- Bitwise turns into the primary issuer to allow staking inside a spot Avalanche ETF.

- BAVA presents the bottom sponsor charge amongst AVAX ETFs, with a full charge waiver on early inflows.

- The ETF goals for Q1 2026 approval as competitors heats up throughout main exchanges.

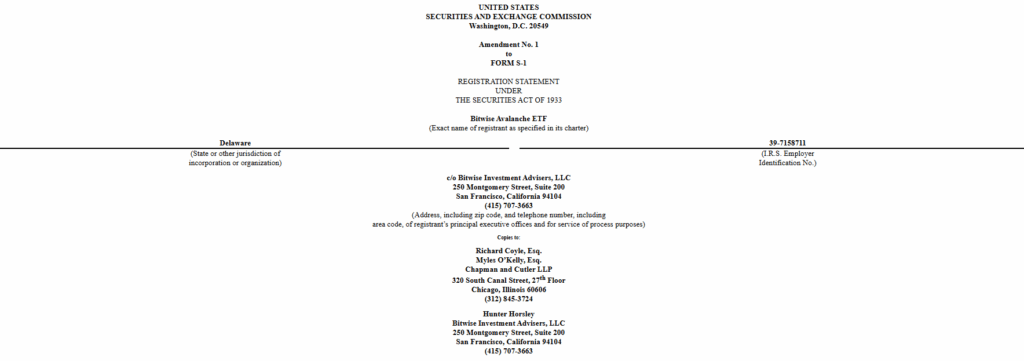

The race to launch the primary U.S. Avalanche ETF simply bought much more aggressive, with Bitwise updating its SEC submitting and changing into the primary issuer prepared to incorporate staking instantly inside a spot AVAX ETF. The modification shifts the fund to the brand new ticker BAVA and locks its sponsor charge at 0.34%, undercutting rivals like VanEck at 0.40% and Grayscale at 0.50%. The transfer alerts Bitwise’s intent to dominate the Avalanche ETF lane whereas additionally giving traders a low-friction method to faucet into yield.

Introducing Yield By Staking for Conventional Traders

In a notable shift for ETF design, Bitwise says BAVA will be capable to stake as much as 70% of its AVAX holdings, producing extra tokens via the Avalanche proof-of-stake community. It’s the primary U.S. ETF proposal to overtly embrace staking after new IRS steerage cleared the way in which for yield-generating crypto ETFs with out creating tax problems. Bitwise plans to take a 12% reduce of staking rewards to cowl bills whereas passing the remainder again to shareholders, making a hybrid mannequin that blends conventional ETF construction with native crypto yield.

BAVA Goals to Turn out to be the Least expensive Route Into Avalanche

To sweeten the providing, Bitwise is waiving all sponsor charges for the primary month on the preliminary $500 million of inflows, making BAVA the lowest-cost entry level for establishments that need publicity to Avalanche alongside staking revenue. The submitting additionally introduces a liquidity reserve, tighter custody preparations with Coinbase, and expanded threat disclosures protecting all the pieces from quantum-computing threats to exchange-level vulnerabilities. It’s a extra strong construction than earlier drafts and alerts Bitwise’s push to safe early institutional credibility earlier than launch.

Eyes on Q1 2026 for Last Approval

If permitted, Bitwise’s BAVA ETF will commerce on NYSE Arca, whereas Avalanche merchandise from Grayscale and VanEck are concentrating on the NASDAQ as a substitute. All three issuers at the moment are aiming for approval in Q1 2026, creating some of the aggressive ETF lineups since Bitcoin and Ethereum entered the regulated ETF panorama. For Avalanche, the introduction of staking inside a spot ETF could possibly be a defining second that reshapes institutional entry heading into the subsequent cycle.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.