- Dogecoin is down 67% yearly and continues slipping, but the Bubble Danger Mannequin and on-chain exercise present indicators of a quiet accumulation part as a substitute of distribution.

- Spot consumers bought round $50 million price of DOGE in per week, with retail demand rising at the same time as general buying and selling quantity weakens.

- A large promote wall at $0.20 threatens upward momentum, but when DOGE can push previous short-term resistance, it could reclaim the $0.14 degree first.

Dogecoin — nonetheless the most important memecoin by market cap at roughly $23.28 billion — retains getting dragged decrease as market sentiment softens. On the yr, DOGE is down a painful 67%, and even its day-to-day chart hasn’t supplied any aid, with one other 2.4% drop within the final 24 hours. It’s been a gradual grind downward, the sort that wears on holders greater than they admit.

However buried underneath the bearish temper, a number of indicators are flashing that possibly—simply possibly—the broader pattern isn’t as easy because it appears to be like. AMBCrypto believes these hints may find yourself shaping Dogecoin’s subsequent main transfer.

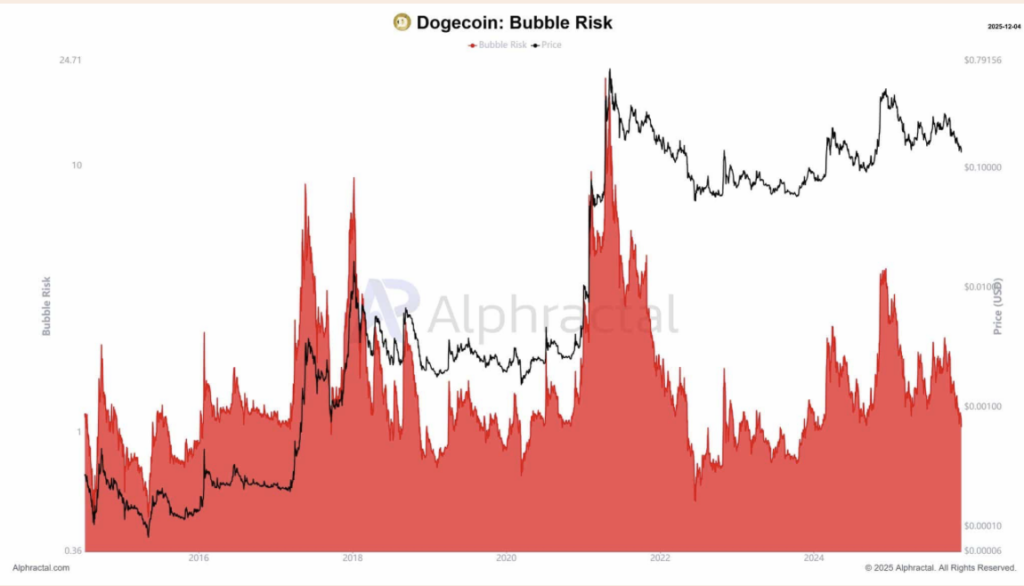

Bubble Danger Mannequin Exhibits No Bubble — Simply Quiet Accumulation

One of many strongest indicators proper now comes from the Bubble Danger Mannequin, which isn’t pointing to an overheated market in any respect. As an alternative, the indicator is trending decrease, not larger, which means there’s no “bubble” forming round DOGE at this stage. When bubble danger is low, it often means buyers aren’t chasing hype—they’re accumulating quietly.

This traces up neatly with what’s taking place on-chain. Santiment knowledge exhibits day by day lively addresses leaping sharply, with the most recent studying hitting 73,560. That’s not the habits of a market abandoning a token. It appears to be like extra like gradual, regular positioning beneath the floor.

Is Demand Really Selecting Up Once more?

So the massive query: is demand really growing, or is it simply noise? Proper now, the information leans towards actual demand constructing—primarily from retail consumers within the spot market.

The Trade Netflow metric exhibits consumers in management. Round $3 million price of DOGE was lately scooped up, pushing the week’s whole to $50 million in web purchases. That’s roughly 2% of DOGE’s total market cap—fairly sizable for a memecoin in a downtrend.

But, buying and selling quantity continues to say no, which often displays weakening confidence. It’s a bizarre combine: quantity fading, however spot demand rising. Typically that mixture precedes a short-term bounce.

If retail momentum continues, DOGE may push again above $0.14 quickly. However, in fact, nothing is ever that easy.

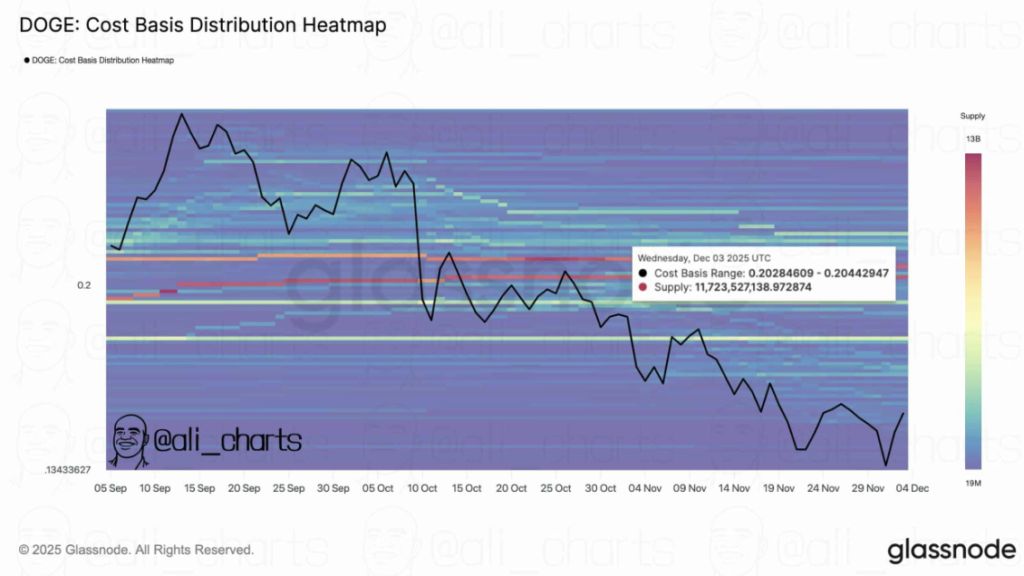

A Huge Promote Wall Nonetheless Threatens DOGE’s Rally

Even with these small bullish indicators, Dogecoin’s upside is fragile. Information from the liquidation chart exhibits 11.72 billion DOGE stacked on the $0.20 degree. That’s an enormous cluster of potential promote stress — principally a wall ready to smack worth again down.

If DOGE does make a run towards $0.20, that zone may set off a pointy reversal as these promote orders get crammed. It’s one of many largest threats to any near-term restoration.

Remaining Ideas

Dogecoin’s chart nonetheless appears to be like bearish, and sentiment isn’t precisely glowing. However behind the scenes, accumulation is choosing up, retail consumers are nibbling, and on-chain exercise is rising. If that pattern continues, DOGE would possibly squeeze out some aid — so long as it doesn’t collide headfirst with the huge promoting barrier at $0.20.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.