- XRP but to catch up

- XRP stays wholesome

In the present day, XRP stands out as the one cryptocurrency within the high 10 with a constructive 24-hour quantity change, reporting a +6.79% improve. All different main belongings on the record, together with BTC, ETH, SOL, BNB, DOGE, ADA and others, are nonetheless firmly within the crimson. This divergence is important as a result of rising quantity right into a declining market incessantly signifies incoming volatility or accumulation.

XRP but to catch up

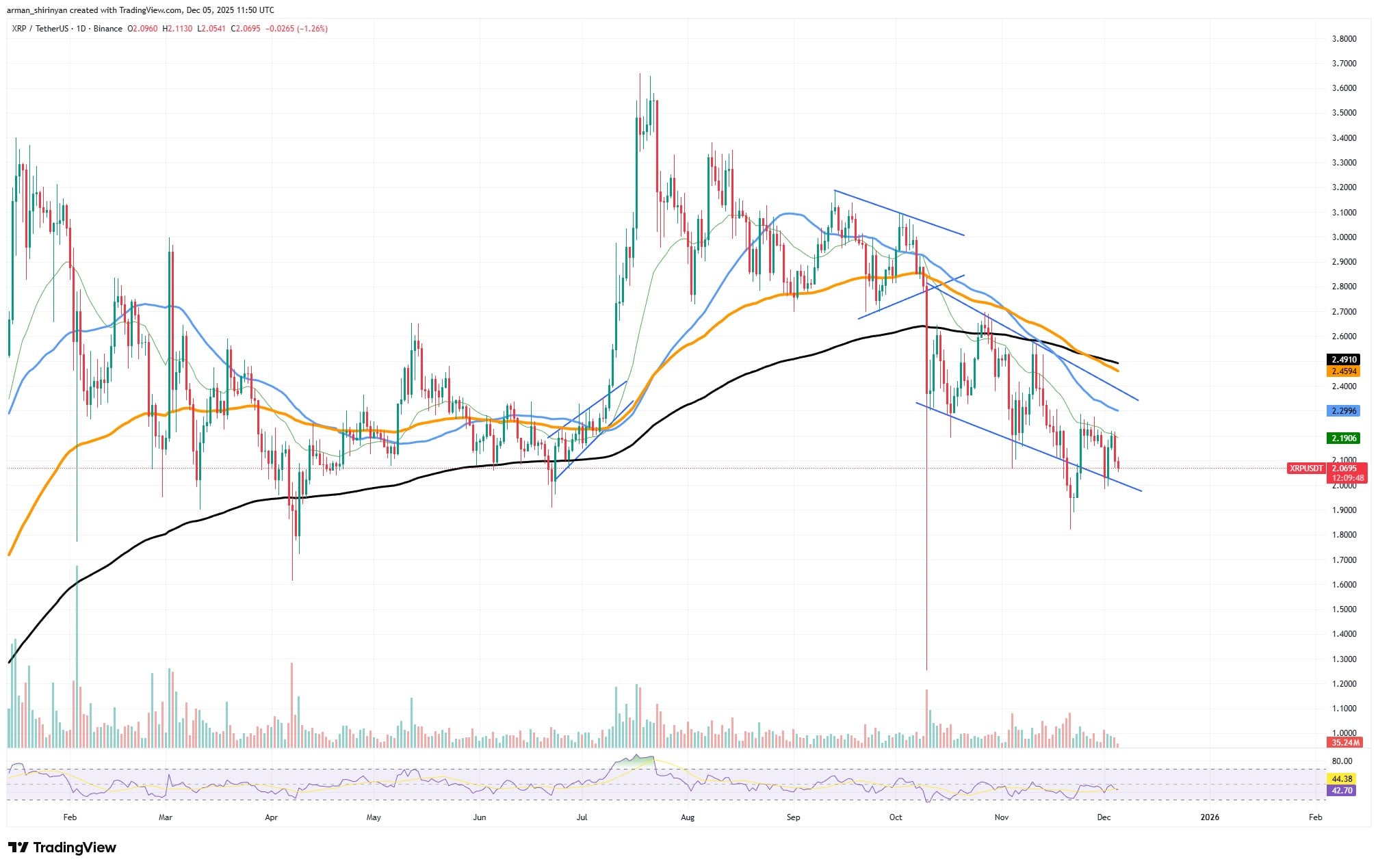

Nevertheless, the worth response just isn’t but bullish: XRP is buying and selling at about $2.05, following a day by day decline of -4%, honoring a persistent declining channel and failing to recuperate any important transferring averages. The chart reveals that XRP remains to be struggling under the downward-sloping 50, 100- and 200-day trendlines.

Sellers hit the asset as quickly because it exams the higher boundary, and repeated makes an attempt to interrupt by midchannel resistance are unsuccessful. Nothing on the chart structurally factors to a verified reversal, momentum (RSI) remains to be low and quantity spikes are related to rejection candles moderately than breakouts.

XRP stays wholesome

Nevertheless, the setup turns into extra attention-grabbing when the on-chain efficiency reveals a unique narrative. XRP remains to be within the one billion+ funds membership as a result of day by day funds routinely surpass the edge, indicating that network-level utilization just isn’t solely strong but additionally rising.

Metrics for profitable transactions, fee quantity and fee rely have all maintained highs over the earlier a number of months. This is a rise in basic exercise moderately than speculative noise, and traditionally, as soon as macro stress subsides, a divergence between worth weak spot and community power tends to resolve in favor of fundamentals.

The idea that one thing is growing beneath the floor is additional supported by change information. Trade reserves hardly transfer, netflows keep beneath management and transaction counts proceed to be excessive. This doesn’t appear to be a panic distribution. Relatively, it is sort of a market that’s ready for a catalyst whereas exercise retains constructing.