Information exhibits distribution on the Bitcoin community has dropped off, with each the most important of whales and small retail arms taking to accumulation.

Bitcoin Accumulation Development Rating Reveals Shift Towards Shopping for

As defined by Glassnode analyst Chris Beamish in an X submit, Bitcoin buyers have been exhibiting so much much less distribution on the current worth ranges. The on-chain indicator of relevance right here is the “Accumulation Development Rating,” which tells us about whether or not BTC holders are shopping for or promoting.

The metric tracks investor habits utilizing not simply the modifications taking place of their pockets stability, but in addition accounting for the dimensions of their wallets. Because of this bigger entities have a better affect on the rating.

When the worth of the Accumulation Development Rating is bigger than 0.5, it means the buyers are displaying a web development of accumulation. Then again, it being below the edge suggests the dominance of distribution.

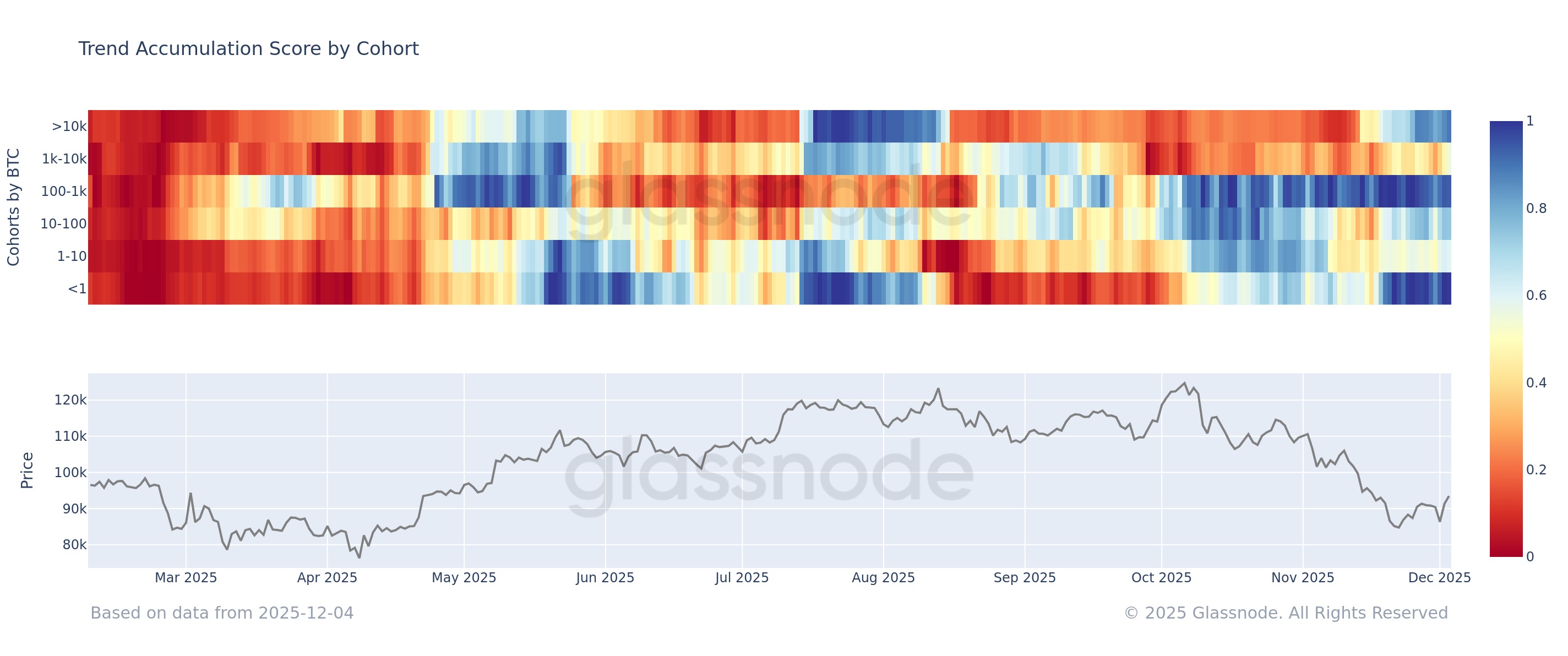

Now, right here is the chart shared by Beamish that exhibits how the Accumulation Development Rating has modified for the completely different Bitcoin investor segments over the previous few years:

The metric seems to have reached the buildup territory throughout the market | Supply: @ChrisBeamish_ on X

As displayed within the above graph, the Bitcoin Accumulation Development Rating has mirrored a assorted habits for the completely different investor segments over the past couple of months, however very just lately, a uniform image has began to develop.

The smallest of buyers out there, these holding lower than 1 BTC, began collaborating in aggressive accumulation across the time of BTC’s low in November and have since maintained the indicator practically at an ideal worth of 1. This implies that retail buyers have been shopping for the dip.

In the meantime, the 100 to 1,000 BTC merchants, popularly referred to as the sharks, have been accumulating all through the drawdown that has adopted because the early October peak, indicating that these buyers haven’t misplaced conviction regardless of the deep decline.

The story is a bit completely different for the whale cohorts, nevertheless. The ten,000+ BTC holders, comparable to the most important of arms on the community, had been in a section of distribution between August and November, however they’ve lastly began accumulating because the worth low, though the Accumulation Development Rating isn’t as excessive because the retail buyers of their case.

The 1,000 to 10,000 BTC whale group didn’t cease distributing even after the underside, however very just lately, their rating has simply breached the 0.5 mark. With this, a uniform habits has begun to seem on the Bitcoin blockchain, with buyers as a complete opting to develop their pockets stability.

It now stays to be seen how lengthy this development of accumulation will proceed.

BTC Value

Bitcoin has confronted a drop of greater than 3% during the last 24 hours that has taken its worth to $89,300.

The development within the worth of the coin during the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.