Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth dropped 2% within the final 24 hours to commerce at $2,805 as of three:50 a.m. EST on a 20% improve in every day buying and selling quantity to $27.18 billion.

The autumn within the ETH worth introduced Tom Lee’s BitMine, the most important Ethereum treasury agency, again into the market with a $70 million purchase.

⚡️ NEW: Tom Lee’s #Bitmine simply added one other 7,080 $ETH to their treasury. pic.twitter.com/85vKJQ5onb

— Rand (@cryptorand) December 2, 2025

BitMine now owns greater than 3% of ETH’s whole provide and goals to extend that to five%.

JUST IN: BitMine buys 23,773 ETH ($70M) in 72 hours, pushing its holdings to three.7M ETH — 62% of the best way towards proudly owning 5% of Ethereum’s provide.

Tom Lee shifts his BTC ATH prediction once more. pic.twitter.com/wvLYBGYMNn

— Jessica Gonzales (@lil_disruptor) December 2, 2025

Ethereum On-Chain Indicators Again Lengthy-Time period Bull Case

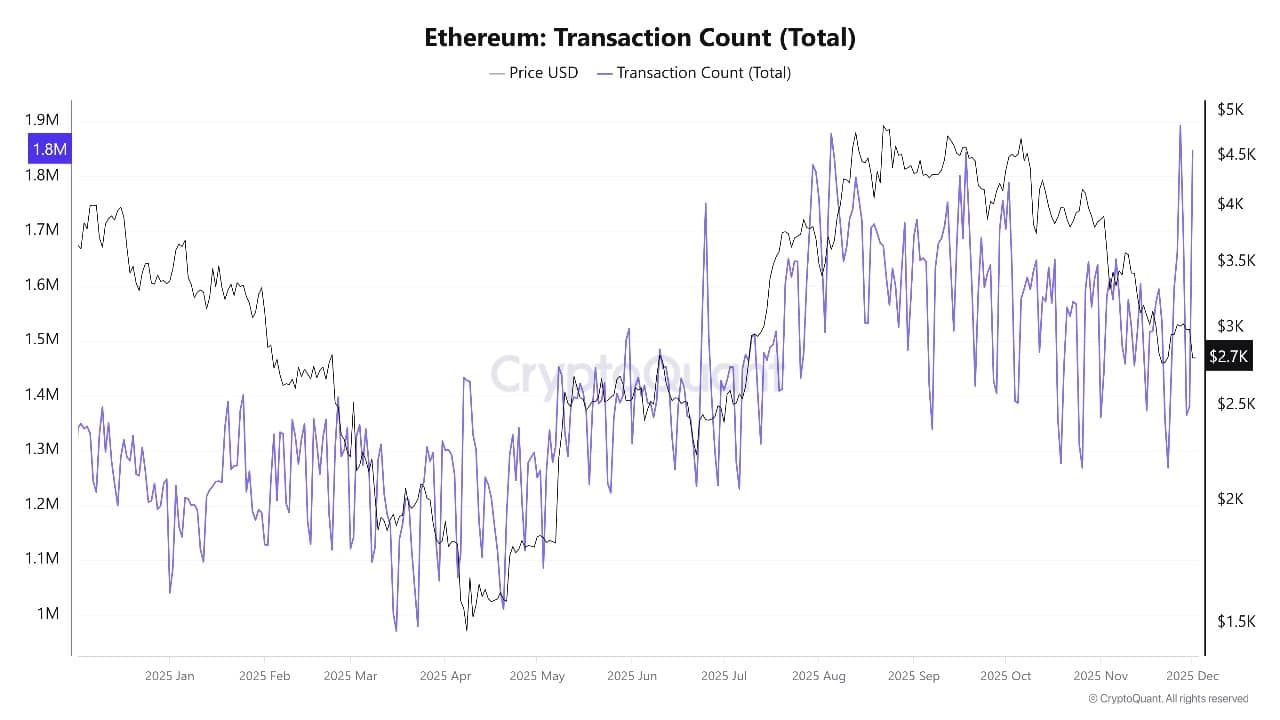

On-chain knowledge for Ethereum continues to indicate a powerful underlying community, even whereas spot costs transfer sideways to down. Analysts report that greater than 130 million transactions had been processed within the third quarter alone, with quantity rising roughly 30% yr‑on‑yr due to progress on Layer 2 networks that settle again to Ethereum.

Ethereum Transaction Depend Supply: CryptoQuant

Staking stays a key pillar of the bull case, with round 35 million ETH locked in validator contracts, equal to about 30% of the overall provide and successfully faraway from day‑to‑day buying and selling.

This excessive staking share, mixed with DeFi’s complete worth locked close to the a whole bunch of billions of {dollars}, alerts that many customers and establishments are committing capital to the ecosystem relatively than exiting.

Nevertheless, trade and derivatives knowledge inform a extra cautious story. Ethereum trade‑traded merchandise have seen each sharp inflows and enormous outflows in latest months. Together with a number of days the place a whole bunch of hundreds of thousands of {dollars} left the ETFs, weighing on worth momentum.

On the similar time, futures open curiosity is elevated, and funding charges have cooled, suggesting merchants are hedging draw back threat at the same time as lengthy‑time period holders quietly accumulate.

ETH Value Technical Outlook And Prediction

The Ethereum worth has damaged down beneath the rising channel that guided the worth increased between April and September, with the development now turned clearly bearish.

ETH just lately bounced from a low close to $2,700. However stays beneath each the 50‑day easy transferring common round $3,450 and the 200‑day SMA close to $3,526. Signalling that sellers nonetheless management the market.

Key Fibonacci retracement ranges from the earlier main rally present an necessary assist zone across the 0.786 degree close to $2,140. With intermediate assist on the 0.5 degree, round $3,165 has already been misplaced on a closing foundation.

ETHUSD Evaluation Supply: Tradingview

Momentum indicators together with the RSI close to the low‑30s and a unfavourable MACD, affirm that ETH is in a downtrend but additionally trace at a attainable oversold bounce if promoting slows.

Within the brief time period, the ETH worth must reclaim the damaged 200‑day and 50‑day transferring averages round $3,450–$3,550 to sign {that a} significant restoration is underway

If bulls fail and worth closes again beneath $2,700, the chart factors to a possible slide towards the deeper assist band close to $2,150, the place stronger dip‑shopping for may seem.

On the upside, a break above $3,550 may open the door for a transfer towards $3,800–$4,200 within the coming months.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection