Be a part of Our Telegram channel to remain updated on breaking information protection

Ripple’s US dollar-pegged stablecoin RLUSD has been cleared for institutional use in Abu Dhabi after receiving recognition as an Accepted Fiat-Referenced Token by the native monetary regulator.

In an announcement right this moment, Ripple mentioned that the recently-gained approval will enable regulated companies to deploy RLUSD inside the Abu Dhabi World Market’s (ADGM) monetary zone. That is a global monetary middle and free zone that’s situated on Al Maryah and Al Reem Islands in Abu Dhabi.

Compliance and belief are non-negotiables for institutional finance.

That is why $RLUSD has been greenlisted by Abu Dhabi’s FSRA, enabling its use as collateral on exchanges, for lending, and on prime brokerage platforms inside @ADGlobalMarket—the worldwide monetary centre of…

— Ripple (@Ripple) November 27, 2025

The regulatory nod got here from Abu Dhabi’s Monetary Providers Regulatory Authority, which oversees the ADGM.

“ADGM is acknowledged globally for its strong and forward-thinking regulatory management, so this approval reinforces RLUSD as a compliant stablecoin that meets the very best requirements of belief, transparency, and utility,” mentioned Ripple Center East and Africa Managing Director Reece Merrick.

“This recognition is yet one more step ahead for Ripple’s operations within the area, the place we’re experiencing surging curiosity in our merchandise,” Merrick added.

Ripple Increasing Its Presence In The UAE

The current approval is the newest improvement in Ripple’s broader push to develop its presence within the UAE.

In October 2024, the corporate revealed that it was pursuing a license from the Dubai Monetary Providers Authority (DFSA) to increase its digital asset service providing within the UAE. Later that month, the corporate then secured in-principle approval.

Earlier this 12 months, in March, Ripple went on to verify that it had acquired full regulatory approval, which allowed the corporate to supply cross-border crypto cost providers contained in the Dubai Worldwide Monetary Centre (DIFC).

A number of months later, the DFSA then permitted RLUSD to be used by corporations working contained in the DIFC. Which means that the stablecoin can be utilized for regulated actions similar to treasury administration and funds.

Along with these regulatory milestones, Ripple has additionally signed Zand Financial institution and Mamo, a fintech app, as early customers of its blockchain-based funds stack.

RLUSD Surpasses $1 Billion Market Cap Amid Stablecoin Growth

Ripple’s RLUSD was launched in late 2024, and has since soared to change into one of many greatest stablecoins available in the market with a capitalization of over $1 billion.

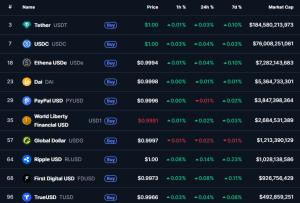

Knowledge from CoinMarketCap reveals that RLUSD is ranked because the Eighth-largest stablecoin by market cap, behind World Greenback (USDG) and above First Digital USD (FDUSD).

High stablecoins by market cap (Supply: CoinMarketCap)

The token is issued beneath a New York Division of Monetary Providers Restricted Function Belief Firm Constitution. In response to Ripple’s announcement, the token has “stringent safeguards” in place. These embrace a 1:1 USD backing with high-quality liquid property, strict reserve administration and asset segregation, third-party attestation, and clear redemption rights.

The current approval for RLUSD to function within the ADGM follows what has been a report 12 months for stablecoins.

The area began to achieve substantial momentum after US President Donald Trump signed the GENIUS Act into regulation in July.

The regulatory readability that the GENIUS Act offered the business noticed a number of main conventional finance companies begin to discover stablecoins. This led to the capitalization of the stablecoin market hovering to above $300 billion for the primary time, in accordance with DefiLlama information.

Amid the increase within the stablecoin market, Tether’s USDT has maintained its dominance. At the moment, the stablecoin accounts for over 60% of the market, or round $184.529 billion, information from DefiLlama reveals. The subsequent-biggest stablecoin is Circle’s USD Coin (USDC), which has a capitalization of over $75.48 billion.

UAE Handed Sweeping New Central Financial institution Legislation For DeFi And Web3

The UAE is usually thought to be a hub for decentralized finance (DeFi) and Web3, given its crypto-friendly insurance policies.

As world regulators proceed to work in direction of making a regulatory framework for digital property, the UAE handed a sweeping new central financial institution regulation earlier this week that brings DeFi and a big portion of the Web3 business beneath formal regulatory oversight.

The UAE’s new central financial institution regulation, Federal Decree Legislation No. 6 of 2025, regulates monetary establishments, insurance coverage enterprise, in addition to digital asset-related actions.

The brand new regulation’s key provisions, Article 61 and Article 62, listing actions that require a license from the Central Financial institution of the UAE, together with crypto funds and digital saved worth.

In follow, the regulation signifies that DeFi initiatives can now not keep away from regulation by claiming that they’re simply code. It additionally signifies that decentralization now not exempts a protocol from compliance.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection