitments are a part of why some merchants are trying previous the non permanent hunch in utilization. Including to this narrative, the U.S. SEC continues to be reviewing VanEck’s proposed spot BNB ETF—an approval that would open a brand new wave of regulated demand for the asset, much like what Bitcoin and Ethereum ETFs skilled.

Burns Proceed, however Exercise Drop Might Gradual Future Reductions

BNB’s long-standing burn mechanism stays one among its strongest worth pillars. In Q3 2025 alone, roughly $1.2 billion value of BNB was completely faraway from circulation. Nonetheless, with on-chain exercise shrinking, future burn totals might soften because the mechanism is partially tied to utilization ranges. Even so, diminished provide over time retains BNB in a good structural place—offered the community can regain momentum because the market recovers.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.