The altcoin market in December not exhibits the heavy losses seen final month. It’s now shifting into a brand new sideways part. A number of altcoins with distinctive catalysts and information flows have pushed many derivatives merchants to take one-sided positions.

Nevertheless, this week additionally brings a number of necessary macro occasions. These occasions might expose their positions to vital liquidation dangers.

Sponsored

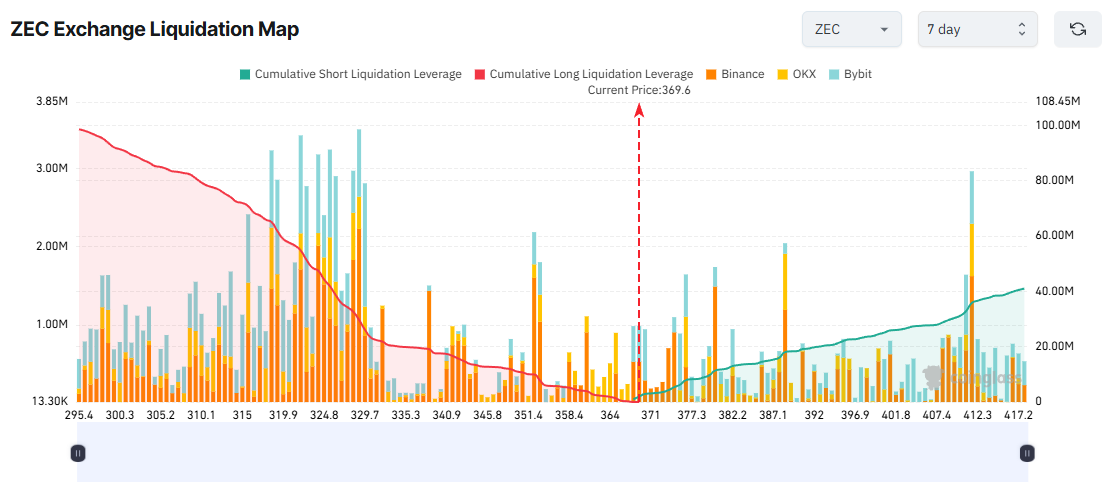

1. Zcash (ZEC)

From the all-time excessive of $748 set final month, ZEC has dropped by 50%. Such a deep decline tends to draw buyers who consider they missed earlier alternatives. This sentiment encourages derivatives merchants to anticipate a rebound in December. Consequently, amassed liquidation quantity on the Lengthy aspect has surged.

Merchants additionally gained another excuse to guess on Lengthy positions. Zooko Wilcox, the founding father of Zcash, will be part of a December 15 dialogue hosted by the SEC on crypto, monetary oversight, and privateness. Traders anticipate his look to amplify assist for privateness altcoins, together with ZEC.

If Lengthy positions stay overly assured with out stop-loss plans, Lengthy merchants might resist $98 million in liquidations if ZEC falls towards $295 this week.

A current evaluation by BeInCrypto exhibits that ZEC stays in a broader downtrend after the sooner FOMO rally. Its technical construction continues to resemble a bubble sample.

Sponsored

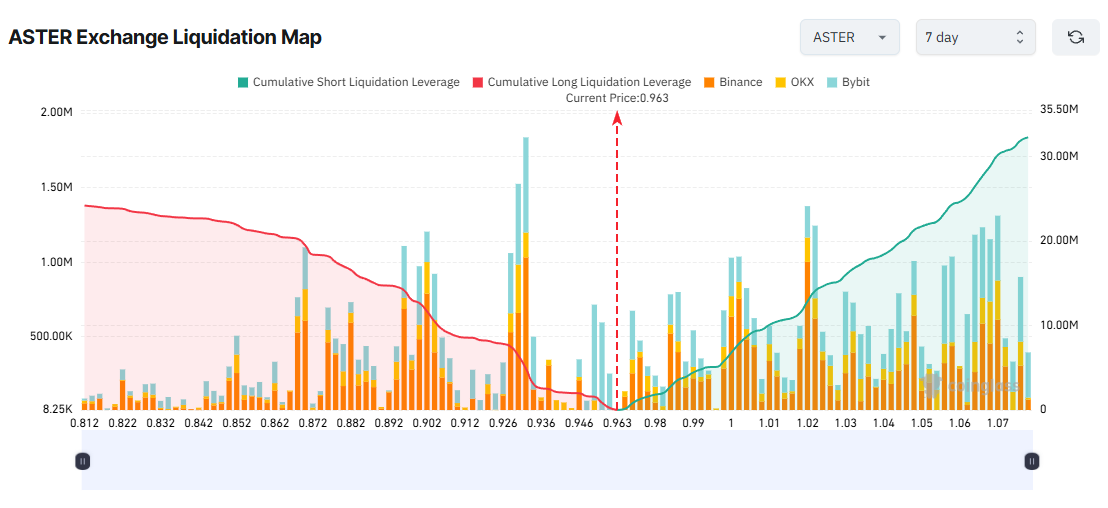

2. Aster (ASTER)

Aster, a number one derivatives DEX on BNB Chain, benefited from hovering buying and selling exercise throughout the Perpetual DEX increase in September. Nevertheless, its value has since dropped by greater than 60% and now fluctuates under $1.

Liquidation maps present that complete lively liquidation quantity for Brief positions exceeds that of Lengthy positions. Even so, Brief sellers might face appreciable danger this week.

Aster lately introduced an accelerated buyback program beginning December 8, 2025. The brand new every day buyback tempo is about $4 million, up from the earlier $3 million.

This improvement may assist a value improve this week. If ASTER rises to $1.07, the whole Brief-side liquidation quantity might exceed $32 million.

Sponsored

Technically, analysts additionally observe that the value has reached a robust assist zone and has damaged above a one-month trendline.

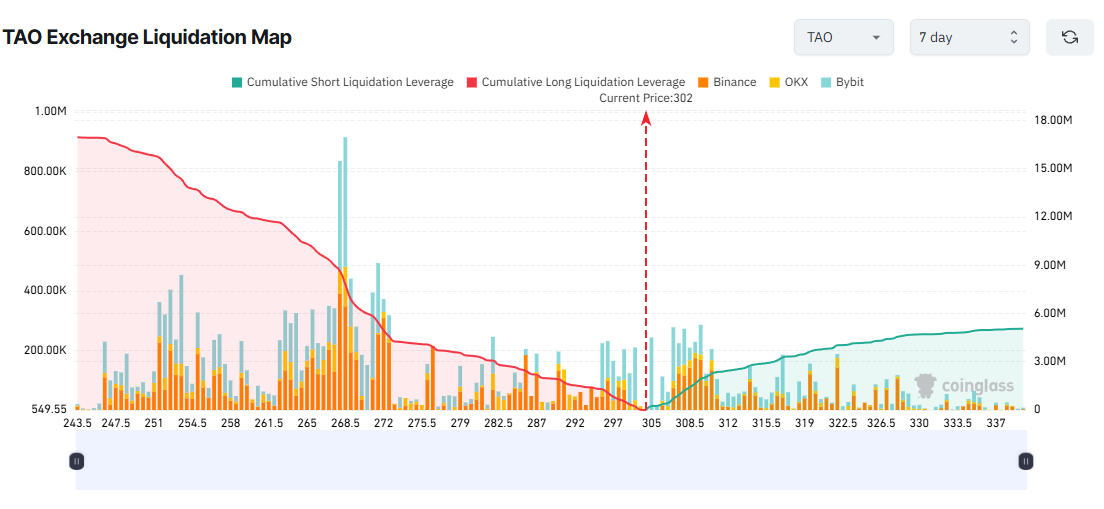

3. Bittensor (TAO)

The liquidation map for Bittensor (TAO) exhibits a extreme imbalance. Lengthy-side liquidation quantity far exceeds that of the Brief aspect.

If TAO drops to $243.50, Lengthy merchants might face practically $17 million in losses. Conversely, an increase to $340 may liquidate roughly $5 million in Brief positions.

Sponsored

Why are so many merchants betting on Lengthy positions? Many anticipate the value to rise forward of TAO’s first halving.

In line with BeInCrypto, round December 14, Bittensor’s first halving will cut back every day issuance from 7,200 TAO to three,600 as soon as complete provide reaches 10.5 million.

“This discount in provide will decrease emissions to community individuals and improve TAO’s shortage. Bitcoin’s historical past exhibits that diminished provide can improve community worth regardless of smaller rewards, as its community safety and market worth have strengthened via 4 successive halvings. Equally, Bittensor’s first halving marks a key milestone within the community’s maturation because it progresses towards its 21 million token provide cap.” – Grayscale defined.

Grayscale’s report has strengthened bullish sentiment amongst Lengthy merchants. With out strict stop-loss planning, a “sell-the-news” impact might set off widespread liquidations.

Moreover, the second week of December is the week the Federal Reserve broadcasts its rate of interest choice. Traditionally, this announcement has far higher market influence than most inner crypto information. Even when merchants appropriately predict the Fed’s transfer, they could nonetheless fail to keep away from excessive volatility that triggers liquidations for each Lengthy and Brief positions.