- Larry Fink says tokenized ETFs and digital wallets will outline the way forward for finance.

- He now calls Bitcoin “digital gold” and an “asset of worry” used to hedge foreign money danger.

- BlackRock’s shift alerts broader institutional acceptance of tokenization and crypto.

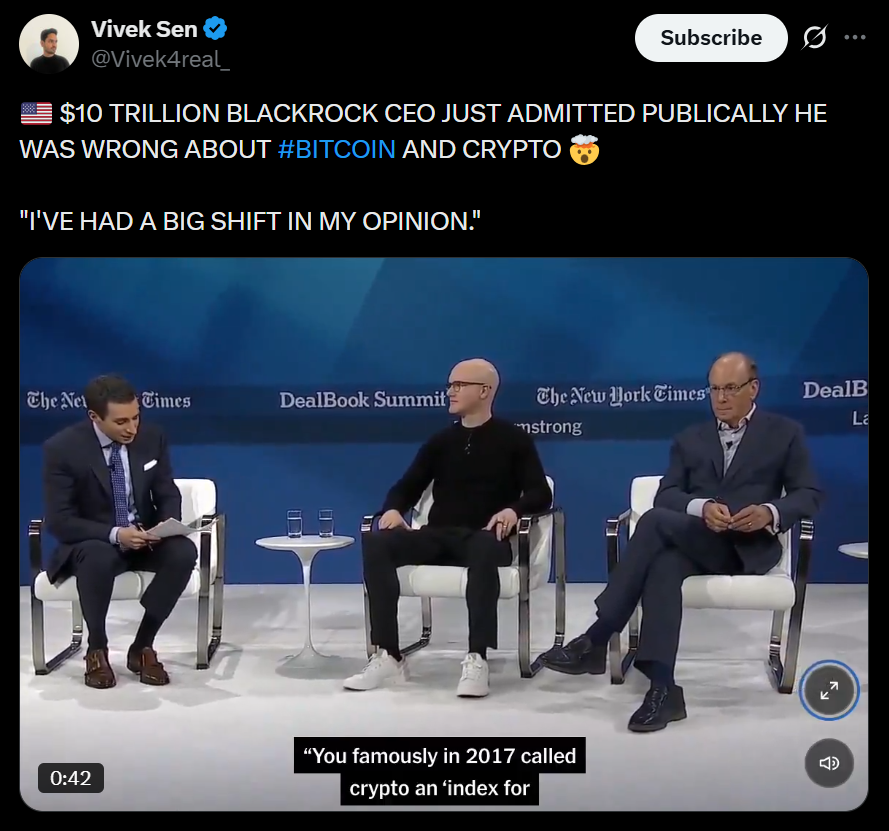

Larry Fink’s stance on Bitcoin has taken one of many greatest U-turns in fashionable finance. Again in 2017, the BlackRock CEO dismissed BTC as nothing greater than an “index of cash laundering,” a quip that echoed loudly via Wall Avenue on the time. Quick-forward to at this time, and Fink is brazenly pushing a imaginative and prescient the place almost each main monetary asset — from ETFs to bonds — might reside inside a digital pockets. The shift is dramatic, possibly even overdue, however it reveals how briskly crypto is forcing legacy finance to rethink itself.

From Critic to Champion of Tokenization

Throughout a dialog with Citadel CEO Ken Griffin, Fink mentioned one thing that may’ve sounded wild ten years in the past however feels oddly regular now. If he might tokenize each ETF and place them inside a easy digital pockets, he mentioned customers might transfer between shares, bonds, or money immediately with virtually no charges. That type of friction-free buying and selling — “from money to shares to bonds and again once more,” as he put it — is what Fink believes the world is heading towards sooner somewhat than later.

It’s a imaginative and prescient mainly constructed on blockchain rails, whether or not conventional establishments admit it or not. And Fink, after years of skepticism, is now saying the quiet half out loud: digital possession goes mainstream.

Bitcoin as an “Asset of Worry”

On the identical occasion, Fink tried to clarify Bitcoin’s position within the present monetary panorama. He in contrast BTC and gold, calling them “property of worry” — the issues individuals run to once they’re fearful of foreign money debasement, geopolitical danger, or… frankly, governments printing an excessive amount of cash.

“You personal it when you’ve got monetary insecurities,” he mentioned. Not precisely a glowing praise, however it reveals how he now sees Bitcoin as a purposeful hedge somewhat than a fringe toy. And for the CEO of the world’s greatest asset supervisor, that’s a fairly large admission.

Actuality Has Already Caught As much as His Predictions

Sarcastically, the longer term Fink describes — digital wallets, seamless token trades, on the spot settlement — already exists in crypto apps at this time. Tons of platforms let customers deposit paychecks straight into digital wallets, then purchase shares, stablecoins, or Bitcoin in a pair faucets.

Gen Z is already residing in that world whereas conventional finance debates whether or not it’s doable. In that sense, Fink is much less predicting the longer term and extra acknowledging a shift that’s already right here, simply outdoors the partitions of the establishments he leads.

The Lengthy Highway to Acceptance

The BlackRock CEO has been warming as much as Bitcoin for years, slowly stepping away from his early criticisms. In 2024, he even admitted he was mistaken — calling BTC a “reputable monetary instrument” with uncorrelated returns and actual macro worth. He went a step additional, labeling it “digital gold,” aligning himself with one of many strongest narratives in all of crypto.

His newest feedback affirm one thing deeper: BlackRock isn’t dipping its toe in crypto anymore. It’s getting ready for a world the place all the pieces — actually all the pieces — turns into tokenized.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.