the heldTron has emerged as one of many strongest performers in the course of the newest market downturn, displaying a stage of resilience not often seen amongst main altcoins. Whereas most large-cap cryptocurrencies have suffered drawdowns of 40% or extra since August, Tron has restricted its losses to simply 24%, outperforming almost the whole altcoin sector. This relative energy highlights the community’s distinctive positioning and the regular demand it continues to draw regardless of broader market weak point.

Associated Studying

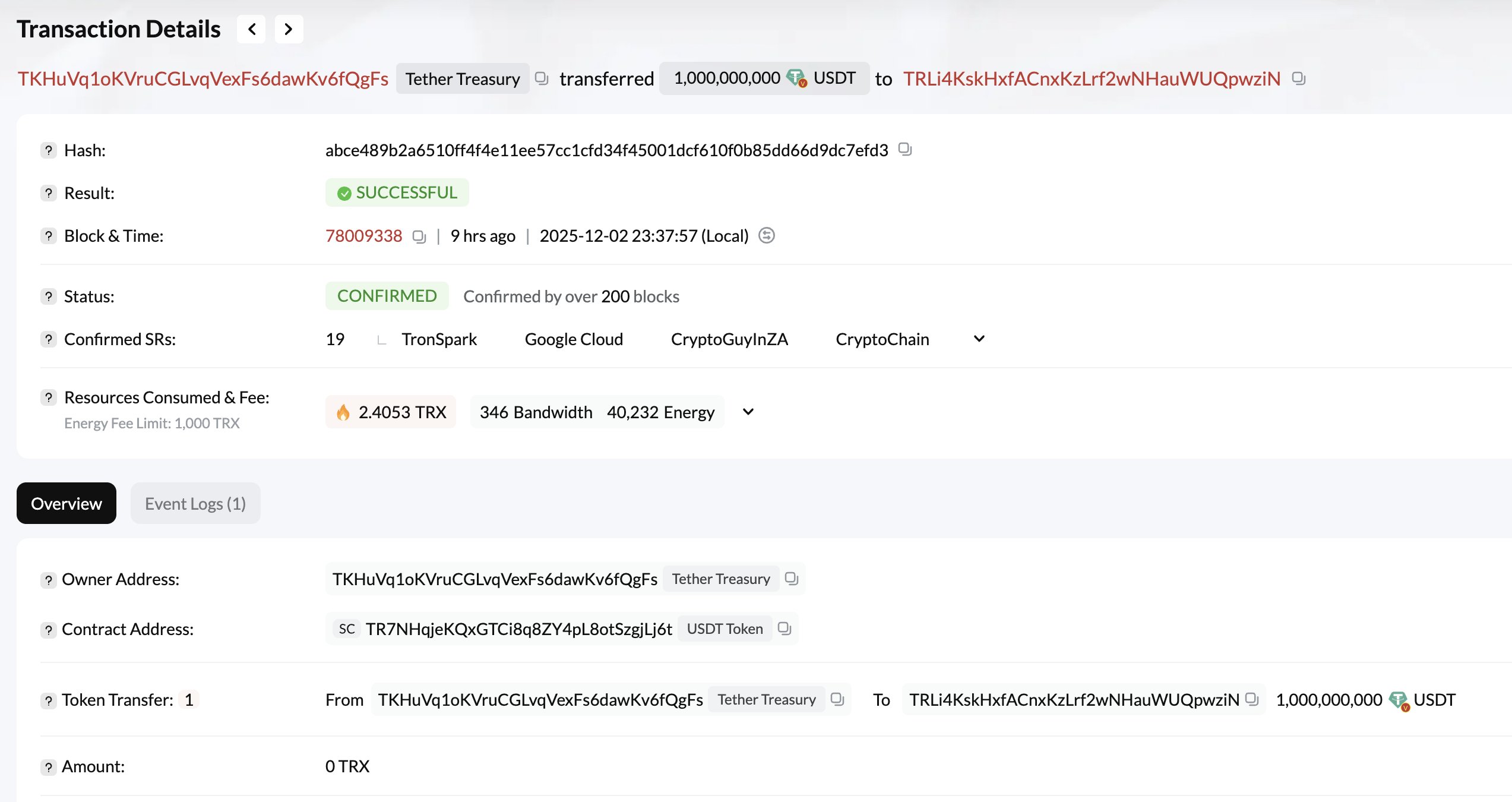

A significant component behind this resilience is Tron’s rising dominance within the stablecoin ecosystem. In response to knowledge from Tronscan, shared by Lookonchain, Tether minted one other 1 billion USDT on Tron, signaling continued confidence within the community’s capability to deal with large-scale stablecoin issuance. This new mint has pushed Tron’s stablecoin market cap above $80.2 billion, solidifying its position because the main chain for USDT circulation.

As capital rotates defensively into stablecoins, Tron tends to learn disproportionately. Its capability to take care of relative stability whereas the remainder of the market capitulates reinforces the concept that Tron’s utility-driven demand stays intact—and will proceed to supply help even when volatility persists.

Tron Strengthens Its Place because the Second-Largest Stablecoin Community

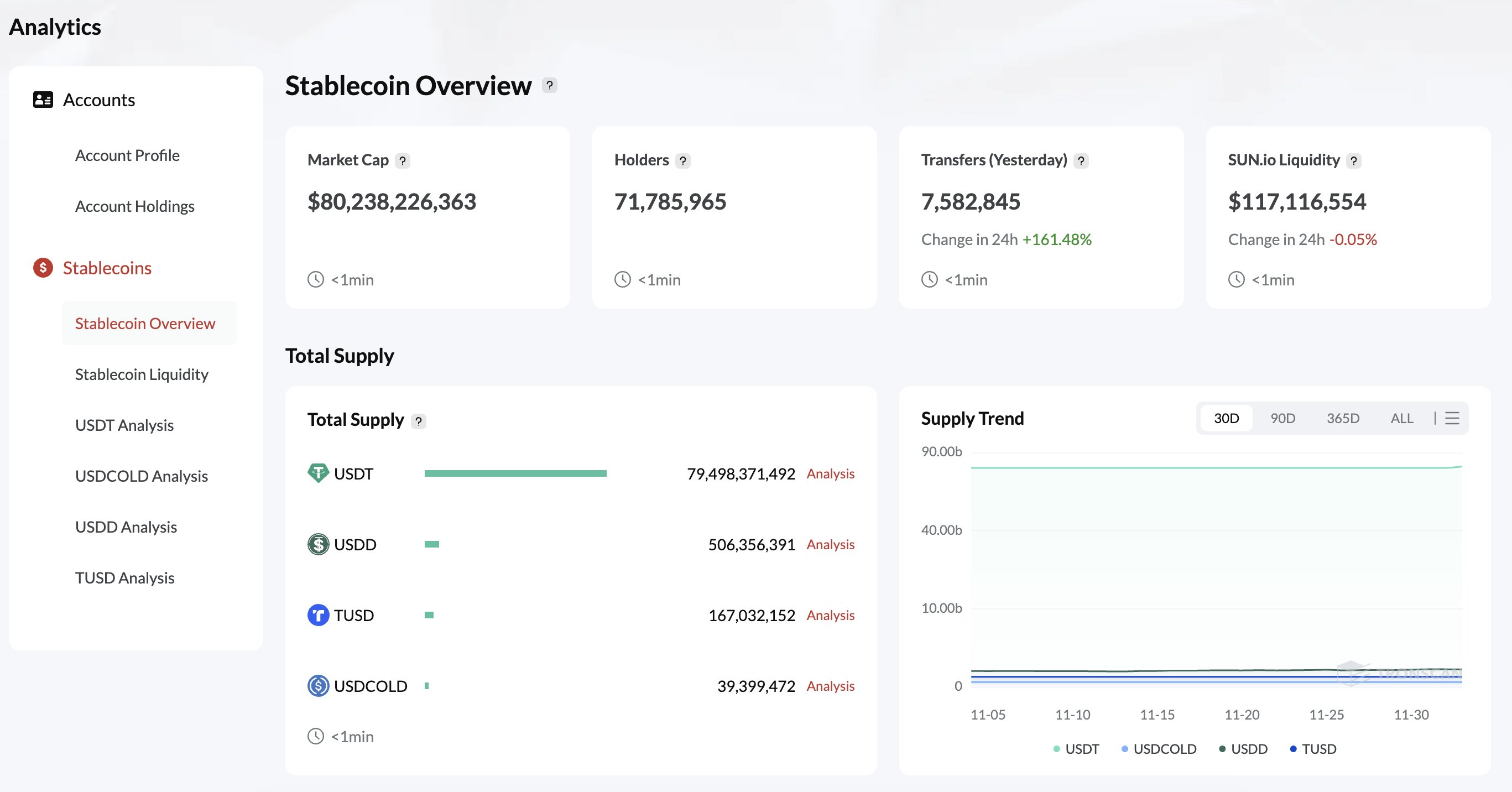

Tron has grow to be a central pillar of the worldwide stablecoin ecosystem, securing its place because the second-largest blockchain for stablecoin exercise. Its attraction comes from quick settlement instances, extraordinarily low transaction charges, and deep liquidity—options that make it the popular community for high-volume USDT transfers, particularly throughout exchanges, OTC desks, and remittance corridors.

This infrastructure has allowed Tron to draw huge stablecoin flows, with its complete stablecoin market cap now exceeding $80.2 billion, largely pushed by Tether’s continuous issuance on the community.

Nonetheless, regardless of Tron’s outstanding development, Ethereum nonetheless dominates the stablecoin panorama, sustaining a market cap of roughly $166 billion, which is almost double that of Tron. Ethereum’s dominance is supported by its broader DeFi ecosystem, institutional presence, and the higher-value exercise that takes place via good contracts, lending protocols, and on-chain monetary functions.

Stablecoins on Ethereum usually function liquidity for classy buying and selling and yield methods, whereas on Tron, they’re primarily used for settlement, funds, and alternate flows.

The 2 ecosystems complement totally different market wants. Ethereum anchors the institutional and DeFi-driven phase of stablecoin utilization, whereas Tron leads in high-throughput, cost-efficient transactions. As stablecoin demand grows globally, each networks proceed to strengthen their positions. One via scalability and pace, the opposite via DeFi depth and capital focus.

Associated Studying

TRX Holds Robust Weekly Construction Regardless of Volatility

Tron’s weekly chart exhibits a notable stage of resilience in comparison with broader market circumstances. Whereas many altcoins have skilled far deeper drawdowns, TRX has held above the $0.27–$0.28 help zone. Sustaining a robust higher-timeframe construction. The latest correction pulled the value down from the $0.36 area, however TRX continues to commerce comfortably above the 50-week SMA. Which now sits round $0.28 and acts as fast dynamic help.

This energy is critical. All through 2025, TRX has revered its rising shifting averages. The 50-week SMA particularly has supplied constant help throughout every market pullback. The 100-week and 200-week SMAs, positioned nicely beneath the present worth, present a broad, wholesome long-term uptrend that continues to be intact.

Associated Studying

For Tron to regain bullish momentum, it should reclaim the $0.30–$0.32 area. Which served as help in the course of the earlier uptrend and now acts as resistance. A robust weekly shut above this zone may open the door for a retest of the $0.34–$0.36 highs. Till then, TRX stays one of many market’s extra secure performers, displaying managed draw back and structural energy.

Featured picture from ChatGPT, chart from TradingView.com