Sonnet shareholders approve merger to type Hyperliquid’s first main DAT, boosting HYPE practically 10%.

Sonnet BioTherapeutics has confirmed shareholder approval for its merger with Rorschach LLC, and the vote clears the trail for creating the primary massive Hyperliquid digital asset treasury. The choice triggered an enormous spike within the HYPE token which soared near 10% with the markets reacting to the incoming institutional demand. The event additionally augments the momentum for Hyperliquid’s growth at massive.

Shareholders Approve Merger to Type Main Digital Asset Treasury

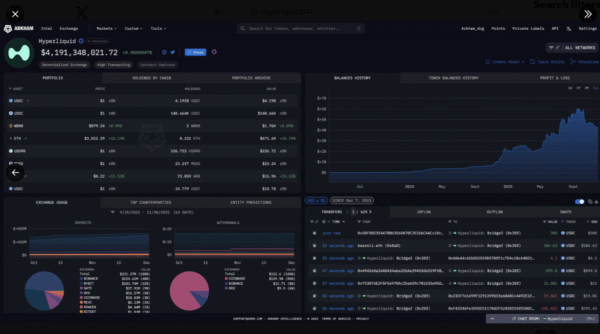

The approval got here on December 2, nearly 5 months after Sonnet reached an settlement to merge with Rorschach to type Hyperliquid Methods. Official paperwork and press releases point out that the mixed entity desires to have $583 million in HYPE tokens and no less than $305 million in money. Subsequently, the entire projected worth for the brand new treasury is $888 million. Experiences from blogs and business watchers point out that this construction is much like accumulation methods in different digital asset treasuries.

Associated Studying: HYPE Information: Hyperliquid Unlocks 1.75M HYPE Tokens Value $60M | Dwell Bitcoin Information

Background info factors out Sonnet’s technique of pivoting into digital property with a regulated company framework. This method additionally makes Hyperliquid Methods one of many first massive measurement digital asset treasury buildings solely targeted on HYPE. The transfer comes in keeping with rising institutional curiosity in blockchain-native treasuries in rising markets.

Following the announcement, HYPE rose greater than 10% and was buying and selling round $33 on December 3. This achieve got here regardless of common market concern, which was nonetheless excessive in line with the CoinMarketcap Worry and Greed Index. Market watchers say the rise is a mirrored image of confidence within the anticipated inflows relatively than short-term sentiment. Furthermore, the information got here at a time of stress attributable to the truth that 1.75 million HYPE tokens have been scheduled to be unlocked for builders and contributors.

Buying and selling blogs present that institutional accumulation tends to neutralize short-term promoting pressures referring to vesting schedules. Subsequently, the optimistic response implies that the market is on the lookout for long-term help with the DAT construction. Analysts additionally state that safe and dedicated capital swimming pools are likely to stabilise liquidity by means of risky phases.

Specialists See Sturdy Institutional Sign in Treasury Construction

Trade commentators liken the treasury deliberate by Hyperliquid Methods to high-profile company accumulation methods. The method is much like the techniques employed by corporations investing big digital reserves in long-term balance-sheet planning. Specialists level out that managed and large-scale holdings symbolize the soundness of demand sooner or later. In addition they level out that 65% of the treasury’s worth can be in HYPE with 35% being in USD, making a balanced reserve mannequin.

Commentary from digital asset analysts highlights how institutional treasuries can drive the adoption course of. In addition they provide deeper liquidity in buying and selling venues. Experiences point out that, relying on treasury will increase, it usually influences the market habits, because it reduces the circulation of provide over lengthy horizons.

The event of Hyperliquid DAT bolsters the expectations of continued inflows into the HYPE ecosystem. Moreover, structured treasuries are sometimes useful in stabilizing liquidation behaviors as a result of they create predictable capital reserves. Because of this, markets will be extra orderly in instances of stress. Early reactions recommend that this growth can help the long-term worth progress, assuming the continued accumulation tendencies.

By elevating a considerable amount of capital and adopting an institutional treasury mannequin, Hyperliquid Methods helps HYPE on its journey to deeper market integration. The approval is a big shift, and it’s a signal of rising curiosity in disciplined digital asset holdings in company frameworks.