- XRP buying and selling quantity rose 7.45% at the same time as worth dropped over 5%, diverging sharply from Bitcoin, Ethereum, and Solana, which all noticed declines in each worth and quantity.

- Analysts recommend whales could also be accumulating XRP, as rising inflows throughout worth dips usually sign strategic positioning quite than panic promoting.

- With new spot XRP ETFs attracting consideration and whale exercise growing, continued inflows might place XRP for a stronger restoration within the coming classes.

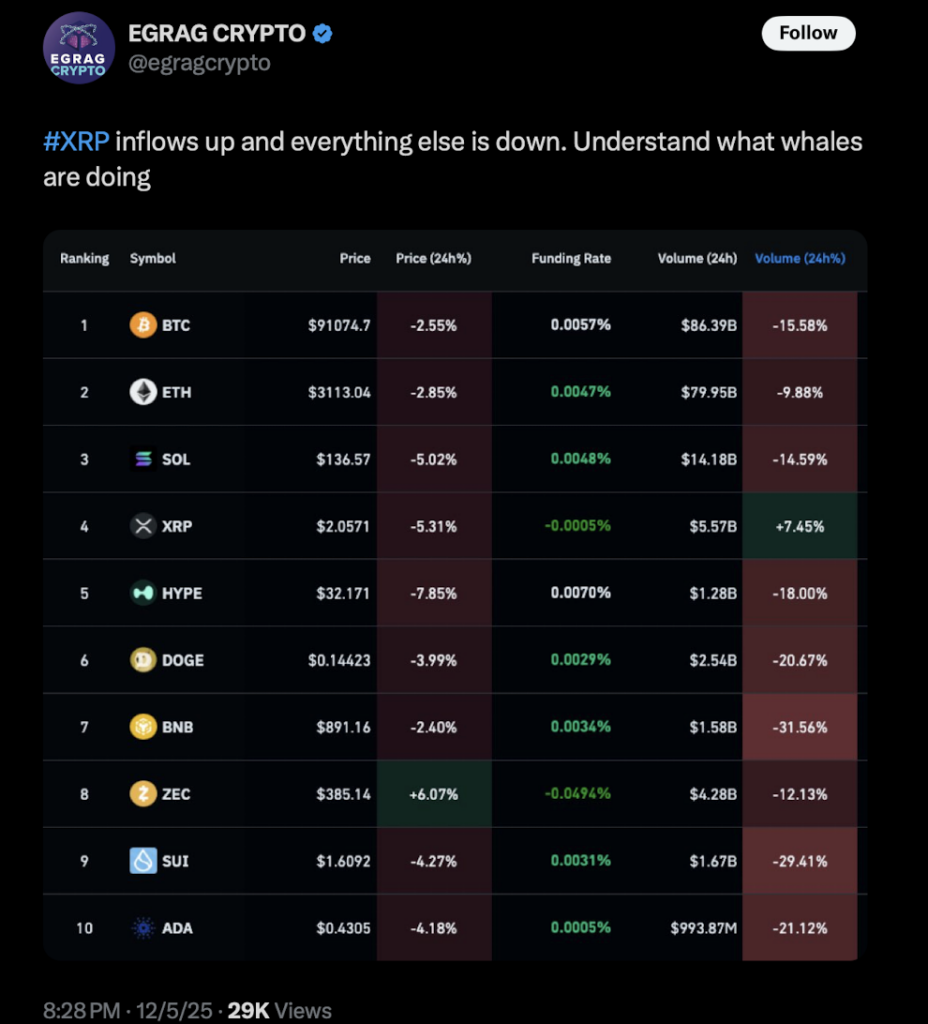

Whereas practically each main cryptocurrency spent the final 24 hours drowning in crimson candles, XRP did one thing… totally different. Crypto analyst EGRAG CRYPTO (@egragcrypto) posted a chart displaying that XRP’s buying and selling quantity jumped 7.45%, despite the fact that the worth dropped greater than 5%.It was an uncommon divergence — particularly as a result of Bitcoin, Ethereum, Solana, and just about the remainder of the market noticed each worth and quantity collapse on the similar time.

Right here’s how the numbers appeared in EGRAG’s chart:

- Bitcoin: $91,074.7 (–2.55%), quantity down 15.58%

- Ethereum: $3,113.04 (–2.85%), quantity down 9.88%

- Solana: –5.02%, quantity down 14.59%

- XRP: worth down… quantity up

When all the pieces else will get quieter, however one asset all of the sudden will get louder, it often means somebody with dimension is stepping in.

Are Whales Scooping Up XRP within the Dip?

EGRAG identified the distinction instantly. XRP inflows had been rising whereas virtually each different chart confirmed outflows. He hinted — with out saying it too straight — that whales may be accumulating. His remark, “Perceive what whales are doing,” form of mentioned all the pieces.

December already introduced a number of noticeable whale transfers. And XRP’s day by day buying and selling quantity hitting $5.57 billion(making it the fourth-highest general, even beating DOGE and BNB) provides weight to the concept giant patrons are quietly establishing positions.

Rising quantity throughout a falling worth is among the oldest accumulation alerts. It means larger traders are absorbing provide, not operating away from it. The info traces up with that sample virtually completely.

That is precisely the form of conduct merchants search for when making an attempt to catch early indicators of liquidity shifts — particularly in property with deep markets and institutional presence, like XRP.

XRP’s Distinctive Place Might Be Strengthening Behind the Scenes

XRP has additionally been getting much more consideration not too long ago for causes exterior of whale conduct. A number of asset managers have launched spot XRP ETFs over the previous few weeks. These merchandise are pulling in curiosity from each establishments and retail traders, despite the fact that the XRP worth hasn’t reacted a lot but.

However whales usually transfer earlier than the narrative turns into apparent. They accumulate first, then let the worth catch up later.

EGRAG’s chart leans towards accumulation — not distribution. And that’s essential as a result of whale accumulation has traditionally preceded main XRP rebounds most of the time.

If these inflows proceed and the quantity divergence retains widening, XRP might be positioning itself for a stronger restoration than the charts presently present.

Typically the earliest alerts aren’t price-based… they’re hidden within the quantity.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.