- Schwab will launch spot BTC and ETH buying and selling in early 2026, beginning with inside trials.

- The agency is open to crypto acquisitions however solely on the proper valuation.

- Pricing stays unsure, however analysts anticipate charges should keep under 50 bps to compete.

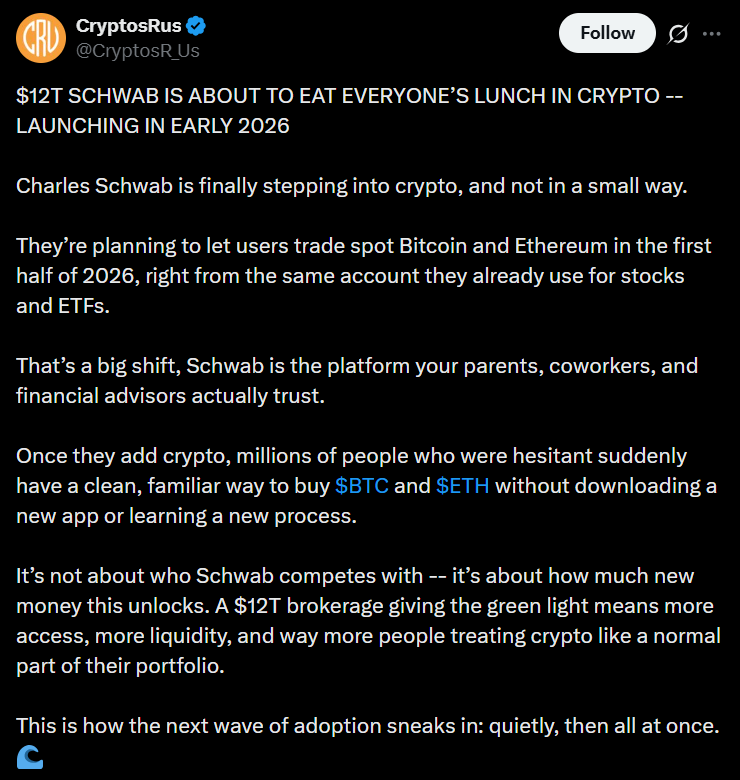

Charles Schwab is formally gearing as much as enter the crypto buying and selling enviornment, with CEO Rick Wurster confirming that spot Bitcoin and Ethereum buying and selling will launch within the first half of 2026. The transfer marks one of many largest U.S. brokerages stepping deeper into digital property — however with a cautious rollout designed to regulate threat, refine consumer expertise, and guarantee regulatory consolation.

Schwab Begins With Inside Trials Earlier than Shopper Entry

The primary section of Schwab’s crypto push will occur behind the scenes. The corporate plans to start spot BTC and ETH buying and selling with staff solely, permitting the agency to check performance, safety, and execution high quality earlier than letting shoppers in.

Wurster defined:

“The agency will begin with staff after which prolong the testing to a restricted shopper base.”

As soon as inside and limited-client testing is full, Schwab will regularly increase entry, giving the agency time to regulate pricing, enhance UX, and tighten threat controls earlier than opening the gates to tens of millions of buyers. For a platform of Schwab’s measurement, a phased rollout helps keep away from the form of operational pressure that conventional crypto exchanges usually face during times of excessive volatility.

Open to Crypto M&A — However Solely on the Proper Value

Alongside product improvement, Schwab is retaining the door open for mergers and acquisitions — together with within the crypto sector. Wurster mentioned the agency is “monitoring the panorama” for alternatives that add worth at scale, signaling curiosity however not urgency.

He confused that Schwab would solely think about a crypto acquisition if the valuation suits the corporate’s long-term technique. No particular firms had been named, and Wurster declined to verify whether or not Schwab is at present in discussions with any crypto companies. Nonetheless, the message is evident: Schwab is exploring methods to speed up its crypto growth with out overpaying.

A Main Step for a $12 Trillion Brokerage

Schwab’s transfer into spot crypto buying and selling displays rising demand from its huge shopper base, which is more and more asking for broader funding choices underneath one roof. With trillions in property and one of many largest retail footprints in finance, Schwab getting into the market may speed up mainstream adoption — particularly amongst conventional buyers preferring regulated, established establishments over crypto exchanges.

As 2026 approaches, all eyes will likely be on Schwab’s payment construction, M&A exercise, and the way rapidly its phased rollout expands to the broader public.

The put up Schwab to Launch Bitcoin and Ethereum Buying and selling in 2026 – Right here Is How Its Crypto Rollout Will Work first appeared on BlockNews.