- GLNK turns into the primary U.S. spot Chainlink ETF, providing regulated publicity for establishments.

- Staking contained in the ETF boosts yield potential however brings added regulatory complexity.

- Chainlink’s increasing integrations and real-world partnerships strengthen long-term demand.

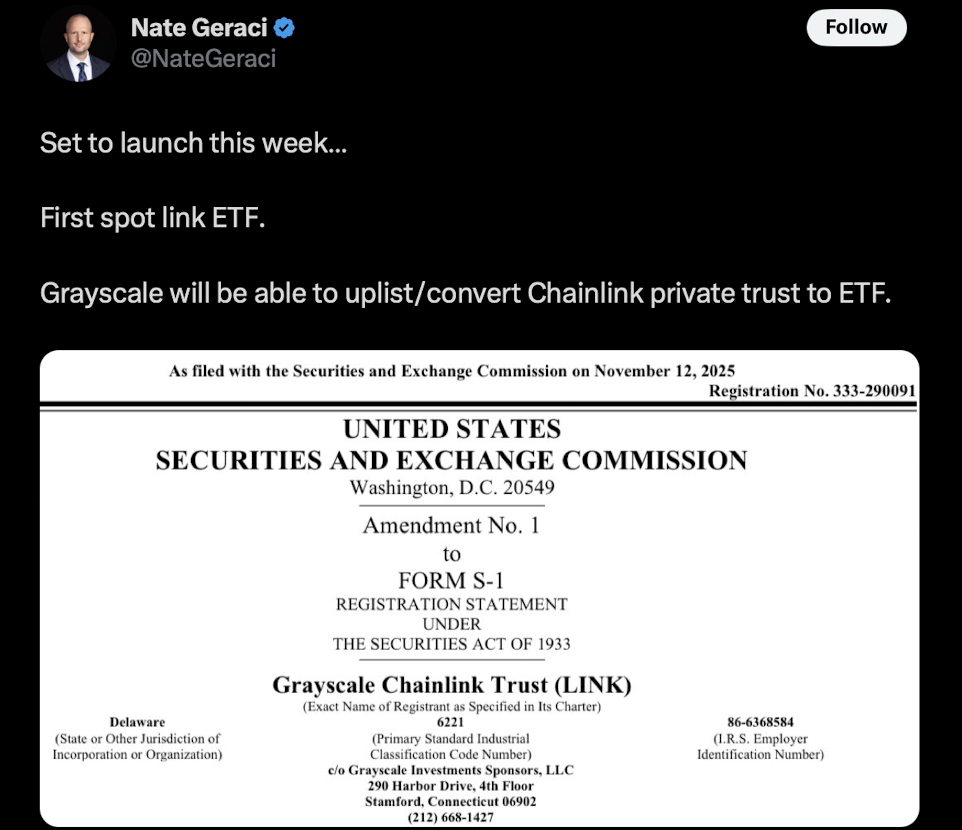

Grayscale has lastly secured approval to launch the first-ever U.S. spot Chainlink ETF, ticker GLNK, and it’s set to hit NYSE Arca on December 2, 2025. The itemizing principally provides institutional traders a regulated doorway into Chainlink (LINK) with out having to cope with personal keys, chilly wallets, or any of the standard crypto–dealing with complications. The SEC signed off after reviewing Grayscale’s S-1 submitting from late September, which formally transformed the outdated Chainlink Belief into an ETF. It’s a transfer that feels overdue contemplating how a lot infrastructure Chainlink already helps throughout Web3 and conventional finance.

A Safer, Less complicated Route for Establishments Getting into Crypto

Massive establishments have at all times been skittish about touching crypto immediately — principally due to compliance guidelines, custodial dangers, and the concern of waking as much as headlines about “misplaced pockets keys.” GLNK solves that downside by wrapping LINK publicity inside a construction they already perceive. Conventional liquidity, transparency, public reporting… all of the acquainted stuff. Based on CryptoRank, this lets main asset managers take part within the tokenized economic system in a manner that matches neatly into current frameworks, without having to handle messy multi-chain setups or self-custody logistics. It’s crypto, however with coaching wheels — and that’s precisely what establishments need.

Staking Contained in the ETF Provides a Twist — and Some Friction

One of many issues making GLNK stand out is the staking function baked immediately into the ETF. Which means the fund can truly generate yield from LINK holdings, which is a reasonably large deal for long-term portfolios hungry for further return in low-interest environments. However after all, this comes with its personal regulatory rigidity. The SEC remains to be determining the place staking suits inside funding merchandise, and Grayscale pushing forward units this ETF other than Bitwise’s CLNK, which launched earlier on the DTCC registry however with out staking. GLNK’s construction is a bit more daring — and a little bit extra sophisticated.

Chainlink’s Increasing Function in Tokenized Finance

Chainlink’s total motive for current is to behave as the info bridge for sensible contracts — offering off-chain info to on-chain programs in a safe, decentralized manner. That perform has turn out to be important for all the pieces from monetary devices to provide chains and tokenized asset platforms. Partnerships with companies like S&P World and FTSE Russell have boosted Chainlink’s credibility with conventional finance, and Grayscale researchers Zach Pandl and Michael Zhao even described LINK as the biggest crypto asset that isn’t a Layer-1. Its significance retains rising as extra establishments experiment with blockchain infrastructure.

Chainlink’s CCIP (Cross-Chain Interoperability Protocol) can be gaining momentum throughout Asia and in personal company networks like World Liberty Monetary. These integrations assist join fragmented networks, letting tokens and information transfer extra simply throughout them — one thing enterprises have been wanting for years.

Extra ETF Launches Sign Grayscale’s Greater Push

GLNK is definitely Grayscale’s third new itemizing in simply two weeks, following contemporary ETFs tied to XRP and Dogecoin. It’s clear the corporate is rolling out a broader technique: give establishments regulated entry to decentralized infrastructure, layer by layer. In the meantime, curiosity in Chainlink itself has been climbing. CaliberCos just lately grew to become one of many first U.S. corporations to carry LINK in its company treasury — and earn staking rewards on it, which is fairly telling.

As tokenized finance grows and extra conventional markets begin tapping blockchain rails, the Chainlink ETF might open the door for a wave of comparable merchandise centered on decentralized networks utilized in settlement, compliance, id, and next-gen securities. Right here is the place establishments could lastly begin dipping greater than only a toe into crypto’s infrastructure layer.

The publish From Oracles to ETFs: How Chainlink Is Powering Tokenized Finance — Right here is Why Establishments Care Now. first appeared on BlockNews.