- Bitcoin worth to drop beneath $70,000?

- Will Bitcoin get well in 2025?

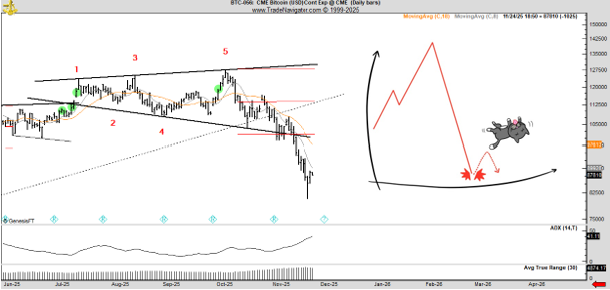

Veteran dealer Peter Brandt stays cautious about Bitcoin’s outlook. In his newest submit on X, he acknowledged that the current rally may be the one retest of the broadening prime sample that merchants will get.

The formation, usually referred to as a megaphone sample, is broadly seen in technical evaluation as a warning signal that an uptrend could possibly be approaching a bearish reversal.

“This week’s rally could also be all of the retesting of the broadening prime we’ll see. In fact, we’ll see,” the seasoned dealer wrote.

Bitcoin worth to drop beneath $70,000?

In response to Brandt, Bitcoin failed to achieve the higher boundary of its long-term worth channel throughout this 12 months’s advance. In earlier market cycles, the identical type of habits usually preceded a decline towards the decrease boundary of the channel.

That space begins beneath $70,000 and stretches into the mid $45,000, which is why Brandt treats that total area as a practical goal slightly than a dramatic state of affairs.

Brandt assigned a 30% chance that Bitcoin had already topped within the present cycle. If the highest comes within the second half of September, it may even be remembered because the “Brandt Prime,” he stated. The remark was made proper on the time when Bitcoin (BTC) was buying and selling at roughly $120,000.

In late November, Peter Brandt revisited the chart with a hand-drawn “useless cat bounce” determine, which often describes a brief restoration inside a broader bearish development. The setup sees Bitcoin’s two-week drop from above $120,000 to the low $80,000s as a full five-wave correction, with nothing greater than a primary rebound on the opposite aspect.

The chart exhibits the identical zone that merchants have been caught in for days: round $88,000 to $92,000. In response to Brandt, the $88,000–$92,000 vary is the one one which issues proper now.

Will Bitcoin get well in 2025?

Bitcoin began December close to 85,000 {dollars} however staged a pointy rebound that pushed it as much as the 94,000 greenback space. This transfer revived hopes amongst merchants {that a} seasonal Christmas rally may nonetheless emerge.

Retail buyers have been eyeing 97,000 {dollars} as an necessary resistance stage and a possible level to take revenue, but the market has not been capable of attain that focus on.

Regardless of the current volatility, Bitcoin continues to dictate path for the broader market. Most main altcoins are likely to mirror its actions, and sentiment throughout the sector often adjusts in response.

For now, market contributors stay cautious however optimistic as they watch for a decisive breakout to set the tone going into 2025.

On the intense aspect, the “excessive worry” state of the previous two months is beginning to shift, because the Concern & Greed index strikes from the pink zone into orange.