- BitMine bought 96,798 ETH final week, bringing its treasury to three.73M ETH value $10.5B.

- Whereas most digital asset treasuries are promoting or pausing buys, BitMine continues accumulating regardless of giant unrealized losses.

- The upcoming Ethereum Fusaka improve and potential Fed price cuts are key drivers behind its accelerated ETH purchases.

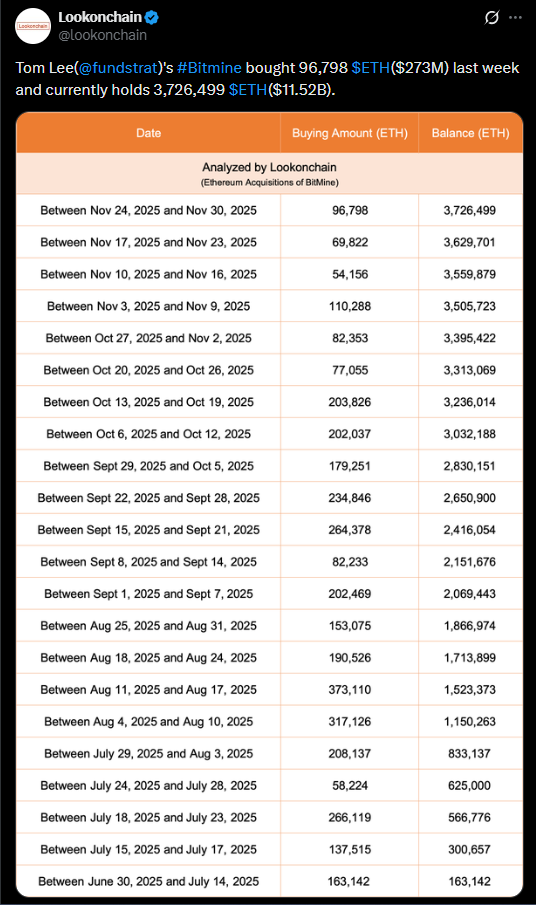

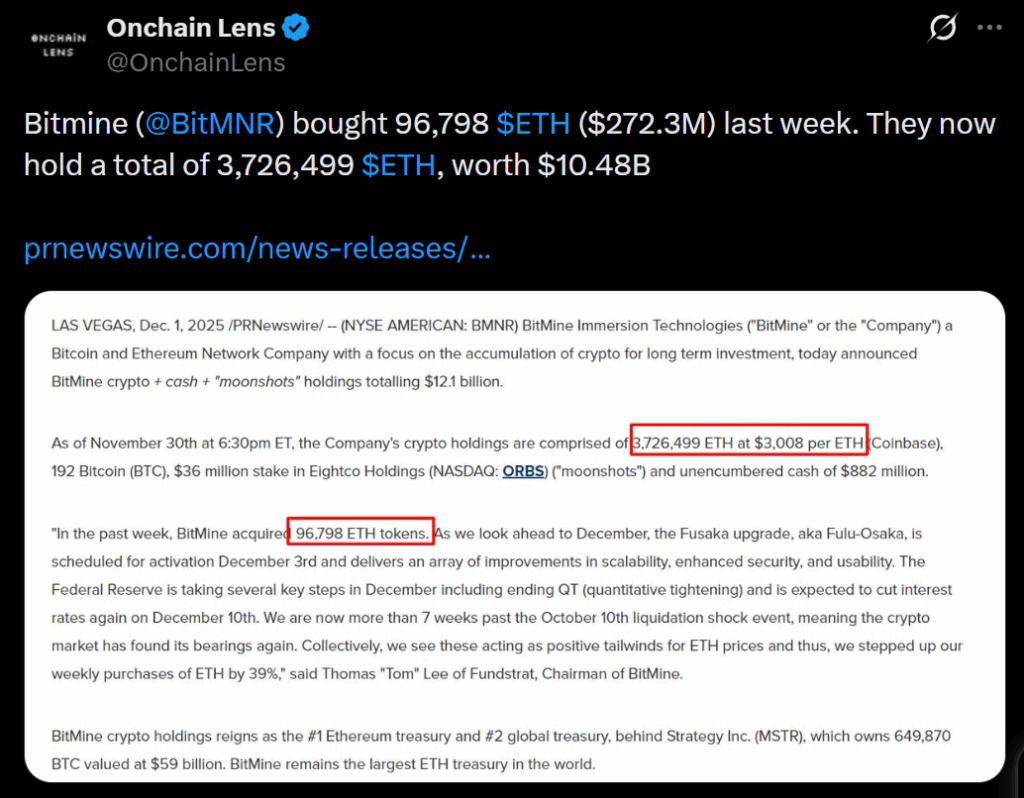

BitMine Immersion Applied sciences (BMNR), the Ethereum-focused crypto treasury agency led by Fundstrat’s Thomas Lee, pushed forward with one other main ETH buy final week — even because the market slumped and digital asset treasuries pulled again. The agency acquired 96,798 ETH through the interval, persevering with its aggressive accumulation technique at a time when most company treasuries are cutting down publicity or outright promoting.

BitMine Now Holds 3.73 Million ETH

With the brand new addition, BitMine’s complete Ethereum stash has climbed to an infinite 3.73 million ETH, valued at roughly $10.5 billion at present costs. This cements its place as the most important Ethereum treasury holder by a large margin. Alongside that large ETH place, the agency additionally holds 192 BTC, a $36 million funding in Eightco Holdings (ORBS), and $882 million in money reserves. However regardless of the shopping for, BitMine’s inventory hasn’t escaped market turbulence — BMNR shares dropped 7.7% in pre-market buying and selling as ETH itself fell 6% in a single day, slipping simply above $2,800.

Most Crypto Treasuries Are Promoting — BitMine Is Doubling Down

Digital asset treasuries (DATs) have been beneath strain as each crypto costs and associated equities proceed sliding. Many corporations have paused accumulation or began trimming their holdings to slender the hole between their inventory value and internet asset worth. BitMine, nevertheless, stays one of many only a few nonetheless actively accumulating — regardless that estimates recommend the corporate is sitting on almost $4 billion in unrealized losses on its ETH holdings. Their technique alerts a long-term conviction that stands in distinction to an in any other case cautious treasury panorama.

Ethereum Improve and Fed Coverage Gas BitMine’s Confidence

Thomas Lee pointed to a mixture of market circumstances and upcoming catalysts as causes for accelerating weekly purchases by 39%. The Ethereum Fusaka improve — scheduled to activate on December 3 — goals to enhance scalability, safety, and total performance on the community. On the identical time, Lee expects the Federal Reserve to halt quantitative tightening this month and probably challenge a price minimize on the December assembly. With crypto markets stabilizing because the October 10 crash, BitMine sees these elements as potential tailwinds for ETH and is positioning aggressively forward of them.

The publish BitMine Expands Its Ethereum Treasury With 96,798 New ETH Regardless of Market Downturn — Right here Is Why the Shopping for Hasn’t Stopped first appeared on BlockNews.