Be part of Our Telegram channel to remain updated on breaking information protection

The second-largest financial institution within the US, Financial institution of America, has beneficial a 1% to 4% Bitcoin allocation to its wealth administration purchasers by way of Merrill, Financial institution of America Non-public Financial institution and Merrill Edge platforms.

“For traders with a powerful curiosity in thematic innovation and luxury with elevated volatility, a modest allocation of 1% to 4% in digital property might be acceptable,” stated Financial institution of America chief funding officer Chris Hyzy in an announcement to Yahoo Finance.

Financial institution Of America Shoppers Will Have Entry To 4 Bitcoin ETFs In January

The financial institution will open up entry to 4 new spot Bitcoin ETFs (exchange-traded funds) beginning Jan. 5. These funds embody the Bitwise Bitcoin ETF (BITB), Constancy’s Sensible Origin Bitcoin Fund (FBTC), Grayscale’s Bitcoin Mini Belief (BTC), and BlackRock’s iShares Bitcoin Belief (IBIT).

The event will allow the financial institution’s wealthiest purchasers to achieve publicity to Bitcoin ETFs. Beforehand, these funding autos had been solely out there on request. Nonetheless, the financial institution’s greater than 15,000 funding advisors will now be capable of advocate the merchandise to purchasers.

The 4 Bitcoin ETFs highlighted by Financial institution of America are among the many largest by way of cumulative inflows for the reason that merchandise launched in early 2024.

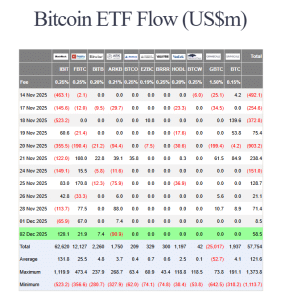

US spot Bitcoin ETF flows (Supply: Farside Buyers)

In line with knowledge from Farside Buyers, BlackRock’s IBIT has been the most well-liked fund, with its cumulative inflows standing at $62.620 billion. In second place is Constancy’s FBTC, which has seen $12.127 billion enter its reserves since launch. BITB has seen the third-highest cumulative inflows of $2.260 billion, whereas BTC’s cumulative inflows stand at $1.937 billion.

Different Main Monetary Establishments Have Advisable A Bitcoin Allocation

Financial institution of America joins different monetary giants which might be giving purchasers entry to crypto and which have beneficial a Bitcoin allocation in traders’ portfolios.

BlackRock, the world’s largest asset administration agency, was the primary establishment to advocate an as much as 2% Bitcoin allocation to its purchasers in December 2024. It stated that round a 1% to 2% allocation is a “affordable vary for Bitcoin publicity.”

The agency added that the main crypto poses the “similar share of general portfolio threat” as a typical allocation to “the ‘magnificent 7’ group of principally mega-cap tech shares.”

In June this 12 months, asset administration agency Constancy beneficial a 2% to five% Bitcoin allocation as effectively, which it stated was sufficiently small to attenuate threat of a Bitcoin crash, however giant sufficient for traders to get pleasure from any upside from the crypto’s inflationary hedge.

A few months later in October, Morgan Stanley additionally urged a 2% to 4% allocation to crypto portfolios for traders and monetary advisers.

In the meantime, Vanguard, which has round $11 trillion in property beneath administration and about 50 million purchasers, has allowed its purchasers to start out buying and selling crypto ETFs and mutual funds on its platform yesterday. This was a reversal in stance for the monetary big.

Vanguard stated in an announcement that it’ll solely permit purchasers to commerce ETFs that meet regulatory requirements. These embody merchandise for cryptos similar to Bitcoin, Ethereum, XRP, and Solana. It additionally stated that it’ll not permit for the buying and selling of meme coin merchandise. Moreover, the asset supervisor stated that it’ll not be launching its personal merchandise.

“Vanguard Impact” Causes Bitcoin To Bounce Over 7%

Bitcoin’s value has surged over 7% up to now 24 hours, knowledge from CoinMarketCap reveals.

Bloomberg ETF analysts Eric Balchunas attributed the rise in BTC’s value and the rebound seen throughout the broader crypto market to the “Vanguard Impact.”

THE VANGUARD EFFECT: Bitcoin jumps 6% proper round US open on first day after bitcoin ETF ban lifted. Coincidence? I feel not. Additionally $1b in IBIT quantity in first 30min of buying and selling. I knew these Vanguardians had somewhat degen in them, even a number of the most conservative traders… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

“Bitcoin jumps 6% proper round US open on first day after bitcoin ETF ban lifted. Coincidence? I feel not,” he stated.

“Additionally $1b in IBIT quantity in first 30min of buying and selling. I knew these Vanguardians had somewhat degen in them, even a number of the most conservative traders like so as to add somewhat scorching sauce to their portfolio,” Blachunas added.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection