Be part of Our Telegram channel to remain updated on breaking information protection

Banking big JPMorgan says Michael Saylor’s Technique, previously MicroStrategy, holds the important thing to BTC’s future course, and that its potential removing from MSCI inventory indexes subsequent month is already priced in.

With the ratio between Technique’s enterprise worth and its Bitcoin holdings, or mNAV, remaining above 1, the world’s largest company Bitcoin purchaser is unlikely to be compelled to promote a few of its $60 billion BTC stash, stated analysts led by managing director Nikolaos Panigirtzoglou.

“If this ratio stays above 1.0 and MicroStrategy can ultimately keep away from promoting bitcoins, markets will seemingly be reassured and the worst for bitcoin costs will seemingly be behind us,” the analysts stated.

They reiterated their perception that Bitcoin has big upside potential, with its volatility-adjusted comparability of Bitcoin to gold implying a theoretical BTC worth close to $170K throughout the subsequent six to 12 months.

That’s an 84% enhance from the $92,354 stage Bitcoin is buying and selling at as of three:43 a.m. EST, in accordance with CoinMarketCap.

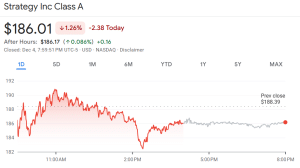

JPMorgan’s feedback observe a greater than 49% drop within the MSTR worth up to now month amid a broad crypto market correction.

Technique share worth (Supply: Google Finance)

That share worth droop ignited fears that Technique could be compelled to promote a few of its 650K BTC to fulfil upcoming debt obligations. Compounding fears is the latest slowdown in Technique’s Bitcoin accumulation, which CryptoQuant says exhibits the agency is making ready for a bear market.

Reserve Fund Buffer

The JPMorgan analysts stated Technique’s choice to arrange a $1.4 billion US greenback reserve fund to make sure it might probably meet dividend funds and different obligations additional reduces the chance that compelled Technique Bitcoin gross sales will happen “within the foreseeable future.”

To view the related press launch and investor presentation, click on right here: https://t.co/5k0IczrI86

— Technique (@Technique) December 1, 2025

In a latest SEC submitting, the corporate stated that the reserve provides it 12 months of runway for its debt repayments. Technique has added that it’s going to look to increase the quilt to a interval of 24 months.

Potential MSCI Elimination Already Priced In

Amid the fears that Technique will promote some BTC as MSTR retains sliding, there may be additionally the potential removing of the corporate from MSCI, which is a benchmark utilized by a number of fund administration corporations.

Technique’s share worth has plummeted 40% since MSCI introduced on Oct. 10 the potential removing of digital asset treasury companies from its indexes. It has additionally underperformed Bitcoin by 20% throughout the identical interval, equating to roughly $18 billion in market worth.

Earlier, JPMorgan had warned that the potential removing from MSCI would set off as much as $12 billion in potential outflows for MSTR.

However its analysts now say the influence the potential removing would have on MSTR is “already greater than priced in.”

That jibes with feedback made by Bitwise CIO Matt Hougan earlier this week.

“I’m not satisfied that removing could be an enormous deal for the inventory,” Hougan stated. “My expertise from watching index additions and deletions over time is that the impact is usually smaller than you suppose and priced in effectively forward of time.”

When MSTR was added to the Nasdaq 100 Index final December, Hougan stated funds monitoring the index had to purchase $2.1 billion of MSTR, however that its inventory worth “barely moved.”

MSCI is scheduled to make its choice on Jan. 15.

The JPMorgan analysts stated that if MSCI retains Technique in its indexes, there could be a powerful rebound for each Bitcoin and MSTR, estimating that this might see costs returning to ranges previous to the Oct. 10 flash crash.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection