Bitcoin is buying and selling round $91,000 after a minor dip earlier in the present day, and uncertainty continues to dominate sentiment. The market sits at a crossroads: a small however vocal group of analysts argues that the current correction served as a wholesome reset earlier than a continuation of the broader uptrend, whereas nearly all of merchants consider the primary leg of a brand new bear market is already underway. With value motion nonetheless displaying hesitation, the controversy grows louder by the day.

Associated Studying

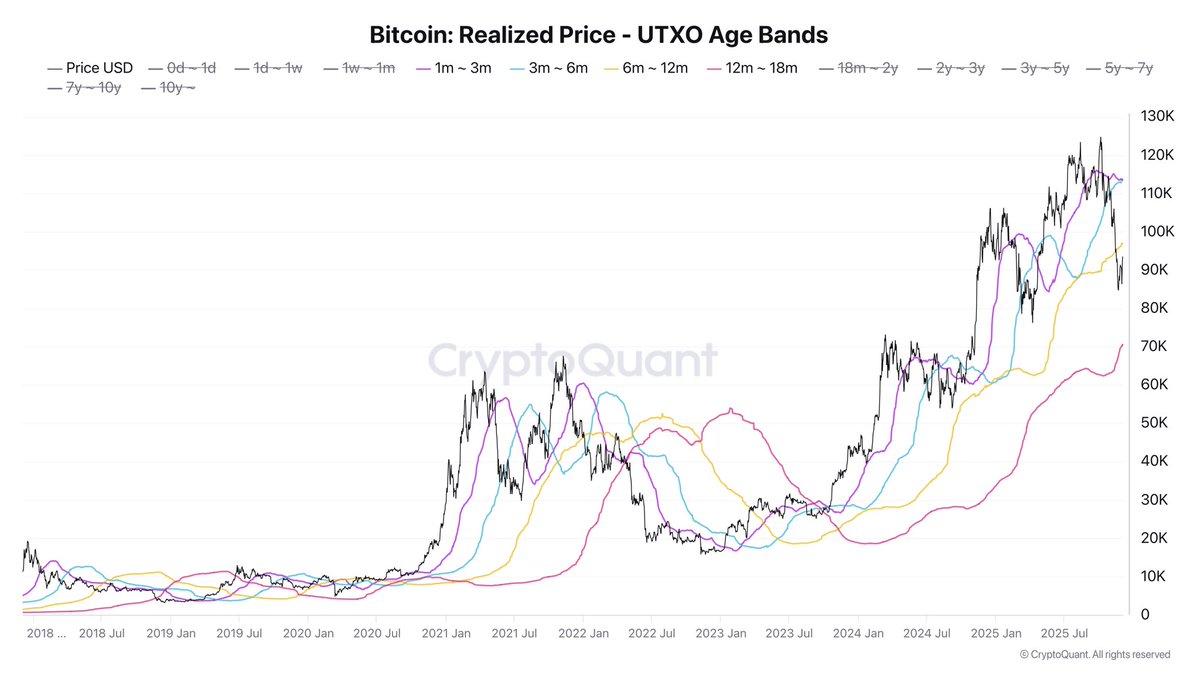

In accordance with prime analyst Darkfost, a essential threshold will assist decide Bitcoin’s subsequent main path. He highlights the significance of the Realized Value of the youngest Lengthy-Time period Holder (LTH) band, which at the moment sits at $96,956. This metric marks the transition level between short-term and long-term holders and is seen as a psychological and structural barrier for market stability.

Reclaiming this stage would push these younger LTHs again into a cushty revenue zone, lowering their incentive to promote and serving to to revive confidence throughout the market. Till Bitcoin closes decisively above $97K, Darkfost warns that warning is warranted, as volatility stays excessive and the danger of additional draw back persists.

Why the $97K Threshold Issues for Bitcoin’s Subsequent Main Transfer

Darkfost emphasizes that the $96,956–$97,000 zone performs an important position in shaping Bitcoin’s subsequent part. This stage represents the Realized Value of the youngest Lengthy-Time period Holder band, that means it displays the typical price foundation of traders who lately transitioned from short-term to long-term holding conduct. When Bitcoin trades beneath this threshold, these holders sit at an unrealized loss, rising the chance of panic promoting and including stress to the market.

Breaking above this zone would flip sentiment for this group nearly instantly. Darkfost explains that reclaiming $97K would place these traders again into a cushty revenue place, restoring their confidence and expectations of potential good points. As soon as this psychological weight lifts, these holders sometimes select to maintain accumulating reasonably than promoting, which naturally brings extra stability to the market.

Nevertheless, he cautions that Bitcoin’s failure to shut above $97,000 retains the danger tilted to the draw back. So long as the value stays beneath this band, the market stays weak, and volatility might proceed.

Even when BTC efficiently reclaims $97K, Darkfost reminds that that is solely step one. The market would nonetheless want stronger structural affirmation—similar to reclaiming key shifting averages and rebuilding demand—to validate a real bullish reversal that might ultimately result in a brand new all-time excessive.

Associated Studying

BTC Weekly Construction Reveals Early Indicators of Stabilization

Bitcoin’s weekly chart displays a market making an attempt to stabilize after a pointy multi-week correction that dragged the value from above $115,000 down towards the mid-$80,000s. The newest weekly candle exhibits a agency rebound from the 100-week shifting common (inexperienced line), now appearing as dynamic help across the $84,000–$86,000 area. This stage traditionally attracts long-term consumers, and the sturdy wick rejection confirms renewed demand.

BTC is at the moment buying and selling close to $91,300, sitting just under the 50-week shifting common (blue line), which now acts as resistance. A clear reclaim of this shifting common—at the moment positioned round $95K–$97K—would considerably enhance the technical outlook and align with on-chain alerts calling for a restoration. Till then, the development stays neutral-to-bearish on larger timeframes.

Associated Studying

Quantity throughout the current bounce stands out, displaying one of many strongest shopping for reactions since early 2025. This means that long-term holders and institutional consumers could also be stepping in as the value approaches key worth zones.

Nevertheless, Bitcoin shouldn’t be out of hazard. Failures to interrupt above $97K would depart the construction weak to a different leg down, probably retesting $86K and even deeper liquidity pockets round $80K.

Featured picture from ChatGPT, chart from TradingView.com