- SUI sits on a long-term assist zone that beforehand triggered main rallies.

- Momentum indicators present weak point however early hints of stabilization.

- Ecosystem development, together with new DeFi platforms, strengthens long-term outlook.

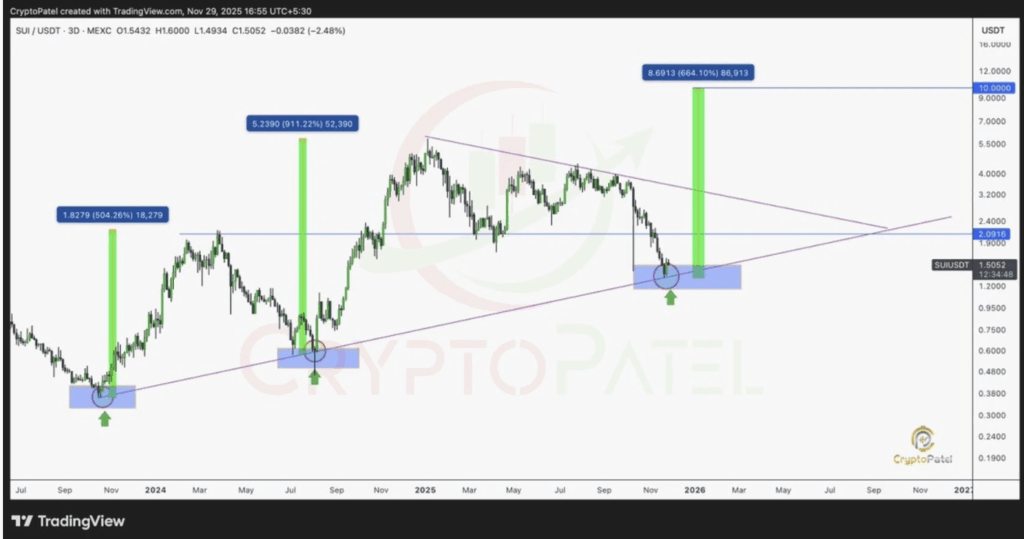

SUI is hovering round $1.55 proper now, urgent proper towards a long-term ascending assist line that has triggered some fairly enormous rallies up to now. The value has slipped into that sturdy demand zone between $1.30 and $1.60 — an space the place consumers have traditionally reacted quick and, truthfully, fairly aggressively. So long as SUI retains holding above roughly $1.40, the general construction stays intact, leaving the door open for a high-timeframe reversal that might stretch over the following few weeks and even months. It’s a kind of spots the place issues really feel tense but additionally kinda stuffed with potential.

Resistance Ranges That Might Set off a Bigger Breakout

For the bullish state of affairs to really affirm itself, SUI has to reclaim resistance at $2.09. That’s the fast hurdle. After that, the large check sits across the descending trendline close to $2.40–$2.60. Clearing this zone opens mid-term targets at $3.20 and $4.00 — ranges that acted as vital pivot zones in earlier cycles. If momentum actually kicks in, the construction even factors to a macro extension goal close to $10.00, which sounds wild at first, however traces up with the broader continuation sample forming on the chart. It’s mainly a high-probability long-term setup if consumers step in with precise conviction.

What Occurs If Assist Breaks?

If SUI slips beneath the ascending assist line, the primary breakdown hazard zone is $1.40. Shedding that will invalidate the bullish setup, sending the value towards the following main assist at $1.00–$1.10. Consumers would possibly try a rebound there, but when that fails, the chart leaves room for a deeper correction all the way in which right down to round $0.80 — the capitulation zone that normally acts as a final line of protection earlier than structural failure. It’s not the popular state of affairs, clearly, however it’s nonetheless on the desk.

Momentum Weak however Displaying Early Indicators of Stabilizing

The RSI sits at 35.31, which places SUI near oversold territory. That sometimes indicators persistent bearish strain, however the curve is barely curling upward — a quiet trace that promoting momentum is likely to be dropping steam after such a protracted downtrend. The MACD stays deeply bearish, with the MACD line under the sign line and each caught in unfavorable territory. The histogram bars are shrinking although, which implies the velocity of the decline is slowing. No bullish cross but, however the promoting impulse isn’t as sharp as earlier than—type of just like the market slowly exhaling.

Sui’s Ecosystem Growth Might Increase Lengthy-Time period Confidence

Basically, Sui’s ecosystem remains to be increasing even whereas the value cools down. A brand new platform, @AftermathFi, has launched to assist on-chain by-product buying and selling, strengthening Sui’s rising DeFi setting. And in a latest livestream, @0xairtx defined why they selected the Sui chain for constructing their perpetual buying and selling product: reliability, efficiency, and structure have been the standout causes. It’s the type of behind-the-scenes growth that usually fuels long-term development even when charts look messy within the quick time period. Right here is the place SUI’s future would possibly quietly be organising, even when the value hasn’t caught up but.

The publish Sui Ecosystem Progress Meets Oversold Technicals at Lengthy-Time period Assist — Right here is Why This Zone Issues Now first appeared on BlockNews.