- Ethereum is testing multi-month help on the ETH/BTC pair whereas a number of analysts count on ETH to outperform Bitcoin from this zone.

- Change balances for ETH have dropped to an all-time low close to 8.84% of provide, signaling a historic provide squeeze pushed by staking, restaking and L2 utilization.

- Key value zones between roughly $2,482 and $2,616 act as robust help, with upside targets stretching towards $3,336 and doubtlessly into the $4,800–$4,800+ area if momentum returns.

Ethereum’s value motion grabbed numerous consideration on Dec. 5, largely as a result of a number of technical alerts instantly lined up on the identical time. Merchants seen what analysts have been calling one of many tightest provide squeezes Ethereum has ever seen on centralized exchanges—one thing that doesn’t occur quietly. Add that to some rising chart setups, and it felt just like the market was quietly laying the groundwork for an even bigger transfer.

All of this occurred whereas crypto markets have been nonetheless making an attempt to catch their breath from Bitcoin’s messy volatility and the broader macro noise that’s saved merchants on edge. Even so, analyst Michaël van de Poppe identified that Ethereum had carved out a clear higher-timeframe help stage. He referred to as it the primary stable step towards a broader reversal, and hinted that ETH might lastly start outperforming BTC once more—a theme he’s been looking ahead to months.

ETH/BTC Assessments Multi-Month Help Zone

The ETH/BTC pair hovered round 0.03440 satoshis, sitting proper above a significant help area that’s held virtually the complete 12 months. The construction even appears like a possible double-bottom forming—value tapped the identical vary as soon as earlier, then returned for a second hit with out breaking down. That zone between roughly 0.026 and 0.034 satoshis has acted like a magnet all by 2024 and into 2025.

If this stage holds, van de Poppe sees room for ETH to climb towards 0.055 BTC—a transfer that might imply a roughly 60% achieve relative to Bitcoin. On the day by day chart, ETH continues to be trapped underneath a descending trendline courting again to mid-2024, however value is consolidating proper beneath that resistance. Merchants like these sorts of compressions as a result of as soon as value decides which technique to break, the transfer tends to hit quick.

Change Balances Hit Document Lows

Milk Highway highlighted one thing much more dramatic occurring behind the scenes: Ethereum’s alternate provide hit an all-time low of simply 8.84% on Dec. 5. That’s an insanely tight provide surroundings. For comparability, Bitcoin nonetheless sits round 14.8% provide on exchanges—practically double.

The shrinking ETH provide displays one thing deeper than simply investor temper. Tokens are flowing into staking contracts, restaking protocols, layer-twos, information availability layers, collateral loops, and long-term custody setups. These flows aren’t “value hype” flows—they’re structural. They take away ETH from circulation, generally completely.

What’s fascinating is that sentiment throughout the market felt fairly heavy in early December, but alternate outflows didn’t decelerate in any respect. Provide saved tightening even whereas merchants argued over macro headlines.

Traditionally, when alternate balances fall this sharply and keep low, the subsequent robust rally typically comes out of nowhere—as a result of as soon as consumers want liquidity, there’s barely any left.

Technical Targets From $3,336 to $4,885

Dealer Crypto Caesar mapped out the important thing ranges he’s watching. His ETH/USDT chart exhibits value within the $3,000 area testing help at $2,616. Resistance overhead sits a lot increased, stretching into the $4,789–$4,885 zone, which strains up with the 2024 weekly excessive.

Caesar additionally identified that ETH broke out of a long-term descending channel earlier in mid-2024. That breakout created the muse for the present consolidation. Now value is compressing inside a cleaner vary, ready for both a clear break upward—or a deeper retest of help.

The help vary between $2,482 and $2,616 has produced a number of robust rallies earlier than. If ETH continues to respect this zone, the subsequent leg might purpose towards the mid-$4,000s.

Will Ethereum Ship Sustained Features?

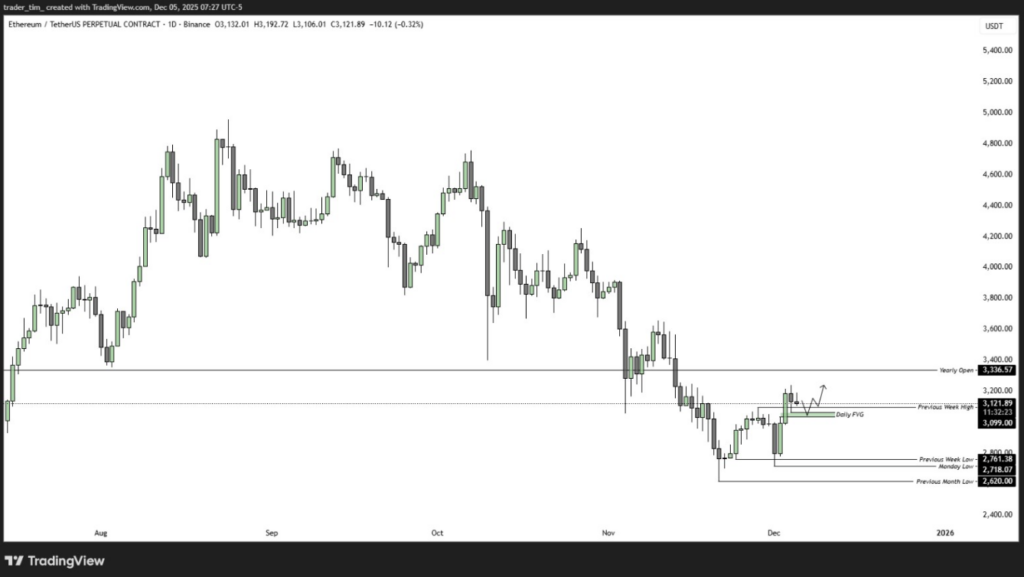

Brief-term dealer Tim added his perspective: although Bitcoin’s chart nonetheless appears fragile, Ethereum is exhibiting relative energy. In actual fact, he stated ETH is the solely pair he’s contemplating for lengthy positions proper now.

On his four-hour chart for ETH perps, value was buying and selling close to $3,067—simply above final week’s low at $2,761 and the month-to-month open close to $2,943. He highlighted a day by day fair-value hole from $2,943 to $3,064 that traditionally attracted algorithmic shopping for. That’s his most popular entry zone.

Targets? The earlier week’s excessive at $3,099 and the yearly open at $3,336.

Tim admitted the setup feels “uncomfortable” as a result of Bitcoin appears weak—however emphasised that ETH’s day by day construction stays intact and the risk-reward continues to be higher than most large-caps.

Ethereum’s Provide Squeeze Might Turn out to be a Lengthy-Time period Tailwind

ETH is at present consolidating above main help whereas alternate provide hits file lows. Analysts throughout a number of timeframes see constructive constructions forming, although market sentiment hasn’t absolutely recovered but.

Whether or not this mixture turns right into a sustained rally relies upon totally on Bitcoin stabilizing and broader danger urge for food returning. However with ETH being locked away in staking, restaking, L2 ecosystems, and long-term storage, the structural provide constraints appear unlikely to vanish—even when sentiment swings round within the brief time period.

When the market finally shifts, Ethereum might not have a lot liquid provide left to satisfy demand.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.