Abstract

BTC is buying and selling round 87,100 {dollars}, deep under its medium and long-term each day transferring averages, confirming a dominant bearish regime on the upper timeframe. The each day RSI sits within the mid-30s, displaying waning momentum however not but true oversold panic. MACD stays detrimental on the 1-day chart, but the histogram has began to contract, hinting that the downtrend could also be dropping energy. Volatility is elevated however not explosive, suggesting managed promoting reasonably than a waterfall crash. Furthermore, Bitcoin‘s market dominance close to 57% reveals capital rotating again towards the benchmark reasonably than into riskier altcoins. Worry & Greed at Excessive Worry indicators that many traders are already positioned defensively, which may restrict additional pressured promoting.

Bitcoin worth down: Market Context and Course

On the macro degree, BTC is pulling again inside a crypto market nonetheless value roughly 3.0 trillion {dollars}, which signifies that the broader digital asset ecosystem has not damaged structurally. Nonetheless, the main coin has clearly been the supply of stress in current periods, with mainstream retailers highlighting its wrestle to reclaim the 100,000 greenback space this 12 months. Furthermore, Bitcoin’s dominance hovering round 57% underscores that, regardless of the correction, merchants usually are not abandoning the asset in favor of speculative options; as a substitute, they’re consolidating threat into probably the most liquid title.

That stated, sentiment is fragile. The Worry & Greed Index prints 23, firmly in Excessive Worry territory, reflecting a market that’s already anxious about additional declines. This backdrop creates an intriguing asymmetry: whereas the each day technical image continues to be detrimental, a lot of the emotional injury could already be executed, leaving room for sharp aid rallies if sellers tire.

Technical Outlook: studying the general setup

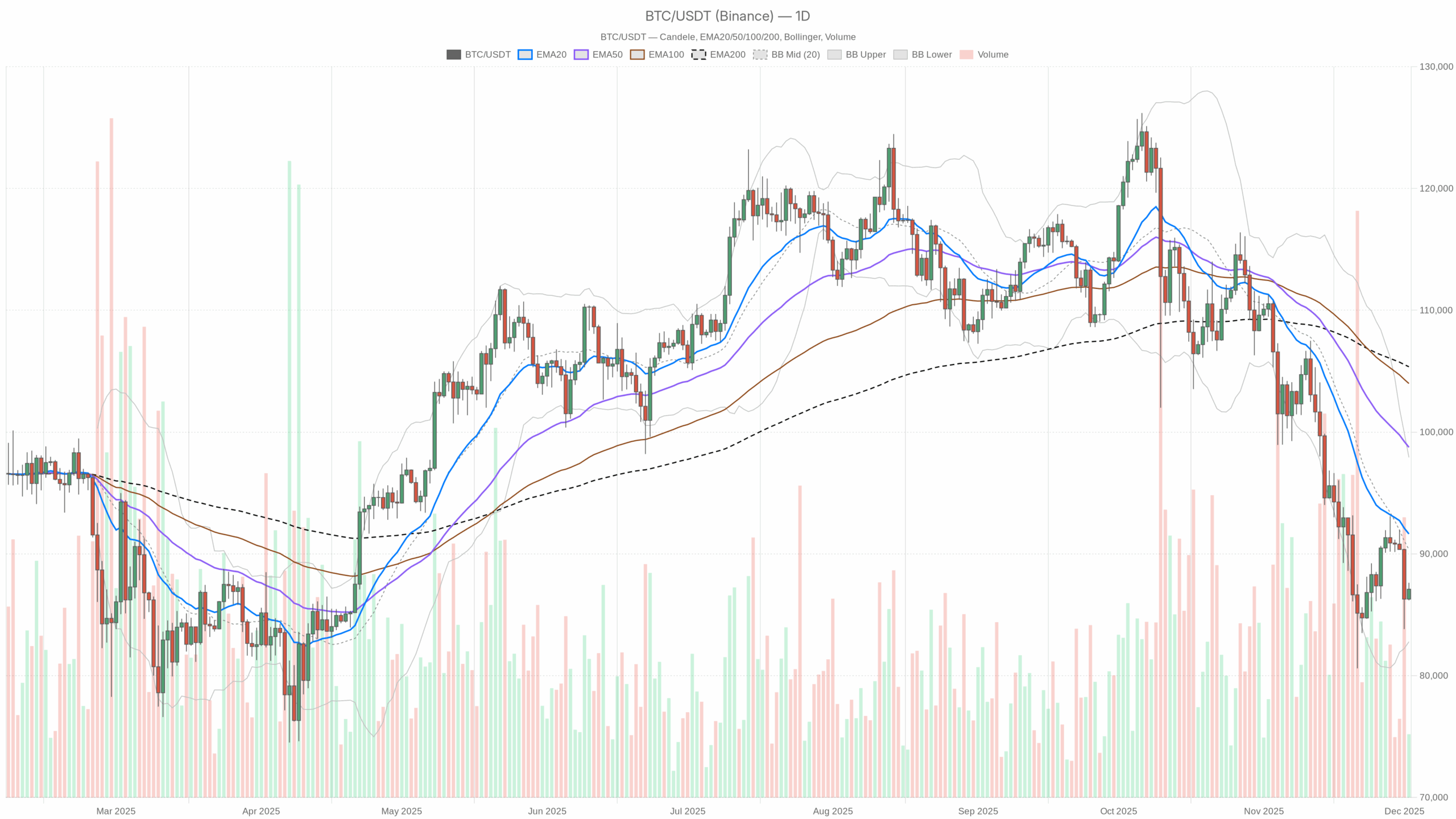

From a each day perspective, BTC trades close to 87,099 {dollars}, under all key exponential transferring averages. Value is below the 20-day EMA at about 91,640, the 50-day close to 98,755, and the 200-day round 105,364. This huge separation confirms a mature bearish development, with the quick, medium, and long-term baselines all pointing above spot worth. For positional merchants, this alignment argues that the burden of proof lies with the bulls till at the least the 20-day EMA is reclaimed.

The each day RSI at roughly 35 tells a complementary story. Momentum is clearly weak, in keeping with a downtrend, but the indicator has not dipped into traditional oversold territory under 30. This means sellers nonetheless retain management however are not urgent as aggressively as throughout the preliminary leg decrease, elevating the percentages of a pause or consolidation section.

MACD on the 1-day chart stays under zero, confirming detrimental momentum, however the MACD line at about -3,790 is now barely above its sign line close to -4,297. The optimistic histogram round 507 suggests a modest momentum inflection: the downtrend isn’t reversed, but its depth is easing. Usually, such a sample precedes both a sideways digestion or a extra forceful bounce again towards the 20-day EMA.

Bollinger Bands add one other layer. The mid-band sits round 90,357 {dollars}, with the higher band close to 97,925 and the decrease round 82,788. Value is buying and selling between the center and decrease bands, which generally signifies sustained draw back bias with out full-blown capitulation. If BTC have been to shut repeatedly under the decrease band, it will sign volatility enlargement to the draw back; for now, the configuration factors extra to grinding strain than panic.

The each day ATR round 3,579 {dollars} highlights comparatively excessive however managed volatility. Swings of this magnitude make threat administration essential: place sizes should respect the truth that intraday strikes of a number of thousand {dollars} are solely believable. Consequently, each breakout merchants and dip patrons must plan entries and exits round broader ranges than in calmer durations.

Intraday Perspective and BTCUSDT token Momentum

In the meantime, decrease timeframes are portray a extra balanced image. On the 1-hour chart, BTC trades near 87,126 {dollars}, above its 20-period EMA (round 86,735) however barely under the 50 and 200 EMAs, clustered close to 87,507 and 88,847. This combine suggests a short-term stabilization try inside a nonetheless fragile medium-term surroundings. Intraday merchants are probing the upside, but they haven’t convincingly flipped the broader construction.

The hourly RSI close to 54 is impartial to mildly optimistic, in keeping with a modest intraday bounce reasonably than a full development reversal. MACD on this timeframe reveals the road slightly below zero however above its sign, with a optimistic histogram; this configuration helps the concept of a growing, but tentative, restoration. On the 15-minute chart, the image is barely extra constructive: worth sits above each the 20 and 50 EMAs and slightly below the 200 EMA, whereas RSI hovers within the excessive 50s. Collectively, these indicators trace at intraday bullish momentum that’s nonetheless preventing in opposition to a dominant each day downtrend.

Key Ranges and Market Reactions

Day by day pivot ranges assist body the battlefield. The central pivot sits near 86,971 {dollars}, successfully the place spot is oscillating. Holding this space retains the door open for a push towards the primary resistance zone round 87,757 {dollars}, which coincides with current intraday highs. A agency break and consolidation above that band may invite a take a look at of the Bollinger mid-line, strengthening the case for a broader mean-reversion bounce.

On the draw back, the primary vital help lies close to 86,313 {dollars}, just under the pivot. A clear breakdown there would affirm that sellers are regaining the initiative, probably steering worth again towards the decrease Bollinger Band close to 82,788. In that case, merchants would look ahead to indicators of vendor exhaustion akin to lengthy decrease wicks, intraday RSI divergences, or sharp reversals off help.

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We could earn a fee at no further price to you.

Future Eventualities and Funding Outlook

Total, the first state of affairs stays bearish on the each day timeframe, so long as worth holds under the 20-day EMA and the cluster of transferring averages overhead. Nonetheless, easing draw back momentum, excessive worry, and stabilizing intraday charts collectively argue for a section of consolidation or aid reasonably than a right away additional collapse. Swing merchants could search for affirmation of a development stabilization section through larger lows on the each day chart, whereas longer-term traders would possibly steadily scale in throughout weak point, all the time respecting the elevated volatility. Till key resistance zones are reclaimed, warning is warranted, however so too is openness to sharp countertrend rallies that may unfold rapidly in such an emotional market.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding selections.