On this piece we’ll unpack how day by day and intraday indicators line up, what that claims about present momentum, and which value zones may form the following important transfer.

Abstract

The broader market is underneath strain, with international capitalization close to $3.17 trillion and falling about 2% over the past 24 hours. Bitcoin dominance hovers round 57%, displaying that capital nonetheless prefers the most important asset whereas altcoins wrestle to draw recent flows. Sentiment is fragile: the Concern & Greed Index sits at 28, in clear concern territory, limiting threat urge for food for speculative tokens.

In opposition to this background, the day by day regime for the asset stays formally impartial, pointing to an absence of a transparent, established development. Nevertheless, intraday timeframes lean bullish, with elevated RSI ranges hinting at aggressive short-term shopping for. General, the market is caught between short-term momentum and a hesitant macro backdrop, growing the chance of sharp swings in both path.

Lunc crypto: Market Context and Course

The present surroundings for this token can’t be separated from the broader crypto image. Complete market capitalization round $3.17 trillion, mixed with a unfavorable 24-hour change of roughly 2%, suggests a corrective or cooling part after prior power. Furthermore, with Bitcoin capturing about 57% of whole worth, liquidity is clustering within the benchmark asset reasonably than flowing freely into smaller caps.

This backdrop issues as a result of it usually dampens the sustainability of aggressive altcoin rallies. The Concern & Greed Index at 28 underscores this: traders are nonetheless in a risk-off psychological regime, faster to take income and slower to chase breakouts. That mentioned, the token’s intraday indicators present patrons making an attempt to push larger regardless of warning elsewhere. The stress between a fearful macro context and localized bullish makes an attempt is the defining characteristic of the present setup.

Technical Outlook: studying the general setup

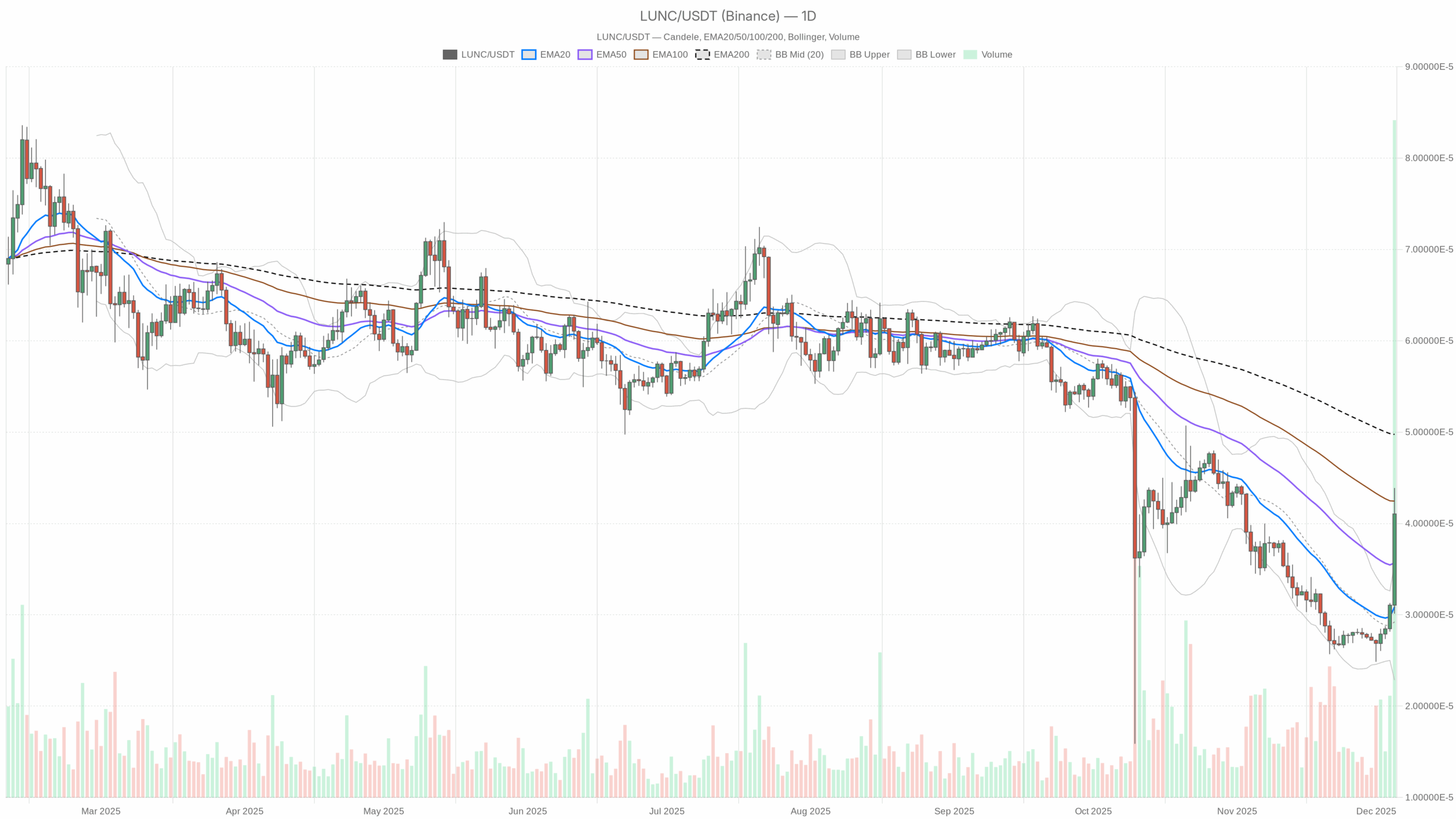

On the day by day timeframe, the system classifies the regime as impartial. With out clear separation between value and its long-term shifting averages, the chart seemingly oscillates in a variety reasonably than in a clear uptrend or downtrend. In such circumstances, merchants usually reply extra to quick bursts of reports or flows than to a sustained narrative, reinforcing the significance of intraday alerts.

The day by day RSI at about 73 is probably the most significant clue right here. This studying comfortably sits in overbought territory, indicating that current classes have been dominated by patrons. Nevertheless, in a impartial regime, an overbought RSI usually alerts momentum exhaustion threat reasonably than the beginning of a sturdy bull leg. It means that whereas the trail of least resistance has lately been up, the likelihood of consolidation or a corrective pause is rising.

The MACD values on the day by day chart present no significant separation between the road and sign, reinforcing the narrative of a non-committal development construction. When MACD fails to point out a decisive optimistic or unfavorable unfold, rallies usually lack sturdy affirmation from underlying momentum. Bollinger Bands knowledge will not be providing a transparent sign both, which inserts a context the place value shouldn’t be executing a textbook volatility breakout however reasonably grinding inside a broader vary.

ATR on the day by day aspect is subdued, pointing to contained realized volatility. That is according to a impartial regime the place directional conviction is restricted and enormous trending candles are much less frequent. Pivot ranges, though numerically flat within the dataset, perform conceptually as reference factors the place merchants look ahead to reactions; in a impartial market, interactions with these zones usually produce uneven reversals as an alternative of fresh follow-through.

Intraday Perspective and LUNC crypto value Momentum

In the meantime, the intraday panorama appears to be like extra energetic. On the 1-hour timeframe, the regime turns bullish, and the RSI climbs to round 78. Such a robust studying signifies that short-term merchants have been aggressively bidding the token, pushing it into overbought territory. Because of this, a short-term upside extension can’t be dominated out, however so can not a quick shakeout if late patrons turn out to be trapped.

The 15-minute chart additionally reveals a bullish regime, with RSI close to 61. This helps the concept of multi-timeframe alignment in favor of patrons on the intraday stage: each scalpers and hourly merchants are leaning in the identical path. Nevertheless, as a result of the broader day by day regime stays impartial, this alignment appears to be like extra like a quick swing or native pump than the beginning of a secure macro uptrend.

MACD on shorter timeframes doesn’t present a pronounced edge, implying that the micro-trend is pushed extra by flows and sentiment than by a mature, well-anchored development. Nonetheless, when each the 1-hour and 15-minute regimes learn bullish, value usually respects larger intraday helps, rewarding dip-buying methods till a transparent reversal sign emerges.

Key Ranges and Market Reactions

Even with out specific value references from the dataset, we are able to nonetheless describe how the important thing zones seemingly behave. With intraday RSI stretched above 70 on the hourly chart, the closest resistance space is probably going simply above current highs, the place profit-taking tends to look. If value stalls there with fading momentum, it might echo the day by day overbought sign and improve the chances of a pullback.

On the draw back, helps are often discovered round prior consolidation areas and close to dynamic ranges reminiscent of short-term shifting averages. In a impartial macro regime, reactions at these helps turn out to be essential: agency bounces would verify ongoing dip-buying urge for food, whereas sharp breaks with quantity would reveal that the current bullish push was non permanent. Merchants will due to this fact watch how value behaves round intraday flooring to gauge whether or not the market nonetheless believes within the present upswing.

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We could earn a fee at no further value to you.

Future Eventualities and Funding Outlook about LUNC value

General, the principle state of affairs rising from these readings is a short-term bullish bias embedded inside a impartial larger timeframe regime. This implies the trail forward is probably going dominated by swings, the place rallies may be sharp however weak to quick reversals as soon as intraday euphoria collides with broader market concern. If Bitcoin dominance stays elevated and the Concern & Greed Index stays in concern, upside on this token could possibly be capped by restricted threat urge for food.

For lively merchants, one pragmatic strategy is to respect the present intraday power whereas carefully monitoring overbought alerts and reactions close to current highs. Swing contributors could desire to attend for both a clearer breakout on the day by day chart, backed by convincing momentum affirmation, or for a corrective dip that normalizes RSI earlier than contemplating publicity. Till that occurs, this asset sits in a fragile steadiness between native optimism and a cautious macro backdrop.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.