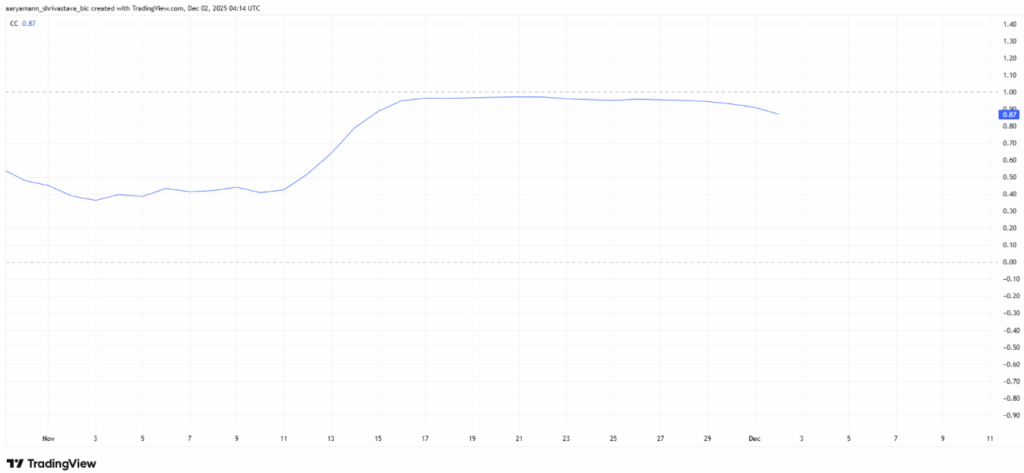

- HBAR struggles as its 0.87 correlation with Bitcoin pulls value downward.

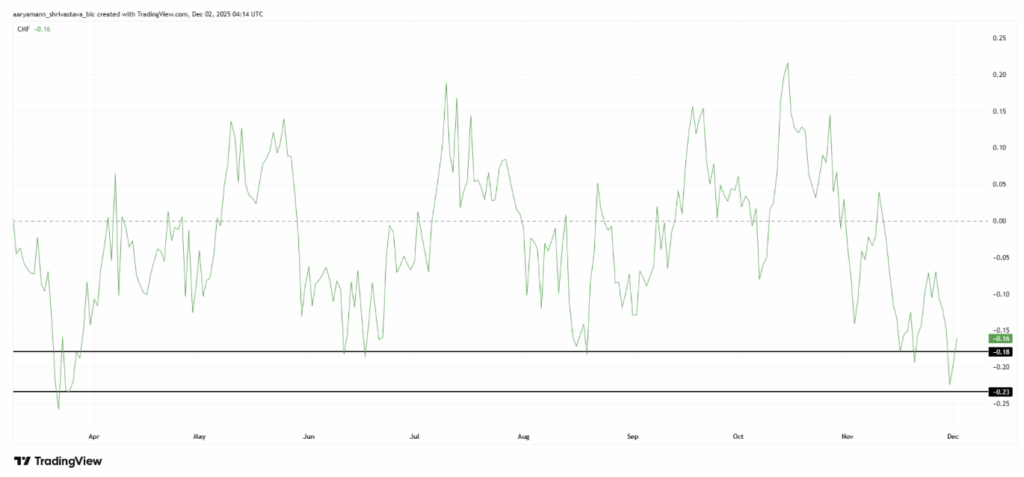

- CMF weak point exhibits continued capital outflow regardless of typical reversal ranges.

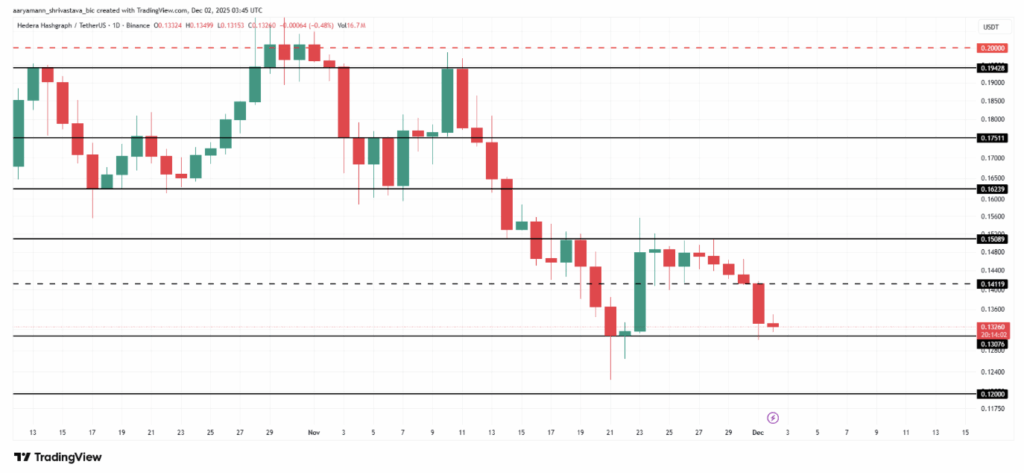

- Holding $0.130 is crucial; shedding it may ship HBAR towards $0.120.

Hedera has been struggling to catch its breath this previous week, despite the fact that the broader market had a short second of aid at the start turned bearish once more. HBAR tried — actually tried — to climb again towards its current highs, however the complete market’s downturn pulled it proper again. What it revealed is one thing most merchants already suspected: Hedera nonetheless strikes nearly fully on the mercy of Bitcoin.

Hedera’s Largest Drawback Proper Now? Bitcoin.

HBAR’s correlation with BTC is sitting at a fairly uncomfortable 0.87, solely barely decrease than final week’s peak. Which means nearly each transfer Bitcoin makes, Hedera copies. And that’s not precisely nice timing, since Bitcoin is caught wobbling across the $86,000 vary with zero momentum.

As a result of BTC can’t reclaim energy, Hedera can’t both. Each try at a rebound stalls out earlier than it even begins. The dearth of unbiased momentum makes HBAR additional fragile — one Bitcoin dip is sufficient to drag it underwater once more.

Capital Flows Present Weak spot Regardless of Ordinary Reversal Ranges

The macro image isn’t providing a lot aid both. Hedera’s Chaikin Cash Movement (CMF) lately dipped to a seven-month low. Usually, when the CMF strikes into the 0.18–0.23 vary, it indicators that outflows are slowing and inflows are starting to indicate up — typically a candy spot for altcoins to stabilize.

However this time, the sample didn’t maintain. CMF fell beneath 0.18 earlier than barely nudging upward once more. That tiny restoration doesn’t replicate energy — it exhibits hesitation. Buyers are nonetheless pulling liquidity from HBAR despite the fact that, traditionally, this sort of setup typically triggers a bounce. The market’s broader bearish tone is overriding the same old indicators.

HBAR Value Caught at Help, Ready for a Catalyst

On the time of writing, HBAR trades at $0.132, sitting simply above the must-hold $0.130 help degree. This value flooring has saved Hedera a number of occasions earlier than, and shedding it will open the door to deeper lows.

If the market stays weak — particularly if Bitcoin dips once more — HBAR will seemingly proceed drifting in a decent vary between $0.130 and $0.150. A clear breakdown beneath $0.130 may ship value towards $0.120, extending the bearish development.

Nonetheless… if Bitcoin catches even a modest restoration, HBAR may comply with go well with. A bounce from $0.130 would possibly push the value again to $0.150, and breaking that degree would flip resistance into help. That might open the trail towards $0.162, which might lastly break the bearish sample and provides HBAR some room to breathe.

Outlook

HBAR is caught in the identical bind as many altcoins — trapped below Bitcoin’s shadow, unable to interrupt free till BTC decides what it needs to do. Capital flows stay weak, momentum indicators present hesitation, and merchants are cautious. But when Bitcoin recovers, even barely, Hedera has a shot at reclaiming short-term energy.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.