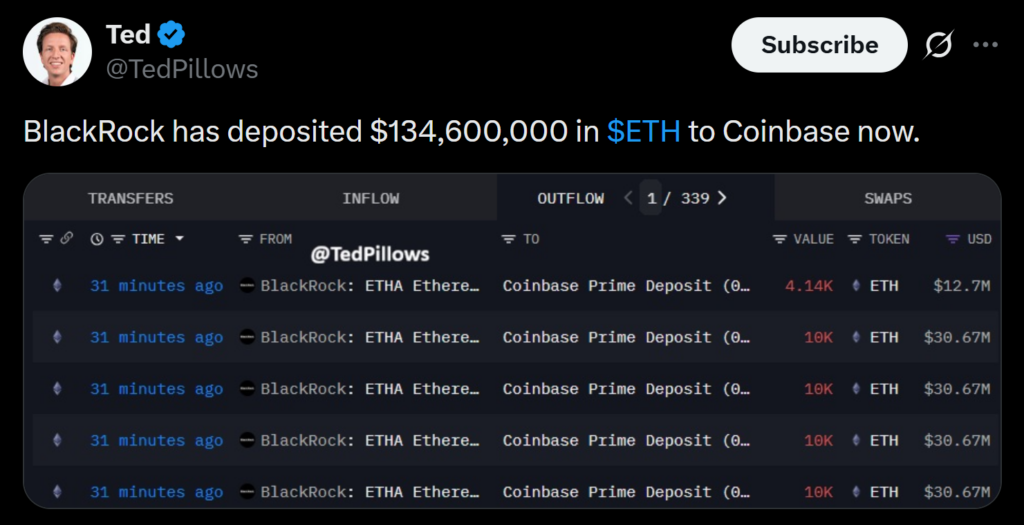

- BlackRock transferred 44,140 ETH (~$135M) to Coinbase Prime for ETF-related operations.

- BlackRock’s ETHA ETF noticed $89M in outflows, whereas Constancy and Grayscale recorded beneficial properties.

- Coinbase Prime stays the go-to institutional platform for safe crypto custody and buying and selling.

BlackRock made a notable on-chain transfer in the present day, sending 44,140 ETH — roughly $135 million — to Coinbase Prime. The switch marks the newest exercise tied to the agency’s increasing crypto ETF infrastructure and ongoing portfolio rebalancing throughout its digital-asset merchandise.

Why BlackRock Is Shifting ETH

The funding big manages each spot Bitcoin and Ethereum ETFs, and these transfers typically replicate inner balancing as funds regulate publicity, liquidity, or redemption pipelines. Coinbase Prime, which acts as an institutional-grade custody and buying and selling venue, handles the operational spine for a lot of ETF-related transfers. For BlackRock, it’s the logical touchdown spot for storing, allocating, or repositioning crypto belongings in a regulated setting.

ETF Flows Present Blended Sentiment

BlackRock’s Ethereum ETF (ETHA) recorded round $89 million in web outflows yesterday — a pointy distinction to the inflows seen by competing funds from Constancy and Grayscale. The cut up highlights how investor sentiment continues to be rotating throughout issuers, particularly as macro uncertainty stays elevated. These crossflows typically result in repositioning on-chain as massive managers hold their ETF backing belongings synced with market demand.

Institutional Infrastructure Retains Increasing

Coinbase Prime continues to cement itself because the hub for institutional crypto exercise, notably for ETF issuers that want extremely regulated custody and quick execution. BlackRock’s repeated use of the platform underscores how seamlessly conventional finance is beginning to mix with digital-asset plumbing. Even throughout unstable stretches, institutional-grade operations like these recommend long-term integration continues to be accelerating behind the scenes.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.