BitMine boosted its ETH holdings previous 3% of provide, shopping for $150M extra whereas many treasuries lower exercise in November.

BitMine continued its heavy ETH shopping for streak throughout a month when many treasury companies lower exercise.

The corporate lifted its holdings previous 3% of circulating provide after one other main spherical of purchases. This raised new questions on its long-term plan, the situation of the DAT sector and the way firm leaders see future demand for Ethereum.

BitMine Raises Its ETH Treasury Throughout Market Pressure

BitMine added one other $150 million price of ETH this week. The brand new buy got here from two massive transactions made by BitGo and Kraken.

On chain knowledge from Arkham confirmed that BitMine gathered 18,345 ETH from BitGo and 30,278 ETH from Kraken. These strikes arrived only some days after earlier buys that had already grown their steadiness.

Every week earlier, the corporate purchased greater than 14,000 ETH to strengthen its holdings. Monday introduced one other surge when BitMine added greater than 96,000 ETH to its treasury.

The mixed purchases lifted its slice of Ethereum’s provide to greater than 3%.

TOM LEE JUST BOUGHT $150M ETH

Two contemporary wallets simply withdrew $92M of ETH from Kraken, and $58M from Bitgo, matching prior Bitmine buy patterns.

Tom Lee is DCAing ETH. pic.twitter.com/uZxEnhVvzi

— Arkham (@arkham) December 3, 2025

Tom Lee has stated that BitMine desires to succeed in 5% of the whole provide. The agency sees Ethereum as a central participant for settlement, tokenisation, and numerous monetary companies.

Thus far, that view has helped information its technique throughout months of unstable market exercise.

Rising Treasury Amid Stress On Its Inventory

BitMine’s pursuit of a bigger ETH place has not translated into regular inventory positive aspects. The corporate’s shares, traded underneath BMNR, fell greater than 80 % from an earlier peak.

That slide confirmed weaker confidence amongst buyers who monitor crypto uncovered companies.

The drop befell whilst BitMine’s treasury reached about $12 billion. The corporate additionally held about $2.8 billion in unrealised losses resulting from earlier worth swings. These numbers have affected debates across the agency’s heavy shopping for tempo and long run plan.

Bitmine’s NAV is collapsing quick.

In response to 10x Analysis, the world’s largest ETH-holding treasury agency is now $3.7B underwater: down $1K per ETH

Its mNAV simply hit 0.77, dragging investor worth whereas BlackRock rolls out a staked ETH ETF

How lengthy earlier than the construction breaks? pic.twitter.com/wjzeaCSyZH

— Edward (@Defi_Edward) November 22, 2025

Market watchers continued to comply with how BitMine balanced its rising ETH publicity with the pressure on shareholder sentiment.

Some analysts additionally famous that fluctuations in crypto-focused equities made it troublesome for companies like BitMine to keep up market confidence even whereas constructing on-chain reserves.

Associated Studying: Tom Lee’s BitMine Buys One other $70 Million ETH

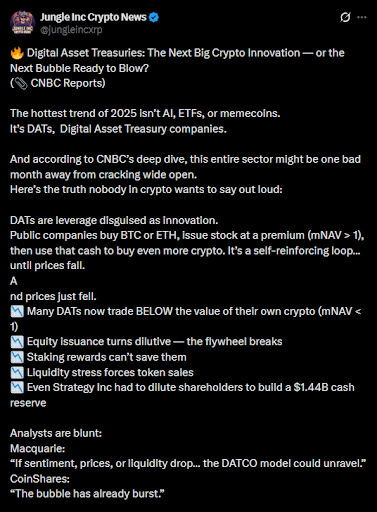

DAT Purchases Sink After Giant August Peak

Treasury shopping for throughout ETH DATs dropped in November. Information from Bitwise confirmed that the group purchased about 370,000 ETH through the month.

That quantity was far beneath the August stage of 1.97 million ETH. The decline reached 81% throughout a brief stretch of time.

Many small treasuries confronted critical stress as mNAV ranges fell and premiums shrank.

Some companies even approached insolvency as their shopping for energy weakened. mNAV readings throughout a number of corporations slipped additional between 10 and November as premiums narrowed and plenty of treasuries struggled to keep up earlier shopping for patterns.

Purchases are nonetheless bigger than the month-to-month provide, though the hole shrank this season. A number of DAT managers expressed that the tempo of shopping for in earlier months was now not sustainable.

This pattern separated BitMine from the remainder of the sphere as the corporate continued to build up, even throughout a interval of stalled exercise.