- Vitalik Buterin cautioned the Zcash group that token-based voting might shift energy to whales and slowly weaken core privateness values.

- Group members stay divided, arguing over committee rigidity versus market-driven governance dangers like plutocracy.

- The controversy intensifies as Zcash regains market consideration, making upcoming governance choices extra impactful than standard.

Ethereum co-founder Vitalik Buterin is urging the Zcash group to rethink its course on governance, warning that adopting token-based voting might undermine the very civil-liberty ideas the mission was constructed to defend.

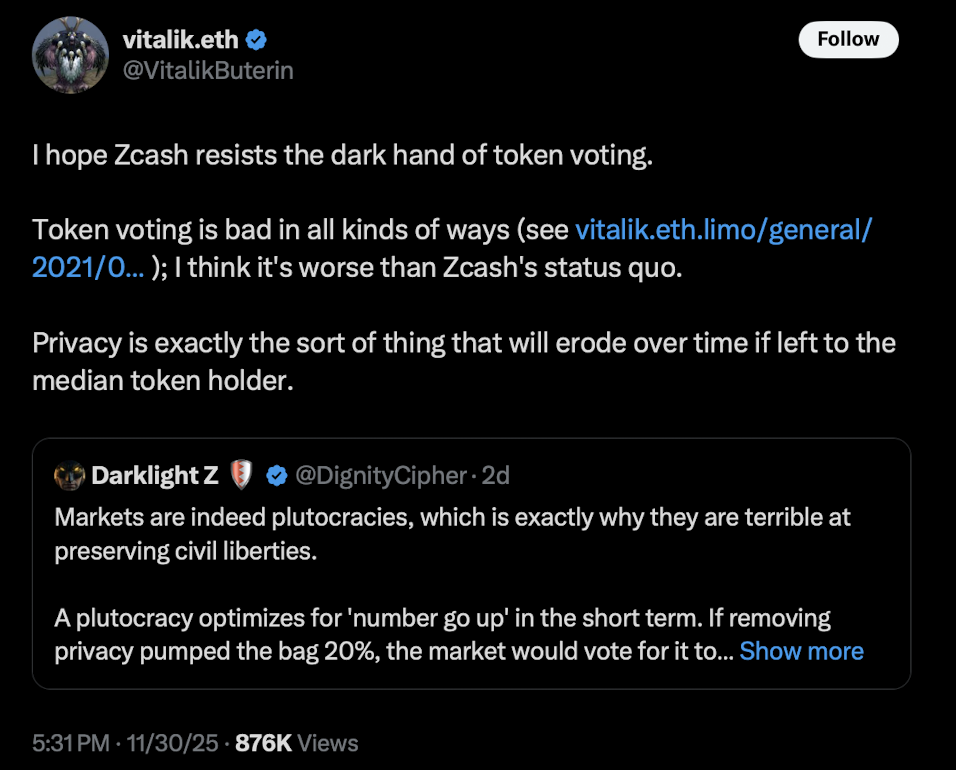

In a November 30 submit on X, he argued that token voting naturally pushes any system towards short-term value incentives, not long-term values like privateness and censorship resistance.

Vitalik flags deep dangers baked into token-weighted governance

Buterin tied his feedback again to a 2021 essay the place he defined the core vulnerabilities of token-weighted programs. One of many greatest points, he stated, comes from unbundled rights, which make covert vote-buying not solely potential, however fairly simple to cover.

He additionally emphasised how these programs inevitably focus energy within the arms of whales, leaving smaller token holders with nearly no actual accountability. Many smaller voters might merely “vote and overlook,” particularly in the event that they really feel their particular person vote barely issues.

Vitalik didn’t soften his view: he known as token voting “dangerous in all types of the way,” including that it could probably be worse than Zcash’s present construction.

“Privateness is precisely the form of factor that can erode over time if left to the median token holder,” he warned.

His remarks arrive as Zcash struggles with an even bigger query — the right way to choose its Zcash Group Grants Committee, a five-member physique chargeable for approving main ecosystem grants.

A group cut up on how decentralization ought to work

Many Zcash group members argue that the prevailing committee-based strategy feels outdated.

Helius CEO and Zcash supporter Mert Mumtaz stated the controversy displays a wider governance challenge. In keeping with him, markets naturally punish dangerous choices by means of falling token costs, shifting affect, and updating collective information. Committees, he argued, don’t have that suggestions loop and may stay fully disconnected from the implications of their choices.

He in contrast this disconnect to what Nassim Nicholas Taleb calls the “interventionista” — a bureaucrat making high-impact choices with out sharing any of the dangers. In distinction, he famous that historical Roman generals made choices from the battlefield, not from behind a desk.

Whereas Mumtaz is conscious token voting has flaws, he believes static committees are much more problematic as a result of they turn into “uncriticizable and account to nobody.” Markets evolve, he stated — committees not often do. “Evolution wins long-term.”

Different group voices echoed associated issues.

- Naval, a person on X, warned that introducing overseers — even unbiased ones — creates systemic safety vulnerabilities.

- Darklight argued that market-driven programs are inclined to drift into plutocracy, which might additionally fail to guard civil liberties over time.

A pivotal debate as Zcash regains market consideration

This governance dispute is unfolding proper as Zcash attracts renewed curiosity from merchants and researchers. That timing raises the stakes much more — as a result of no matter system the group settles on subsequent might affect how Zcash evolves for years to return.

Right here is the place the group should select between imperfect fashions, every with very completely different penalties for its future.

The submit Vitalik Warns Zcash In opposition to Token Voting — Right here Is Why He Says It Might Slowly Destroy Privateness first appeared on BlockNews.