- Bitcoin pushes towards $93K as short-liquidation clusters construct above.

- Bollinger Bands and reclaimed SMA present situations for an upside growth.

- $92K–$94K stays the crucial choice zone for both a squeeze or one other rejection.

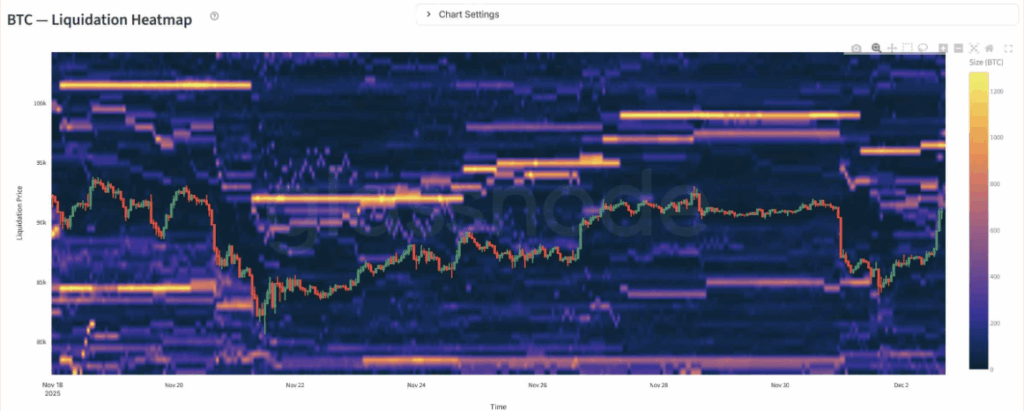

Bitcoin is making one other run on the $93,000 area — its second try in lower than every week — and this time the derivatives information is throwing off some critical volatility warnings. Glassnode’s liquidation heatmap is lighting up with dense short-liquidation clusters between $92.5K and $94K, hinting {that a} squeeze might erupt if BTC pushes only a bit larger.

What makes this cluster attention-grabbing is the timing. Bitcoin was sharply rejected at this precise stage simply days in the past, and but worth is true again within the zone. That normally means merchants are stacking quick positions once more, attempting to fade the transfer — which, mockingly, units the stage for a fair larger breakout.

Shorts Are Fueling the Fireplace

Quick-liquidation pockets act virtually like dry tinder below a spark. As soon as BTC pushes into these areas, over-leveraged shorts are compelled to purchase again their positions, which creates quick upside momentum with out requiring a flood of latest consumers. It’s principally compelled demand.

This mechanic has powered a few of Bitcoin’s strongest, most explosive rallies in earlier cycles — and the setup appears to be like comparable proper now.

Technicals Are Now Aligned With a Larger Transfer

Bollinger Bands on the day by day chart help this view. BTC has lastly reclaimed the 20-day SMA round $90.5K, a stage the market struggled with for almost two full weeks. Closing above it normally indicators a short-term development reversal.

Volatility is increasing too. After days of tight compression, the bands are widening once more — a basic precursor to main directional motion. The higher Bollinger Band sits close to $97.9K, that means Bitcoin has technical room to run if momentum retains constructing.

At the moment’s bullish candle additionally helped. It engulfed the whole multi-day vary that worth was trapped in, displaying that consumers nonetheless have power. And final week’s rebound from the decrease Bollinger Band close to $83K was one other key second — consumers absorbed the sell-off immediately, a response that aligned completely with long-liquidation pockets on the heatmap.

The Make-or-Break Zone: $92K–$94K

This complete push now comes down to 1 crucial area: $92K–$94K.

This zone consists of:

- Dense short-liquidation clusters

- Increasing volatility

- A reclaim of main technical ranges

- Merchants aggressively shorting into resistance

If Bitcoin can break decisively above $93K, the situations favor an accelerated transfer — the form of rally the place worth jumps 1000’s in minutes as compelled consumers pile in.

However… there’s the opposite aspect of the coin. This precise area rejected BTC aggressively only a few days in the past. If bears handle to defend it once more, it might affirm that sellers nonetheless see this as a cycle-defining resistance wall.

Both manner, right here is the place issues get loud — the subsequent transfer out of this zone might form Bitcoin’s December path.

The put up Quick Squeeze Threat Grows as Bitcoin Revisits $93K Resistance Zone – Right here is why the subsequent transfer could possibly be explosive. first appeared on BlockNews.