Dogecoin pushed by way of key resistance with its strongest quantity in weeks, signaling retail-driven momentum whilst whale exercise fell to multi-month lows.

Information Background

- Dogecoin’s newest transfer unfolded towards a backdrop of modest however regular ETF participation.

- The 2 newly launched U.S. spot Dogecoin ETFs — Grayscale’s GDOG and Bitwise’s BWOW — recorded $177,250 in web inflows on December 3, bringing cumulative inflows since launch to $2.85 million, in keeping with SoSoValue knowledge.

- Whereas not explosive, the flows point out early-stage adoption amongst conventional buyers as regulated DOGE merchandise start to determine a foothold. The broader memecoin market remained subdued, however continued ETF demand supplied a small but notable tailwind as DOGE tried to reclaim key technical ranges.

Technical Evaluation

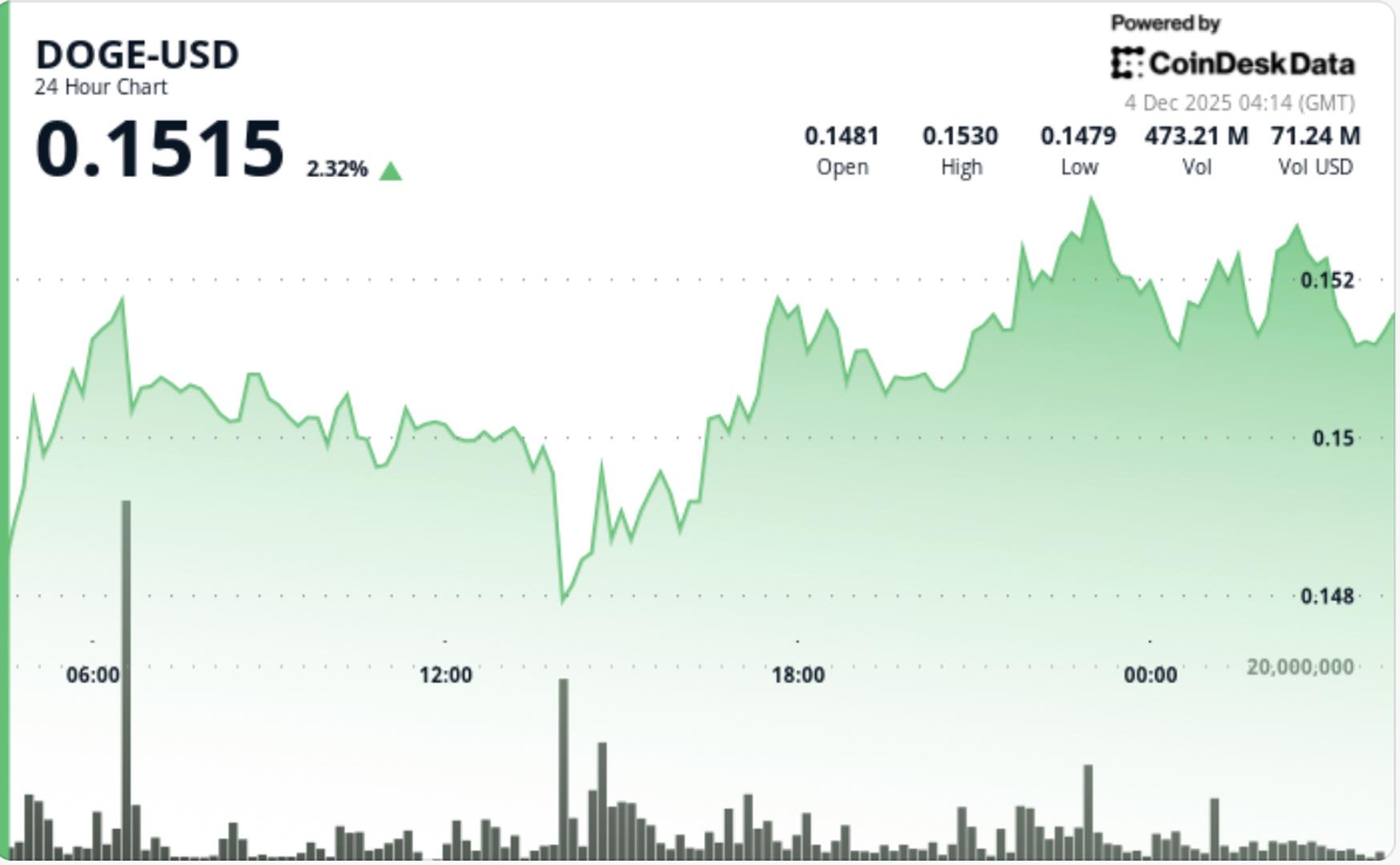

- DOGE’s construction strengthened notably as value confirmed an ascending channel constructed throughout three greater lows at $0.1469, $0.1488, and $0.1512. This sample displays sustained accumulation, with quantity increasing sharply on each upward leg and contracting throughout pullbacks—actual conduct merchants search for when differentiating true pattern shifts from noise.

- The breakout above $0.1505 marked the primary resistance clearance since late November. Tuesday’s quantity growth—triple the every day common—strengthened the legitimacy of the transfer.

- Regardless of declining whale involvement, the chart reveals constructive momentum: upward-sloping assist, growing amplitude on every breakout try, and clear reactions to intraday dips.

- Importantly, DOGE maintains structural integrity above the $0.1470 assist band. This space now acts because the technical pivot for continuation and defines the decrease boundary of the ascending channel.

- On the next timeframe, the $0.138 area stays the most important structural ground aligning with the 0.382 Fibonacci retracement and 200-week transferring common—ranges that proceed to draw long-term patrons.

- DOGE opened with regular accumulation earlier than breaking resistance at $0.1505. The rally accelerated round 14:00 GMT as the amount spike hit 874.7M tokens. Value briefly pulled again to $0.1513 earlier than patrons reasserted management, confirming the brand new assist.

- Intraday motion displayed clear bid absorption at every greater low whereas the higher channel boundary guided rallies towards the $0.1530 area. The session closed contained in the higher half of the day’s vary, signaling bulls maintained dominance.

• $0.1470 is now the important thing assist stage; holding it preserves the breakout construction

• Speedy upside goal sits at $0.1530, with $0.1580-$0.1600 as the following resistance band

• Quantity affirmation stays important — a drop again under common might gradual continuation

• Retail-driven rallies can speed up rapidly but additionally fade with out institutional reinforcement

• Lack of $0.1470 dangers a deeper pullback towards $0.1430 and, in excessive instances, the $0.138 macro assist

What Do Technicals Recommend For DOGE?

- Market construction reveals early indicators of a momentum shift, backed by combined however enhancing indicator alerts. Analyst Ali Martinez highlighted a recent “Purchase” sign on Dogecoin’s weekly chart utilizing the TD Sequential indicator — a software designed to determine pattern exhaustion and potential reversal factors.

- Traditionally, TD Sequential “Purchase” alerts on DOGE have preceded sharp multi-week rallies, making the looks of a brand new sign notable because the coin exams the higher boundary of its ascending channel.

- Nevertheless, not all indicators align cleanly. TradingView’s Bull Bear Energy software — which measures the steadiness between bullish and bearish strain — flashed a promote sign, suggesting sellers nonetheless keep affect throughout intraday swings.

- In distinction, the MACD indicator, which tracks momentum by way of moving-average convergence and divergence, flipped bullish because the MACD line crossed above its sign line, usually interpreted as constructing upside momentum.

- Collectively, the combined indicator profile implies DOGE is within the early phases of a possible pattern transition, the place bullish momentum is rising however not but dominant.

- Merchants are looking forward to affirmation by way of sustained closes above resistance and rising quantity, each of which might validate the TD Sequential sign and negate short-term bearish readings.