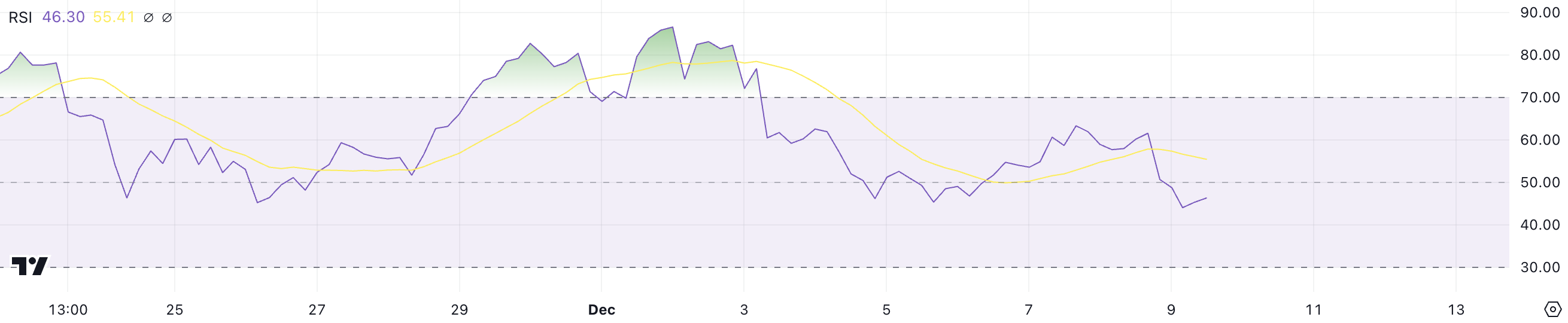

Ripple (XRP) worth has surged greater than 330% within the final 30 days, surpassing Solana’s market cap and reaching its highest ranges in 6 years. Nonetheless, its RSI is now at 46, a major drop from the overbought degree above 70 that was seen between November 29 and December 3, when XRP peaked round $2.90, its highest degree since 2018.

This decline means that the bullish momentum has cooled, and the market sentiment is now impartial or barely bearish. In consequence, XRP might face a interval of consolidation or delicate downward stress earlier than any potential restoration.

XRP RSI Is Impartial After Consecutive Days Above 70

XRP RSI is presently at 46, a major drop from the overbought degree above 70 between November 29 and December 3, when its worth peaked round $2.9, the best since 2018.

The decline in RSI means that the current bullish momentum has cooled off, and the market might now be in a impartial or barely bearish part.

RSI, or Relative Energy Index, is a momentum oscillator that measures the pace and alter of worth actions. It ranges from 0 to 100, with values above 70 usually indicating an overbought situation, whereas values beneath 30 counsel oversold situations.

With XRP’s RSI at 46, it signifies that the asset is neither overbought nor oversold, suggesting a impartial market sentiment. If this pattern continues, Ripple worth might expertise a interval of consolidation or delicate downward stress earlier than a possible restoration.

Ripple CMF Is Now Round 0

XRP’s CMF is presently at -0.01, following a short constructive studying of 0.04 only a few hours in the past. The indicator reached a unfavorable peak of -0.25 on December 6, after remaining constructive between November 29 and December 5.

This shift within the CMF means that XRP subsequent actions are nonetheless unsure, and the asset is struggling to take care of upward momentum.

CMF, or Chaikin Cash Circulation, measures the buildup and distribution of an asset over a particular interval, taking into consideration each worth and quantity. It ranges from -1 to +1, with values above 0 indicating accumulation (shopping for stress) and values beneath 0 indicating distribution (promoting stress).

The present CMF of -0.01 signifies a weak promoting stress, suggesting that whereas there was an try and reverse the downtrend, it was not robust sufficient to maintain the constructive momentum. If this pattern continues, it might point out additional downward stress for XRP worth within the close to time period.

XRP Value Prediction: Can Ripple Go Beneath $2?

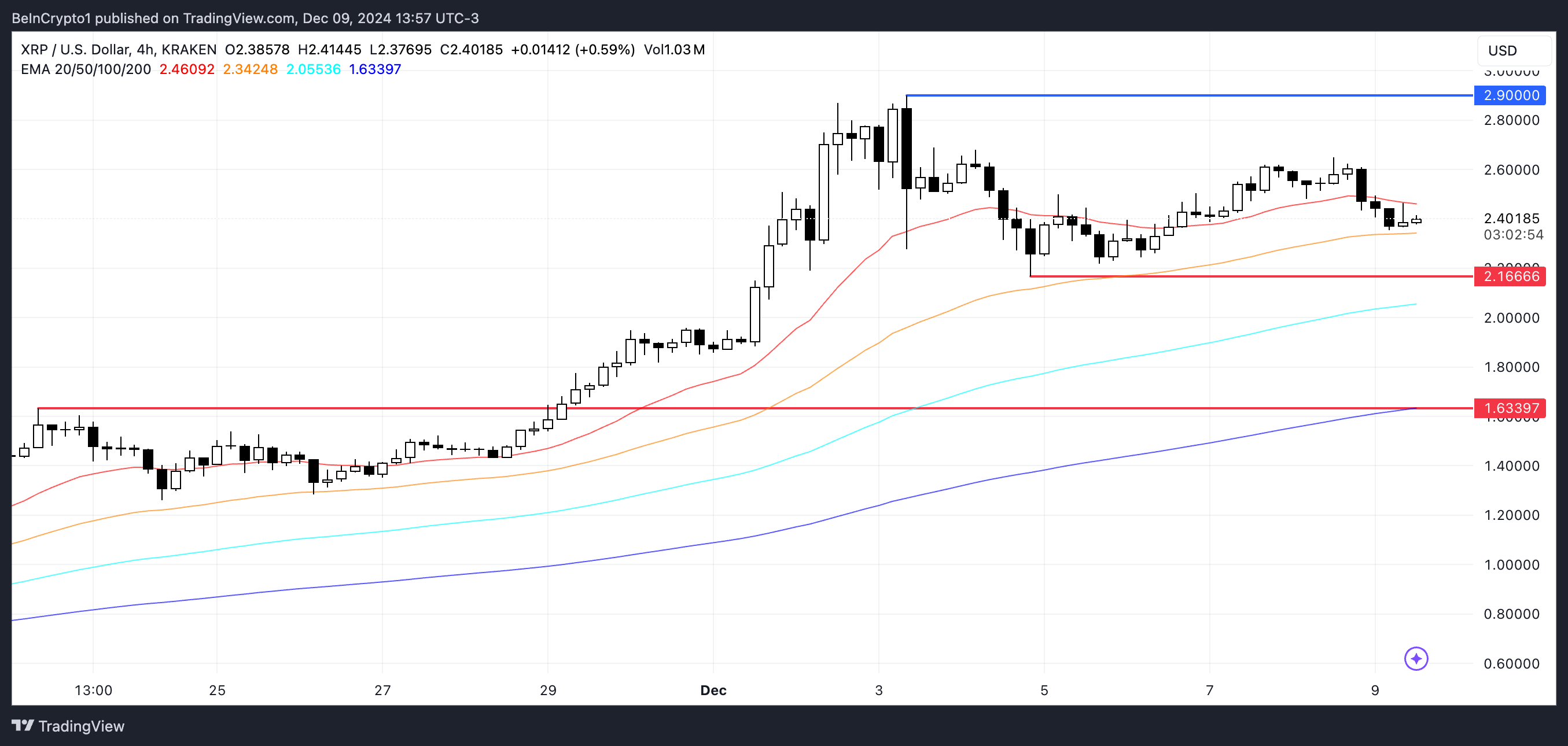

Ripple EMA strains stay bullish, with short-term strains positioned above the long-term ones, suggesting an total upward pattern.

Nonetheless, the present worth is beneath the shortest line, indicating that the pattern could also be shifting and the bullish momentum may very well be weakening.

If a powerful downtrend develops, XRP worth might take a look at the help at $2.16, and if that degree fails to carry, it might fall as little as $1.63, probably marking a 32% correction.

However, if Ripple worth regains its upward momentum, following the greater than 330% surge within the final 30 days, it might rise to retest $2.90 and probably push towards $3, a degree not seen since January 7, 2018.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.