Crypto markets head into this week’s Federal Reserve assembly targeted much less on charge minimize and extra on whether or not Jerome Powell quietly declares the beginning of quantitative easing (QE). The important thing query on Wednesday for macro-sensitive merchants is whether or not the Fed shifts right into a bill-heavy “reserve administration” regime that begins rebuilding greenback liquidity, even when it refuses to name it QE.

Futures markets recommend the speed determination itself is essentially a foregone conclusion. In response to the CME FedWatch Instrument, merchants are assigning roughly 87.2% odds to a 0.25 share level minimize, underscoring that the true uncertainty just isn’t in regards to the measurement of the transfer, however about what the Fed indicators on reserves, T-bill purchases and the long run path of its steadiness sheet.

Former New York Fed repo specialist and present Financial institution of America strategist Mark Cabana has grow to be the focus of that debate. His newest shopper word argues that Powell is poised to announce a program of roughly 45 billion {dollars} in month-to-month Treasury invoice purchases. For Cabana, the speed transfer is secondary; the balance-sheet pivot is the true occasion.

Associated Studying

Cabana’s argument is rooted within the Fed’s personal “ample reserves” framework. After years of QT, he contends that financial institution reserves are skirting the underside of the snug vary. Invoice purchases could be introduced as technical “reserve administration” to maintain funding markets orderly and repo charges anchored, however in follow they’d mark a flip from draining to refilling the system. That’s the reason many in crypto describe the possible transfer as “stealth QE,” though the Fed would body it as plumbing.

What This Means For The Crypto Market

James E. Thorne, Chief Market Strategist at Wellington Altus, sharpened the purpose in X submit. “Will Powell shock on Wednesday?” he requested, earlier than posing the query that has been echoing throughout macro desks: “Is Powell about to confess on Wednesday that the Fed has drained the system too far and now has to start out refilling the bath?” Thorne argues that this FOMC “is not only about one other token charge minimize; it’s about whether or not Powell is compelled to roll out a standing schedule of bill-heavy ‘reserve administration’ operations exactly as a result of the Fed has yanked an excessive amount of liquidity out of the plumbing.”

Thorne ties that on to New York Fed commentary on funding markets and reserve adequacy. In his studying, “By Powell’s personal framework, QT is finished, reserves are skirting the underside of the ‘ample’ vary bordering on being too tight, and any new invoice shopping for can be dressed up as a technical tweak moderately than a confession of error, though it’s going to plainly rebuild reserves and patch the funding stress that the Fed’s personal over-tightening has triggered.” That framing goes to the guts of what crypto merchants care about: the course of web liquidity moderately than the official label.

Macro analysts adopted carefully by digital-asset buyers are already mapping the following section. Milk Highway Macro on X has argued that QE returns in 2026, doubtlessly as early as the primary quarter, however in a a lot weaker type than the crisis-era packages.

Associated Studying

They level to expectations of roughly 20 billion {dollars} a month in balance-sheet progress, “tiny in comparison with the 800bn monthly in 2020,” and stress that the Fed “can be shopping for treasury payments, not treasury coupons.” Their distinction is blunt: “Shopping for treasury coupons = actual QE. Shopping for treasury payments = sluggish QE.” The takeaway, of their phrases, is that “the general direct impact on threat asset markets from this QE can be minimal.”

That distinction explains the stress now gripping crypto markets. A bill-only, slow-paced program aimed toward stabilizing short-term funding may be very totally different from the broad-based coupon shopping for that beforehand compressed long-term yields and turbo-charged the hunt for yield throughout threat property. But even a modest, technically framed program would mark a transparent return to balance-sheet enlargement.

For Bitcoin and the broader crypto market, the fast impression will rely much less on Wednesday’s basis-point transfer and extra on Powell’s language round reserves, Treasury invoice purchases and future “reserve administration” operations. If the Fed indicators that QE is successfully beginning and the bath is beginning to be refilled, the liquidity backdrop that crypto trades towards in 2026 could already be taking form this week.

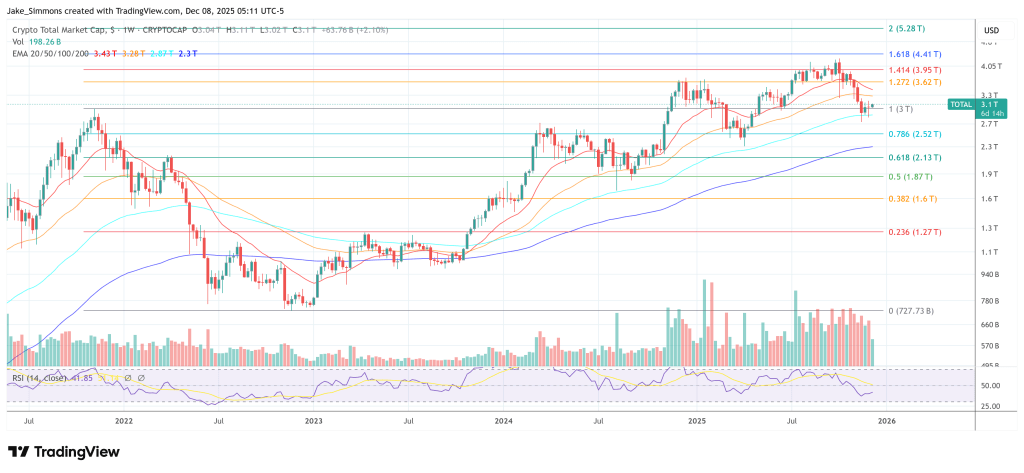

At press time, the entire crypto market cap was at $3.1 trillion.

Featured picture created with DALL.E, chart from TradingView.com