Bitcoin is buying and selling inside an outlined vary as market individuals monitor two key ranges. The present value is $91,000, exhibiting a small achieve over the previous 24 hours and an nearly 10% rise over the previous week (CoinGecko).

Regardless of the latest upward pattern, BTC stays capped under resistance, with sturdy help sitting decrease within the chart.

Key Value Ranges Shaping Bitcoin’s Vary

On-chain information reviewed by Ali Martinez means that Bitcoin is caught between two high-activity zones. Round $84,570, roughly 610,635 BTC have been final moved. This degree displays a big quantity of previous transactions, indicating sturdy shopping for curiosity that will assist maintain the worth throughout downward strikes.

For Bitcoin $BTC, $84,570 is the help that issues, and $112,340 is the ceiling to observe. pic.twitter.com/rI0dhCgiMK

— Ali (@ali_charts) November 27, 2025

On the increased finish, $112,340 is taken into account the following main degree at which provide might return to the market. Roughly 576,252 BTC have been final traded close to this value. A smaller cluster close to $104,765, with over 402,000 BTC moved, might provide extra resistance earlier than any strategy to $112K.

Resistance at $91,772 and Momentum Outlook

Bitcoin has been testing the realm slightly below $91,800. This zone has held agency as a short-term cap, stopping additional upside. Analyst Michaël van de Poppe mentioned,

“BTC wants to interrupt this significant degree.”

Momentum has returned after the latest bounce from the $82,000 area. Nevertheless, with out a clear break above the present ceiling, the worth route stays unsure. Key ranges to observe if the pattern continues embody $107,260 and $111,918.

Furthermore, Lennaert Snyder noticed that Bitcoin is compressing close to the $93,000 resistance. He defined that if this degree breaks, the worth might head to $95,480. If rejected, a transfer again towards $90,000 and even $87,800 might happen.

“If we lose $90,000 help, shorts to ~$87,800 are triggered,” he added.

Snyder additionally famous that $87,800 might act as one other help for lengthy entries if the worth finds stability there. The compression close to $93,000 signifies {that a} clear directional transfer could possibly be coming quickly.

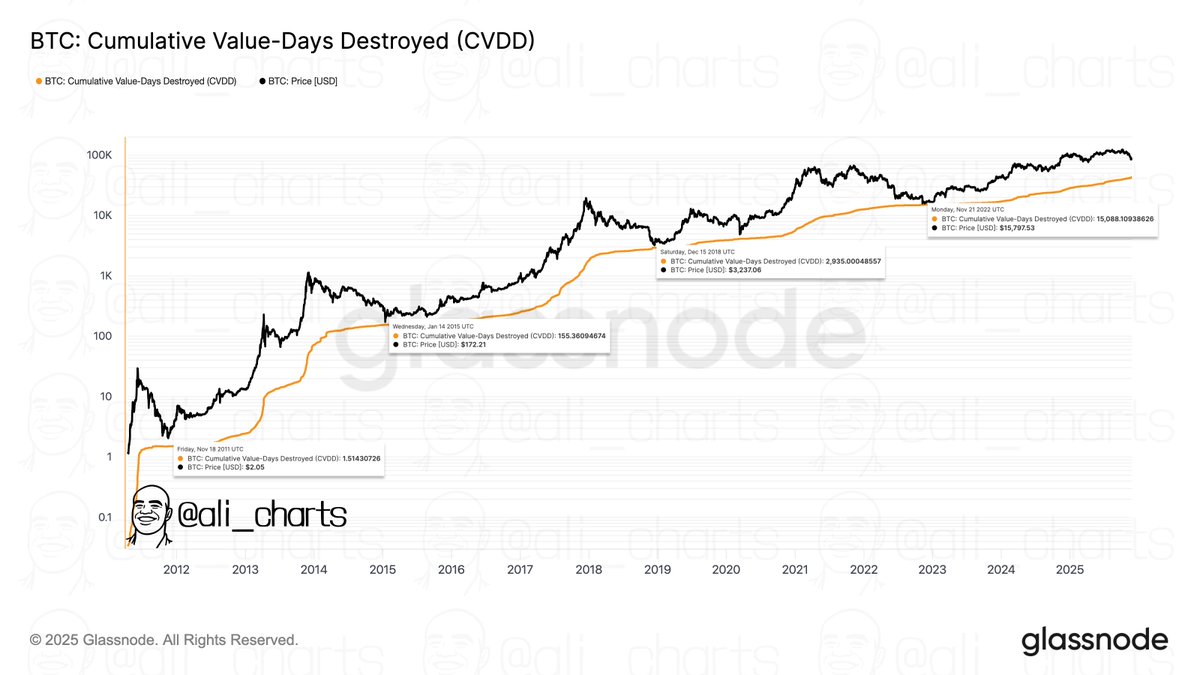

Community Exercise Sign Strikes Forward

Moreover, Martinez additionally referred to the CVDD metric as a information for figuring out market bottoms. The mannequin tracks when older models are moved, giving perception into potential cycle lows. Previous information exhibits it has been near the precise backside throughout earlier downturns.

“The CVDD has a stable monitor file of serving to establish terminal bottoms,” he defined.

Elsewhere, Daan Crypto Trades pointed to rising world liquidity as a potential driver. The World Liquidity Index, which turned increased this week, might help stronger value motion if the pattern continues.

The submit Bitcoin’s $84K-$112K Vary: Which Method Will BTC Breakout Subsequent? appeared first on CryptoPotato.