- Solana has bounced again above $140 after briefly tagging $123, with on-chain knowledge displaying robust USDC inflows and SOL outflows that trace at quiet accumulation.

- Key help sits within the $130–$135 vary whereas resistance round $145–$150 have to be damaged for a push towards $175, whilst futures exercise nonetheless lags spot demand.

- Community fundamentals stay robust with excessive throughput, low charges, rising DeFi and NFT ecosystems, plus a brand new quantum safety patent including long-term confidence.

Solana has clawed its approach again above $140 after a reasonably chaotic drop under $130, the place it briefly touched $123 earlier than bulls lastly stepped in. The rebound was sharp—virtually just like the market realized it overreacted—and SOL is now hovering round $140.25. It’s a stable bounce from the lows, although it’s nonetheless removed from its 2025 peak close to $295.83. Nonetheless, the sudden acceleration feels completely different this time, virtually like one thing beneath the floor shifted.

On-Chain Alerts Level to Massive Accumulation

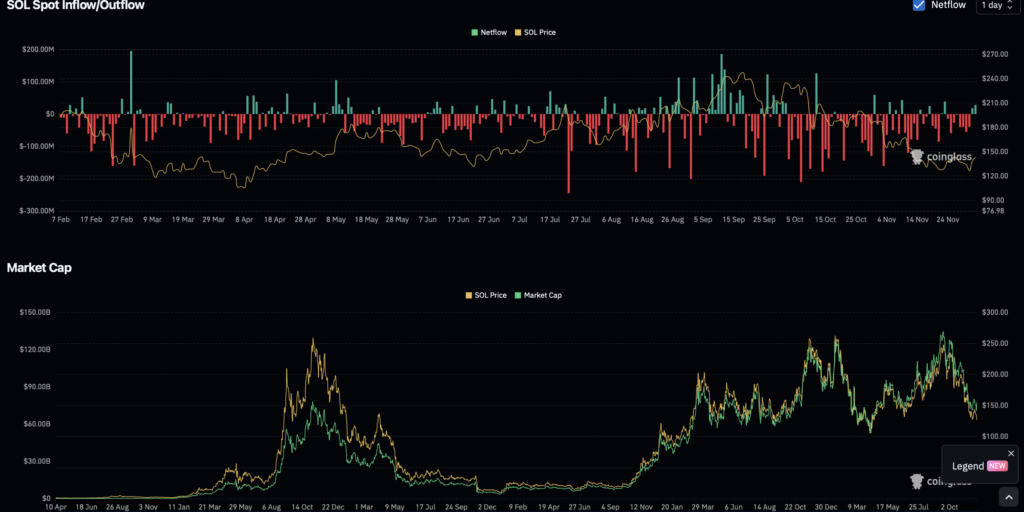

Behind the worth bounce, the on-chain numbers look… truthfully sort of wild. CryptoQuant knowledge exhibits an enormous liquidity imbalance on Binance simply final week. USDC inflows spiked to $2.12 billion, whereas SOL outflows hit $1.11 billion. That’s the basic bullish cocktail—stablecoin liquidity flowing in, whereas native tokens stream out, often hinting that patrons are loading their wallets off-exchange.

Glassnode’s cost-basis heatmap backs it up. It exhibits greater than 17.8 million SOL purchased round $142, and one other 16 million round $135. These large clusters principally act like invisible help zones—huge pockets of holders who don’t wish to let value fall under their entry. For this rally to essentially breathe, SOL must reclaim $135 after which punch by means of $142 with confidence. Doing that will flip all these freshly-minted patrons into agency, psychological help.

Technicals Lean Bullish, However Not With out Warning Indicators

From a charting angle, issues look cautiously optimistic. Solana’s RSI has bounced from a low 35 again to the mid-50s, which often alerts recovering momentum. The MACD simply flipped optimistic too—for the primary time in months. However the token nonetheless sits inside a long-standing descending resistance channel that’s been choking each rally try since March 2025.

The $130–$135 vary stays rock-solid help. Lose that, and also you begin flirting with extra painful territory—presumably $120. If the market will get nasty, the 0.786 Fibonacci degree sits all the way in which down close to $75, which… yeah, nobody desires to see examined once more. On the upside, a clear maintain above $145–$150 might open a runway towards $175, however SOL has failed at that zone greater than as soon as this yr.

Futures Merchants Aren’t Absolutely on Board But

Whereas spot shopping for seems robust, the derivatives aspect tells a quieter story. SOL futures quantity truly fell 3% whilst Bitcoin and Ethereum futures jumped 43% and 24%. That sort of imbalance means spot patrons is perhaps stepping in, however merchants haven’t absolutely returned to speculative positioning but. Liquidity is warming up, however conviction isn’t all the way in which there.

Relative unrealized revenue has additionally slipped again to 2023 ranges—particularly to the place Solana was buying and selling round $20. Traditionally, these full resets usually occur earlier than main restoration phases, however they require energetic participation from merchants. With out that, the setup turns into sluggish, even when the basics scream energy.

Community Fundamentals Keep Exceptionally Sturdy

By means of all of the volatility, Solana’s uncooked efficiency metrics stay virtually boringly constant. The community processes round 1,100 TPS, block confirmations occur in beneath 400 milliseconds, and uptime has sat above 99.9% since mid-2024. The typical transaction charge? About $0.00025—principally mud when in comparison with Ethereum’s $2.50 common. For top-speed functions, it’s nonetheless probably the most environment friendly chains on the earth.

The broader ecosystem seems wholesome too. DeFi TVL sits at $5.4 billion throughout protocols like MarginFi, Jupiter, and Raydium. The NFT phase is holding above $1.2 billion, and greater than 350 energetic dApps are pulling in over 1.3 million month-to-month energetic wallets. For a supposedly “bearish” interval, adoption hasn’t slowed down in any respect.

A Quantum Safety Patent Provides One other Layer of Confidence

A stunning twist got here from Quantum Inc., which simply filed a U.S. patent for its Quantum DeFi Wrapper expertise. The purpose is to defend Solana-based DeFi protocols from rising quantum-computing threats—one thing your complete trade has been nervous about for years. If this tech works the way in which it claims, Solana would acquire one of many strongest long-term safety pitches within the ecosystem.

Solana Value Outlook: Breakout or Breakdown?

Solana is sitting at a genuinely essential second. If bulls can anchor the worth above $135 and eventually break by means of the $145–$150 resistance wall, the market might ignite a full development reversal. The subsequent logical goal could be someplace round $175. However failure to carry $130 opens the door to $120, and in a harsher state of affairs, presumably a plunge again towards double digits.

The excellent news is that on-chain accumulation seems robust, technicals are bettering, and community fundamentals are rock stable. The not-so-good information? Futures exercise is gentle, and Solana nonetheless must flip a number of resistance zones earlier than momentum can absolutely return. For now, merchants ought to look ahead to rising quantity and a each day shut above $145—these could be the clearest indicators that the subsequent leg increased is lastly beginning.

The publish Solana Close to Breakout Zone as Help Holds Above $135 and Demand Builds on Binance – Right here is the place value could go. first appeared on BlockNews.