- Chainlink Reserve purchased 170k+ LINK this week regardless of treasury worth dropping.

- Spot Taker CVD reveals consumers firmly in management; Netflow stays damaging.

- LINK may goal $15–$16.1 if momentum holds; SAR helps sit close to $11.94.

By 2025, Digital Asset Treasuries and token-buyback applications grew to become one of many largest shifts within the crypto trade. Main gamers began treating their tokens extra like company belongings — shopping for provide throughout weak point, tightening float, and reinforcing long-term worth. Chainlink joined this development on August 7, 2025, launching the LINK Strategic Reserve — an entity created to soak up enterprise demand and funnel it immediately into LINK itself.

Chainlink Reserve retains accumulating whilst values fall

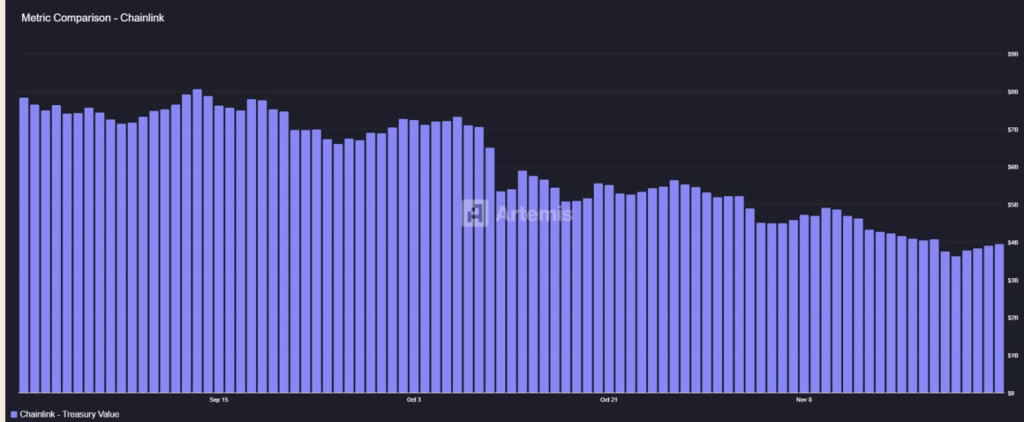

This autumn has been brutal for the crypto market. Treasuries misplaced billions, retail holders watched portfolios bleed crimson, and even Chainlink’s reserve worth dropped sharply — falling from $8.1 billion to $4 billion in simply two months. But the Reserve hasn’t backed down in any respect.

Within the final 24 hours alone, the Strategic Reserve bought roughly 89,000 LINK, value about $1.18 million. Over the past week, it amassed 170,300 LINK, valued at round $2.2 million. One of these regular, nearly cussed accumulation suggests robust inside conviction about LINK’s future outlook — whilst market situations look shaky from the surface.

And there’s extra to it: each Reserve buy quietly removes LINK from the circulating provide. Much less provide = much less potential promote strain, particularly during times the place liquidity dries up. It’s a long-term bullish mechanic hiding in plain sight.

Market demand stays agency as consumers dominate

On prime of the Reserve stacking LINK, buyers throughout the market are piling in as effectively. Over the previous six days, Spot Taker CVD has proven clear purchaser dominance — that means merchants are aggressively shopping for on the ask, not ready passively for cheaper entries. That’s precise demand, not leverage-driven noise.

Spot Netflow stayed damaging all through the previous week too, sitting at -$578k at press time (down from -$2.88 million the day earlier than). Unfavorable Netflow means LINK is leaving exchanges — an indication holders choose self-custody over promoting, and infrequently a precursor to larger upside strikes.

What’s subsequent for LINK?

Chainlink has been climbing inside a mini ascending channel ever since bouncing from its drop to $11 final week, rallying to a neighborhood excessive of $13.5. At press time, LINK trades round $13.4, up 0.46% on the day and 11.3% on the week — an indication of strengthening purchaser strain.

Stochastic RSI has surged to 97, which is deep in overbought territory. When Stoch hits this degree, it often means consumers have full management… nevertheless it additionally warns of volatility coming quickly. If momentum continues, LINK may break by means of $15 and goal the subsequent resistance round $16.1.

Nevertheless, if the market turns and sellers step in, LINK’s Parabolic SAR locations the closest assist round $11.94 — the extent bulls should defend to maintain the present construction intact.

Closing ideas

With strategic buybacks, actual demand, damaging netflows, and a Reserve that retains stacking tokens, LINK’s supply-side strain continues shrinking. Despite the fact that the market backdrop seems tough, the underlying mechanics for Chainlink are pointing upward. Right here is the place accumulation begins mattering greater than headlines.

The publish Chainlink’s Strategic Reserve Retains Shopping for LINK — Right here Is Why Accumulation Is Heating Up Regardless of Market Losses first appeared on BlockNews.