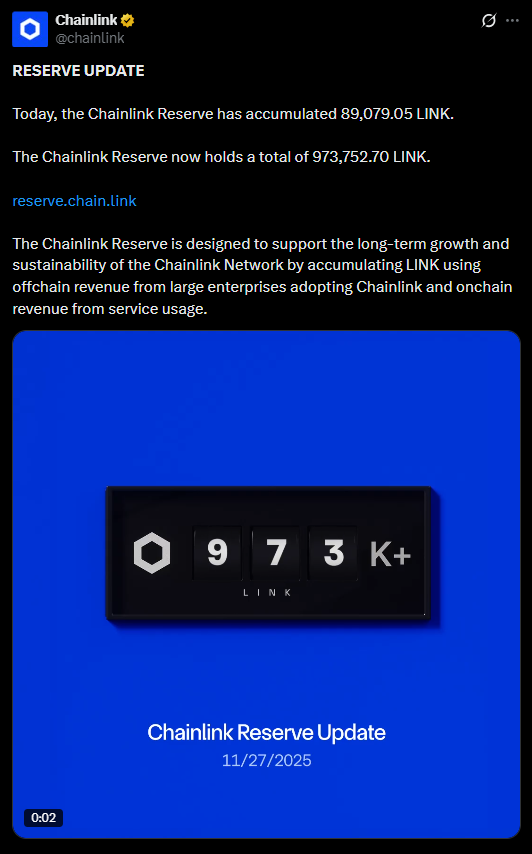

- The Chainlink Reserve has accrued over 973,700 LINK and is near hitting the one-million milestone.

- Income from off-chain and on-chain community exercise is mechanically transformed into LINK and locked for years.

- Constant deposits sign increasing enterprise utilization and stronger long-term fundamentals for the Chainlink ecosystem.

Chainlink is closing in on a serious milestone, with its on-chain treasury system now holding greater than 973,700 LINK after a gradual three-month accumulation streak. The community confirmed one other deposit this week, bringing it inside placing distance of 1 million LINK locked for long-term progress. The tempo has been surprisingly constant, reflecting how a lot exercise continues to move into Chainlink from each enterprise customers and on-chain protocols regardless of the uneven market backdrop.

How the Autonomous Reserve Really Works

The Chainlink Reserve isn’t a standard treasury. It runs mechanically by way of good contracts that convert income—coming from off-chain enterprise funds and on-chain service charges—immediately into LINK by way of decentralized exchanges. As soon as deposited, the tokens are locked for a number of years underneath a no-withdrawal rule, enforced by a timelock. It’s mainly a slow-burn accumulation engine designed to maintain LINK flowing again into the ecosystem over time, as an alternative of letting income sit idle or get redirected elsewhere.

Adoption Continues to Gas Regular LINK Inflows

An enormous a part of why the reserve retains rising is solely utilization. Enterprises utilizing Chainlink’s off-chain computation instruments, information feeds, and cross-chain providers contribute actual cost quantity. In the meantime, on-chain merchandise akin to CCIP and automation proceed producing charges that get directed into the reserve. Even in a softer market, utilization hasn’t slowed, and people weekly deposits paint an image of a community with rising real-world traction. Each new integration pushes extra LINK into long-term storage, tightening total circulating provide.

A Basis for LINK’s Lengthy-Time period Stability

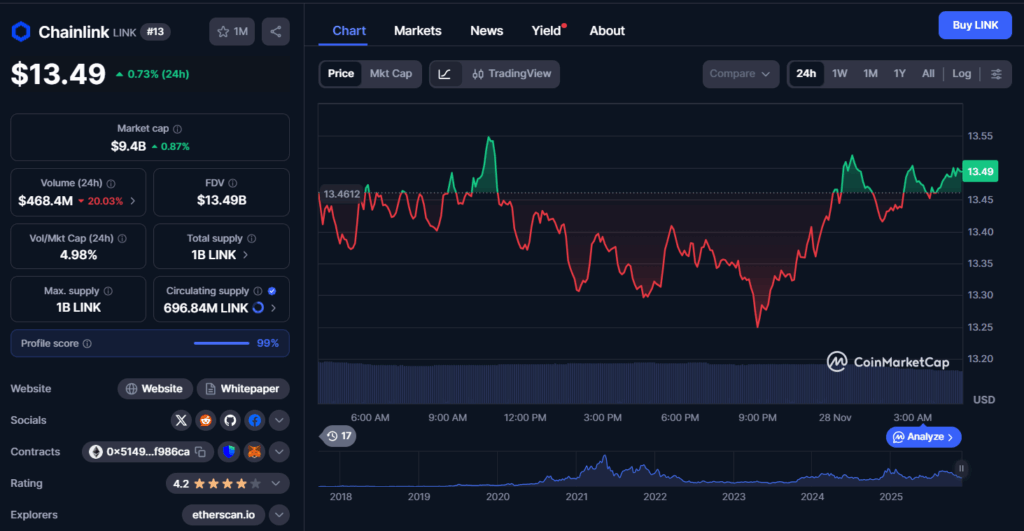

With the reserve nearing a million LINK, Chainlink is reinforcing its financial framework at a second when many networks are nonetheless attempting to outline theirs. The multi-year lock mechanism pushes the venture towards sustainability moderately than fast liquidity, and that may assist stabilize LINK’s market profile over time. Whether or not the tempo of accumulation will increase heading into 2026 seemingly relies on how rapidly enterprise adoption scales, however the present pattern suggests regular energy beneath the floor.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.