With the shortage of route of a number of belongings, uncertainty covers the cryptocurrency market, which could possibly be a worrying signal for buyers: volatility may drop even decrease and liquidity will likely be so skinny that any promoting stress will ship the market into limbo.

XRP wants assist

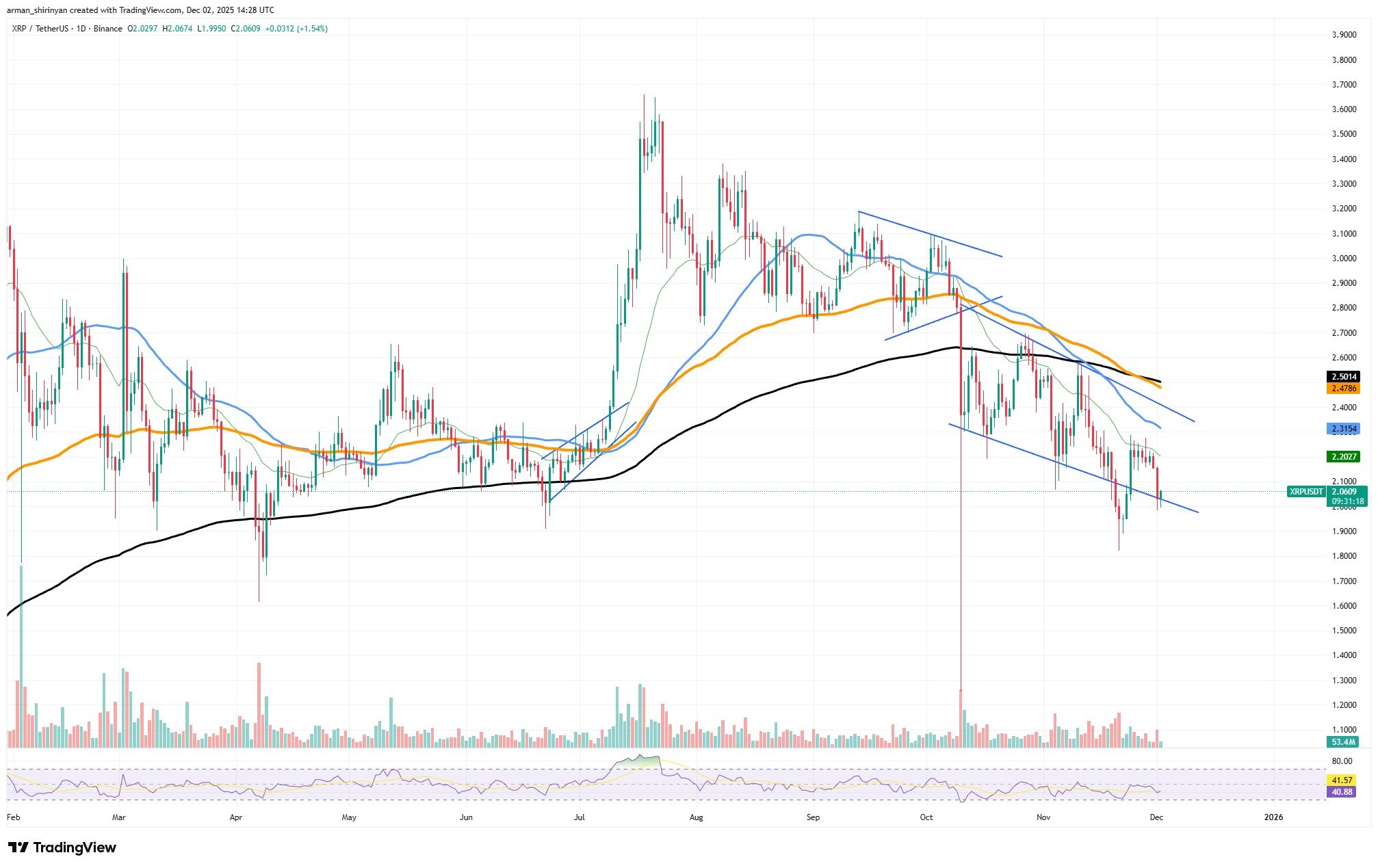

There’s little or no area for optimism on the chart, and XRP is barely hanging onto the $2 degree. The construction that has been constructing since early October, decrease highs, decrease lows and a clear descending channel are nonetheless absolutely intact. Each try to interrupt above resistance has been slapped down instantly, and the newest rejection from the midchannel area confirms sellers are nonetheless firmly in management.

The market will not be confused. It’s drained, illiquid and directionally biased to the draw back. The way in which XRP is declining, moderately than the drop itself, is the primary drawback. The worth continues to retreat from the 20- and 50-day EMAs as in the event that they had been unbreakable limitations. Momentum by no means survives previous a few candles, and quantity on inexperienced days stays pathetic in comparison with the heavy sell-side spikes you see on every breakdown.

That’s basic continuation conduct — not a base, not an accumulation zone, not even a significant pause. Dropping $2 logically opens the door to the subsequent liquidity pocket round $1.85-$1.90, and if the channel breaks once more (prefer it did in the course of the panic wick in November), you might be speaking about a fair deeper slide.

Nothing on the chart hints at incoming power. The RSI is hovering round mid-40s, however with no divergence or a development shift, that’s simply impartial noise. The 200-day EMA sits far above the present value, and the 50/100 EMA mini-death cross continues to stress the asset from above.

The issue is that XRP usually bottoms out. Traditionally, its reversals come from overextended capitulation moderately than managed promoting. However proper now, we don’t even have that exhaustion.

So sure, the subsequent leg decrease is not only doable, it’s the most coherent consequence based mostly on construction and momentum. Moreover, nothing signifies that issues will get higher until XRP produces a very uncommon spike in demand. Consumers should not stepping in, and the chart displays that brutally.

Bitcoin can get better

Bitcoin’s present construction is messy however not hopeless. The worth ultimately discovered consumers within the mid $80,000s after the violent plunge in mid November, and a transparent restoration was initiated. The restoration is adequate to pave the way in which for a quick transfer towards $90,000, however it’s not robust sufficient to sign a development reversal.

The bottom line is the form of the bounce. BTC printed a basic exhaustion wick close to the native backside, adopted by a string of upper lows on growing quantity. That alone alerts consumers should not lifeless. However the true driver is the hole between spot value and the 20-day EMA.

One other structural issue is that, in November, an especially oversold RSI studying was created, which Bitcoin usually resolves with a reduction rally. The worth recovered sufficient to check important resistance the final time the momentum reset this dramatically. The identical dynamic is feasible now.

The issue is that the chart above $90,000 is stacked with resistance. The $92,000 to $96,000 pocket is the place the 50- day EMA, the prior breakdown zone and the cluster of unsuccessful help ranges from October converge. Until there’s a shift in macro sentiment or a rise in demand, that space is a brick wall.

So sure, hitting $90,000 will not be a stretch. It suits the sample: oversold bounce returning to check the underside of damaged help. However anticipating something past that, particularly a sustained breakout, doesn’t match the present market posture. BTC continues to be firmly under the 200 day EMA, nonetheless printing decrease highs and nonetheless missing the sort of shopping for aggression that defines development shifts.

Dogecoin’s stabilization dangers

Dogecoin is making an attempt to stabilize, however calling this the tip of the downtrend can be wishful considering. The chart continues to be locked inside a clear, well-defined descending construction, with each bounce getting offered virtually instantly. The most recent transfer, a push off the $0.13 to $0.14 zone, is extra of a technical reduction than an precise shift in market sentiment.

The worth stays under the 20-day, 50-day and 200-day EMAs. The three are stacked in a basic bearish sample, all pointing downward. That alignment not often resolves rapidly, and it tells you that merchants nonetheless have management.

The important thing degree to observe is $0.155 to $0.16. That is the place DOGE was repeatedly slapped down, and the midpoint resistance of the newest slide. If consumers can’t reclaim that zone, any dialogue a couple of development reversal is pointless. Breaking it could at the very least present that sellers are dropping their grip, and never beginning a bullish development however making step one towards one.

Nevertheless, Bitcoin is the extra important exterior issue. DOGE doesn’t get to maneuver independently in market situations like these. BTC continues to be deep inside its personal downtrend, and each failed bounce there cascades straight into belongings like DOGE. Meme belongings stay suppressed if Bitcoin retains declining, and even simply chopping sideways within the face of serious resistance.

So, is the DOGE downtrend ending? Nothing on the chart confirms that. Buyers ought to count on extra sideways-to-down conduct until BTC prints an actual restoration leg. With out broader market power, DOGE is prone to preserve drifting, and any short-term bounces will stay simply that, bounces not reversals. Liquidity drains quick, and speculative urge for food evaporates, precisely the setting DOGE performs the worst in.