Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin (BTC), Ethereum (ETH) and XRP all tumbled prior to now 24 hours as crypto liquidations reached $636 million even amid rising optimism round a December rate of interest reduce by the US Federal Reserve.

Throughout the previous buying and selling day, the full crypto market cap has additionally plunged over 5% to under $3 trillion, in accordance with CoinMarketCap information.

The most important cryptos by market cap all plunged. Bitcoin slid over 5% prior to now 24 hours, as did altcoin king Ethereum.

Smaller tokens took an even bigger hit. Ranked at quantity 4 when it comes to market cap, XRP noticed its worth plummet over 6%, sufficient to push its 7-day efficiency again into the crimson.

In the meantime, Binance’s BNB, Solana (SOL), and TRON (TRX) dropped over 5%, 7%, and 1%, respectively. Dogecoin (DOGE) and Cardano’s ADA token suffered the most important worth drops among the many high ten cryptos, with each tokens seeing falls of greater than 8%.

Liquidations Soar

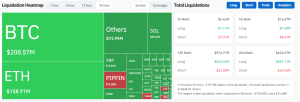

Following the market-wide tumble, 24-hour liquidations within the crypto house topped $636 million, information from Coinglass exhibits.

Crypto market liquidation information (Supply: Coinglass)

Lengthy trades, that are bets that crypto costs will rise, accounted for almost all of the capital that was worn out within the final 24 hours. Some $567 million was liquidated from these trades, whereas solely $69.46 million was worn out from bearish quick positions.

BTC and ETH trades accounted for the lion’s share of the liquidated positions. Greater than $358 million was worn out from lengthy trades for the 2 crypto market leaders.

“Excessive Concern” Continues To Grip The Market As Merchants Anticipate Curiosity Price Lower

The current drop in crypto costs comes because the market stays in a fragile state following the file $19 billion liquidation occasion on Oct. 10.

The Crypto Concern & Greed Index, a preferred measure of market sentiment, fell 4 factors within the final day and 9 factors from a month in the past to face at 24, signaling “Excessive Concern.”

However whereas investor sentiment stays cautious, analysts and merchants are rising more and more optimistic that the Fed will announce an rate of interest reduce this month.

In a Polymarket contract asking what the Fed’s resolution will likely be in December, customers on the decentralized prediction markets platform have pegged the chances of a 25 bps lower at 89%, up 1% prior to now 24 hours. Solely 11% of merchants imagine there will likely be no change in charges this month.

Skinny Liquidity And Excessive Leverage Are Holding The Crypto Market Again

A number of analysts attributed the Oct. 10 crash to excessive ranges of leverage. In crypto, it’s not unusual for merchants to commerce with as a lot as 50X leverage. Whereas this will result in parabolic good points on small worth actions, it additionally amplifies losses if there’s a correction.

Commenting on the continued fragile state out there, The Kobeissi Letter informed its over 1.1 million followers on X that the market is battling with a liquidity situation.

Crypto’s liquidity situation:

As seen numerous occasions this yr, Friday night time and Sunday night time usually include LARGE crypto strikes.

Simply now, we noticed Bitcoin fall -$4,000 in a matter of minutes with out ANY information in any respect.

Why? Liquidity is skinny.

Then, add this to the truth that… https://t.co/BTRNPV8Y5a

— The Kobeissi Letter (@KobeissiLetter) December 1, 2025

Along with the “skinny” liquidity out there, leverage out there “is at file highs proper now,” The Kobeissi Letter stated within the submit.

“Because of this, the sudden rush of promoting quantity results in a domino-effect selloff, which is simply amplified by the historic quantities of levered positions being liquidated,” it added.

It stated that the present bear market “is structural in nature,” and that it doesn’t view the current worth drop as a “basic decline.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection