Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth edged up a fraction of a p.c previously 24 hours to commerce at $87,061 as of two:35 a.m. EST on buying and selling quantity that soared 18% to $76.3 billion.

This comes as Japanese 30-year authorities bond yields climbed to a report excessive on Tuesday amid considerations that the Financial institution of Japan (BOJ) could increase rates of interest as quickly as this month. Governor Kazuo Ueda mentioned in a speech that policymakers would contemplate the “professionals and cons” of a December fee hike.

Japan’s 10Y bond yield simply surged to 1.84%, the best since 2008.

When yields rise, borrowing yen turns into costly.

Traders who used low cost yen to purchase threat belongings are compelled to unwind their trades.Consequence: international worry + greater than $400M in leveraged longs liquidated. pic.twitter.com/56nvaJVtTq

— Impressed Analyst (@inspirdanalyst) December 1, 2025

However many merchants consider the BOJ will quickly begin stepping again from its ultra-loose coverage, a change that would ship waves by way of international funding markets.

US Bitcoin ETFs Document Inflows

Regardless of an unsure backdrop, information from Coinglass reveals that US BTC ETFs (exchange-traded funds) posted a internet influx of $8.5 million yesterday, the fourth straight day of internet inflows.

BlackRock’s IBIT recorded a internet outflow of $65.9 million, whereas Constancy’s FBTC noticed a internet influx of $67 million.

This additionally comes as Vanguard shoppers will now achieve entry to chose crypto-focused ETFs and mutual funds holding digital belongings by way of the agency’s brokerage platform.

Beginning tmrw vanguard will permit ETFs and MFs monitoring bitcoin and choose different cryptos to start buying and selling on their platform. They cite how the ETfs have been examined carried out as designed by way of a number of durations of volatility. Story by way of @emily_graffeo pic.twitter.com/AKhMdR7pab

— Eric Balchunas (@EricBalchunas) December 1, 2025

Beginning tmrw vanguard will permit ETFs and MFs monitoring bitcoin and choose different cryptos to start buying and selling on their platform. They cite how the ETfs have been examined carried out as designed by way of a number of durations of volatility. Story by way of @emily_graffeo pic.twitter.com/AKhMdR7pab

— Eric Balchunas (@EricBalchunas) December 1, 2025

In keeping with the corporate, these merchandise can be supplied by way of third-party issuers, because it does with gold-based funding automobiles.

Vanguard emphasised that it’s going to checklist solely ETFs that meet regulatory necessities. These will embrace merchandise tied to main digital belongings similar to Bitcoin, Ethereum, XRP, and Solana.

With BTC in demand from establishments, can the present surge proceed?

Bitcoin Worth Set For A Restoration Regardless of Bearish Strain

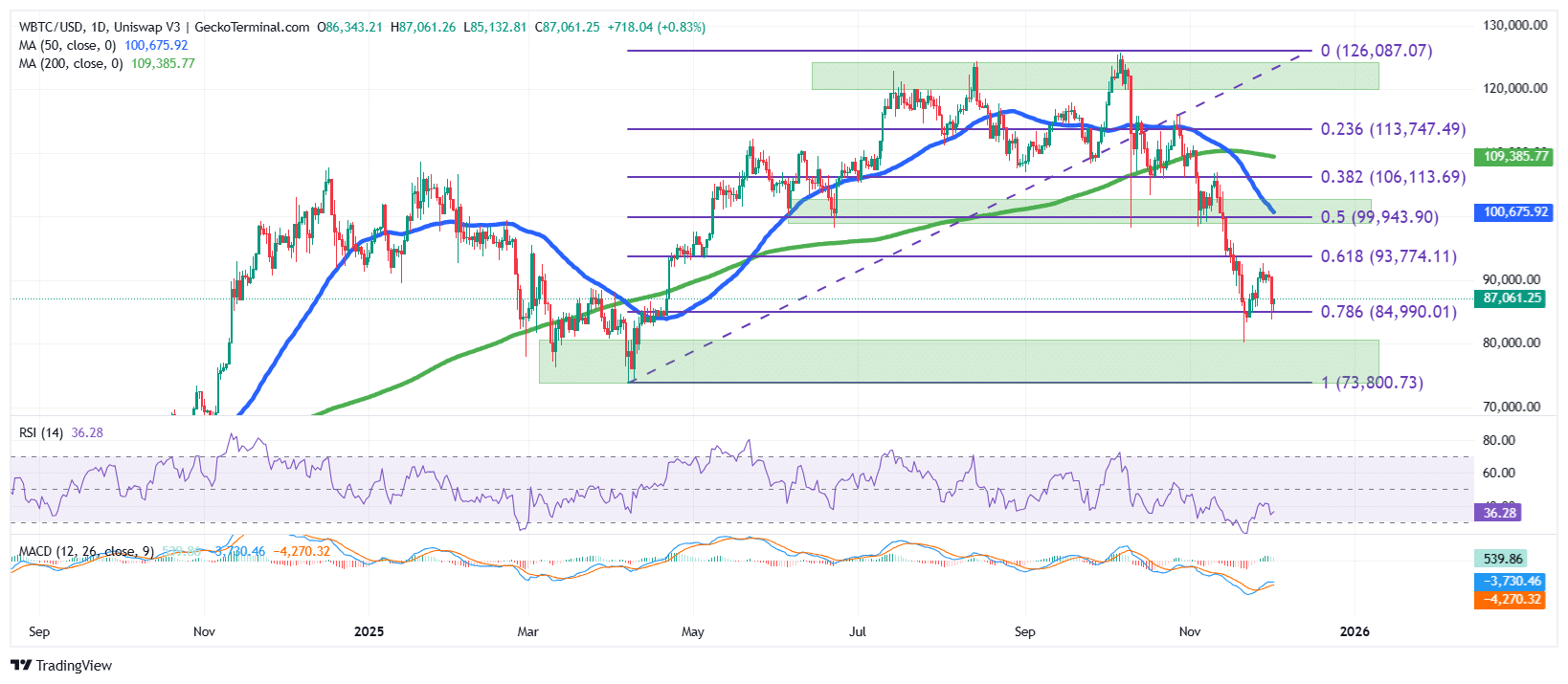

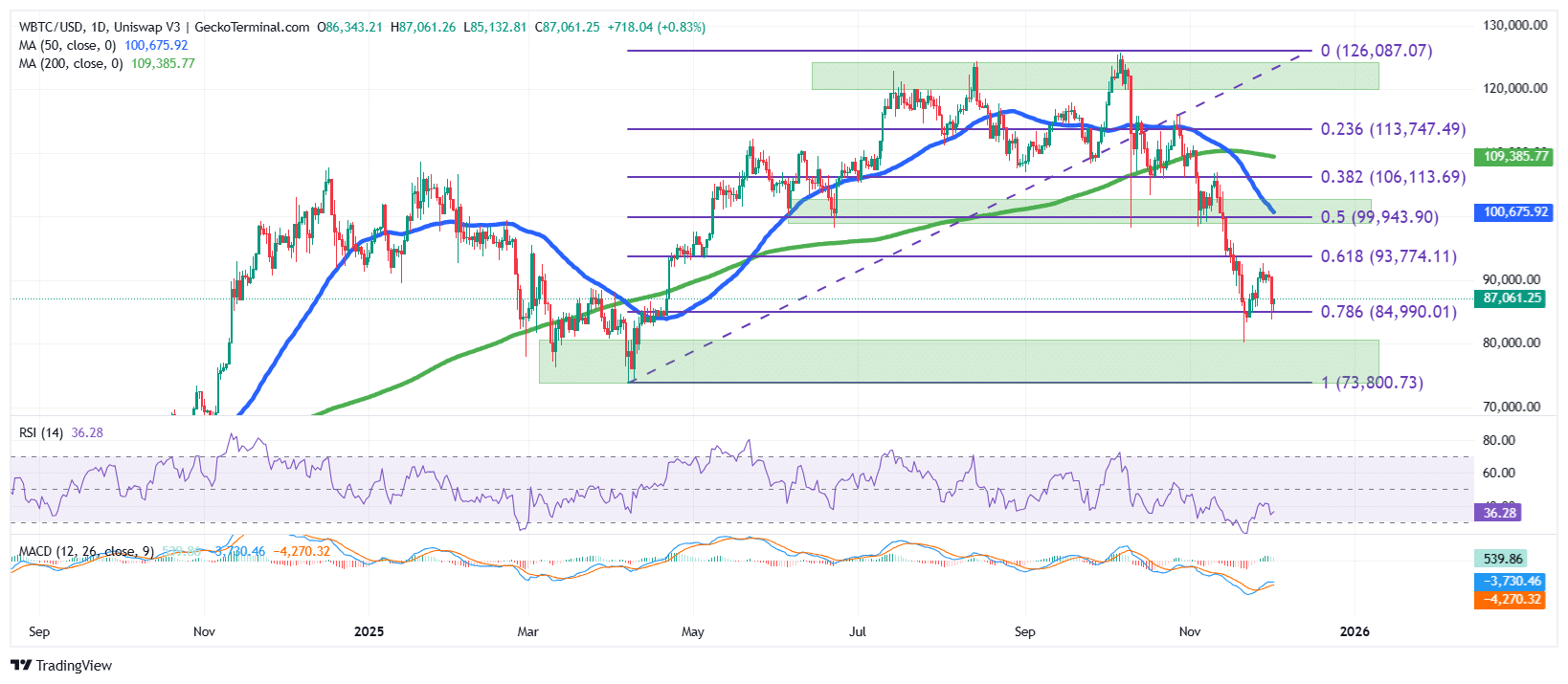

After surging from the $73,800 in April to the touch the $126,000 all-time excessive (ATH), the BTC worth fashioned what regarded like a rounded prime on the day by day chart.

The sample has since fueled a sustained downtrend, closing under the $100,000 help space and key Fibonacci retracement degree. This drop was additionally castigated by the BTC Easy Transferring Averages forming a demise cross round $110,700, because the 50-day SMA crossed under the 200-day SMA.

The Bitcoin worth has since retested the $84,000 zone twice, which can be a powerful help space at this degree, as the most recent day by day candle reveals that the asset is recovering.

In the meantime, the value nonetheless trades properly under each the 50-day and 200-day SMAs, which means that Bitcoin remains to be underneath bearish strain.

On account of the volatility within the final 24 hours, now we have seen the Relative Power Index (RSI) soar and plunge, and now transfer throughout the 36 space, barely above the 30-oversold area. In the long run, the RSI signifies that sellers nonetheless have management.

Nonetheless, the value of BTC could also be poised for a restoration, because the Transferring Common Convergence Divergence (MACD) has turned optimistic.

The blue MACD line has crossed above the orange sign line, forming a bullish crossover, because the inexperienced bars on the histogram begin forming.

BTC Worth Prediction

Based mostly on the day by day chart, the BTC worth is in restoration from under the 0.786 Fib degree ($84,990), supported by the most recent candle and optimistic momentum from the MACD indicator.

If the restoration continues and breaches the 0.618 Fib zone, the value of Bitcoin may surge additional, aiming at breaking out of the $0.5 Fib zone ($99,943) to focus on the 0.382 Fib zone ($106,113).

Conversely, if the general bearish development picks up, the Bitcoin worth may drop again under the $84,000 help zone, with the $73,800 degree performing as a cushion in opposition to draw back strain and the last word help.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection