Bitcoin extends its decline: What’s taking place?

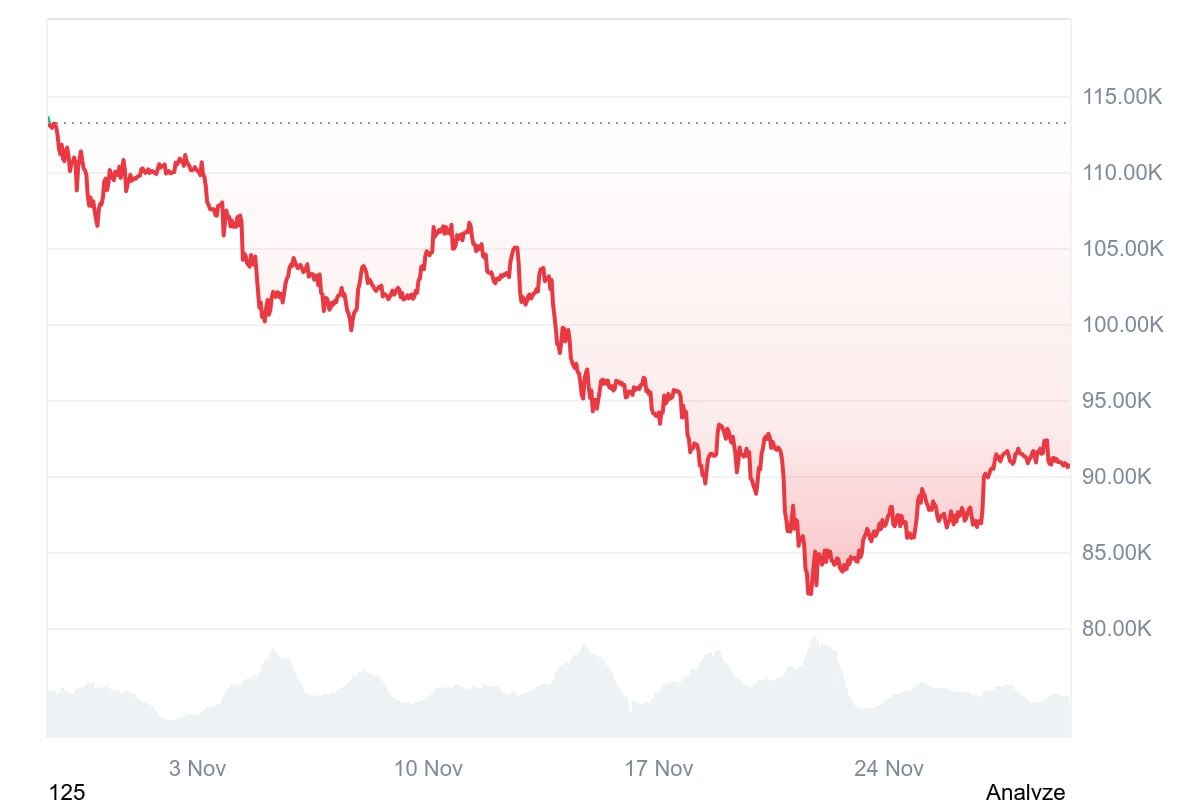

Bitcoin has seen a variety of straggles recently, dropping greater than 20% over the previous month and dropping over 40% from its early October excessive above $126,000.

November grew to become its worst month since June 2022, a interval remembered for deep market turmoil.

The current drop to the $80,000 space marked its lowest level in seven months. Even with a modest restoration afterward, the broader chart nonetheless displays a transparent downward pattern.

There has additionally been a noticeable shift in the way in which sellers behave. For example, final week Bitcoin reached some extent the place passive promoting strain on spot markets and perpetual futures stopped driving costs decrease.

Liquidity stays stacked above the $92,000 stage, which exhibits that some traders are nonetheless keen to promote into power. Nonetheless, they’re now not overwhelming the market as they did in the course of the sharp declines in early November.

Institutional help for BTC continues

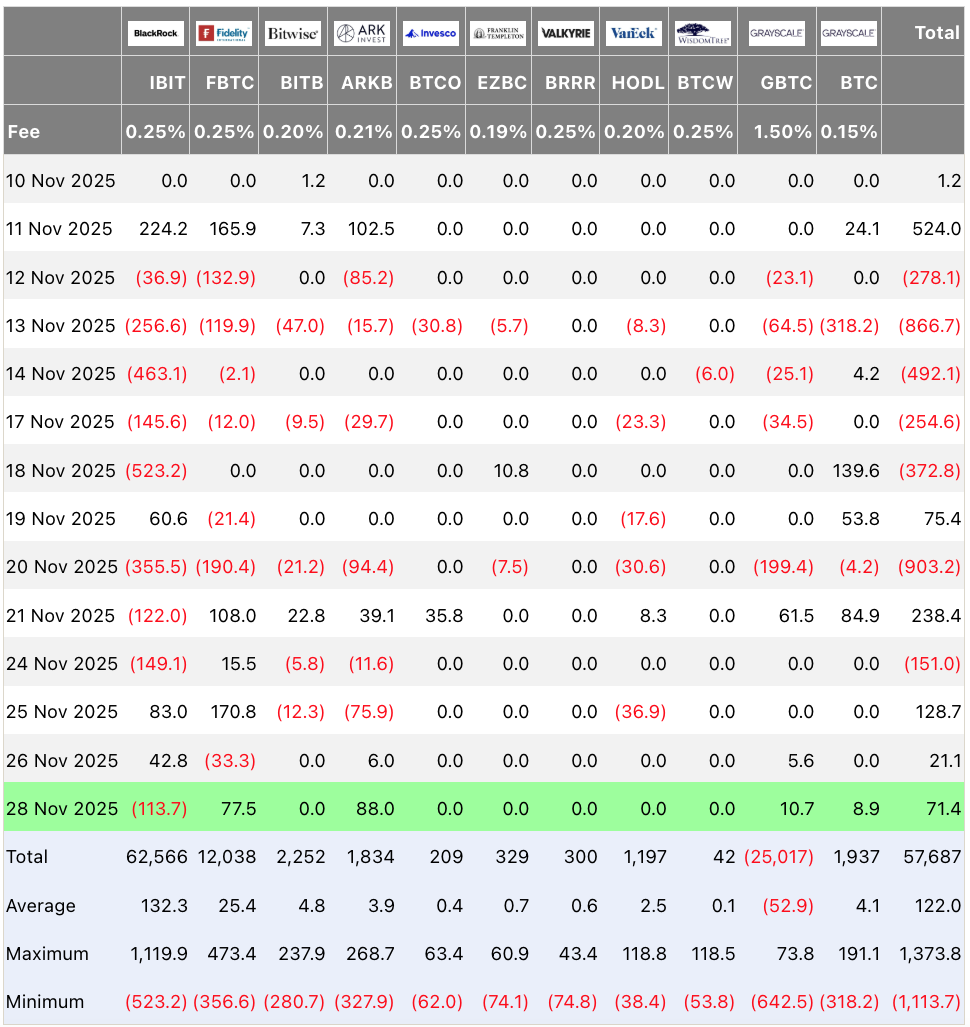

Institutional flows stay a significant a part of the story. The iShares Bitcoin Belief ETF recorded about $2.2 billion in outflows in November.

Analysts at Sentora say ETF redemptions are actually appearing as a mechanical drive that accelerates declines by pushing Bitcoin via help zones and creating stress throughout the market.

JPMorgan not too long ago famous that macroeconomic circumstances have grow to be a extra dominant driver of crypto costs than the normal four-year halving cycle. The financial institution additionally highlighted that early-stage initiatives as soon as leaned closely on giant personal fundraising rounds, leaving retail consumers to enter later at greater valuations.

Retail participation has light since then, and institutional traders now play a bigger position in offering depth and stability to the market.

Some companies stay assured. ARK Make investments elevated its publicity to the ARK 21Shares Bitcoin ETF, buying greater than 70,000 shares. This transfer appears to mirror ARK’s bullish long-term view on Bitcoin even in a troublesome surroundings.

The massive information this month was JPMorgan getting ready to launch a structured bond linked to the efficiency of BlackRock’s Bitcoin ETF IBIT. Some traders see this as an indication of speculative short-term technique.

Anthony Scaramucci, alternatively, sees a variety of potential for Bitcoin, with a big funding financial institution launching a Bitcoin-based by-product product.

The Technique downside

In a current report, JPMorgan estimates that Technique (previously MicroStrategy) may face as a lot as $2.8 billion in outflows if MSCI removes it from key fairness indices. This can make it more durable for the corporate to proceed sustainable progress.

About $9 billion of Technique’s $50 billion market valuation is linked to passive funds that observe these indices. Regardless of all that, Technique did not again down after a $19 billion liquidation occasion in October.

Some merchants even view JPMorgan’s sudden change of stance on Technique as a significant contribution to the October flash crash.

In response to the JPMorgan report, CEO Michael Saylor has argued that Technique shouldn’t be seen as a fund or a holding firm.

He described the corporate as an working enterprise with a big software program division and a treasury method that treats Bitcoin as productive capital. The message right here is obvious: Technique will proceed to purchase Bitcoin regardless of the high-volatility market.

Bitcoin value prediction: What’s subsequent in December?

Veteran dealer Peter Brandt has identified that current value motion resembles a full lifeless cat sample, though the short-term outlook could also be shifting. Regardless of that, Brandt holds a bullish view in the long run.

The $80,000 area stays essentially the most closest help stage examined final week. A break beneath may set off a slide towards t$70,000 vary, which represents a significant technical and psychological help space.

In case a deeper market sell-off, Bitcoin may fall into the $60,000 to $65,000 zone, which represents the bottom projected draw back below present circumstances. Additional decline will doubtless be contained by ETF inflows and treasury firms.

None of this ensures a reversal, however it alerts that bulls are regaining some management of the short-term market. The subsequent few weeks will decide whether or not Bitcoin can stabilize or whether or not the downward pattern reasserts itself as the brand new yr approaches.