The Grayscale Chainlink Belief ETF ($GLNK) launched on Tuesday, attracting roughly $41.5 million in its first day and marking a milestone for altcoin ETFs within the U.S.

Institutional demand for cryptocurrency publicity is increasing past Bitcoin and Ethereum. Consequently, many buyers at the moment are watching to see if LINK can attain new all-time highs.

Sponsored

Sponsored

ETF Launch Displays Rising Institutional Curiosity

The Grayscale Chainlink Belief ETF, buying and selling below the ticker $GLNK on NYSE Arca, is the primary spot Chainlink ETF for US buyers. Based on SoSoValue information, as of Dec 3, it noticed $40.90 million in internet inflows on its debut, with complete internet belongings reaching $67.55 million and $8.45 million in quantity. The ETF closed up 7.74% at $12.81 per share.

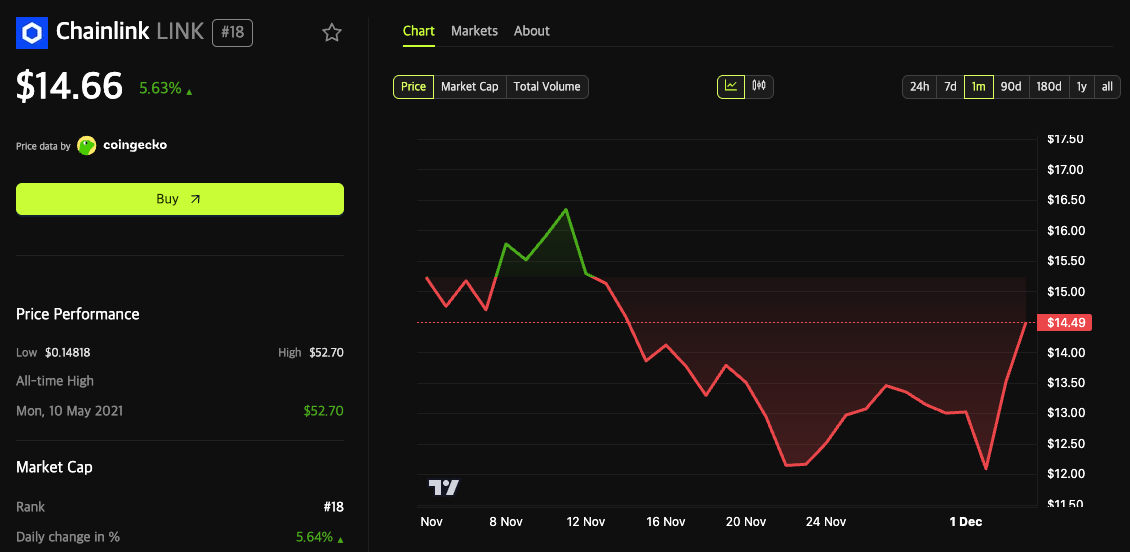

Grayscale transformed its current Chainlink Belief, first launched in February 2021, into this ETF. This transfer aligns with the corporate’s broader technique and offers establishments with direct publicity to LINK via conventional accounts. On the time of reporting, LINK, Chainlink’s native token, was priced at $14.66.

Grayscale CEO Peter Mintzberg famous the launch was “a transparent sign of broader market demand for Chainlink publicity,” pointing to elevated institutional curiosity in oracle community tokens. With its sturdy first day, $GLNK has change into one of many top-performing new crypto ETFs, launching amid rising market exercise and regulatory modifications.

LINK Technical Breakout and Whale Exercise

Technical analysts have seen a crucial sample shift in LINK’s value construction because the ETF debuted. The token broke out of a month-long downward channel. Many observers now consider this might assist drive LINK previous 2021 highs, as institutional flows via $GLNK could also be a catalyst for brand new information.

Sponsored

Sponsored

On-chain information highlights main whale accumulation earlier than and after the ETF launch. Lookonchain reported that 39 new wallets withdrew 9.94 million LINK, value $188 million, from Binance since October’s market correction. This conduct underscores confidence amongst giant holders, regardless of current volatility.

But not all giant buyers have benefited. OnchainLens recognized one deal with that acquired 2.33 million LINK over six months for $38.86 million. This whale now faces an unrealized lack of $10.5 million, with the place valued at $28.38 million. The case highlights the dangers and volatility in LINK accumulation, particularly for early purchasers at greater costs.

Market Dynamics and Potential Dangers

Open Curiosity information presents a nuanced view after the ETF launch. Open Curiosity has risen to round $7 million, following a previous dip. This development indicators renewed dealer engagement and larger confidence in LINK’s potential. A simultaneous value enhance and Open Curiosity usually factors to bullish momentum and energetic derivatives buying and selling.

Nevertheless, analysts warning that whales who accrued LINK earlier than the ETF launch might quickly method break-even or revenue targets. If these holders promote, promoting stress may restrict short-term positive factors regardless of sturdy institutional inflows. Merchants are carefully watching as LINK checks resistance, weighing optimism in opposition to attainable reversals whereas awaiting additional momentum.

The ETF’s outlook is determined by whether or not institutional demand meets potential whale promoting and continues to draw capital. As technical breakouts, whale accumulation, and Open Curiosity rise alongside file ETF inflows, each breakout and correction stay attainable. Market contributors are watching to see if LINK sustains its upward momentum or if profit-taking will drive a correction earlier than new highs.