Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth climbed 2% prior to now 24 hours to commerce at $91,603 as of two:40 a.m. EST on buying and selling quantity that soared 76% to $40.8 billion.

BTC buying and selling above the $90,000 stage comes as markets anticipate that the Federal Reserve will implement a 25-basis-point rate of interest lower at its Federal Open Market Committee (FOMC) assembly on Dec. 9-10.

Knowledge from the CME FedWatch Instrument exhibits that merchants are pricing in an 87% likelihood of a 25-basis-point lower, which might decrease the goal price to three.5%-3.75%.

In the meantime, the BOJ is extensively anticipated to hike rates of interest at its December 18-19 coverage assembly.

Excessive volatility is anticipated round each central financial institution bulletins as markets alter expectations for future price paths.

As markets gear up for a risky week, financier Anthony Scaramucci mentioned that the value of BTC may soar to $1 million, a greater than 10X surge from the present worth.

ANTHONY SCARAMUCCI JUST SAID ON LIVE TV THAT BITCOIN IS GOING TO $1,000,000.

“10X OPPORTUNITY IN BITCOIN RIGHT NOW”

You’re not bullish sufficient! 🚀 pic.twitter.com/QZYyFLanzJ

— That Martini Man ₿ (@MartiniGuyYT) December 8, 2025

Harvard College is effectively positioned for such a worth surge, with Bitwise CIO Matt Hougan saying that the establishment expanded its BTC holdings in Q3 from $117 million to $443 million.

Harvard ramped its bitcoin funding in Q3 from $117m ot $443m. It additionally boosted its gold ETF allocation from $102m to $235m.

Take into consideration that for a second: Harvard determined to placed on a debasement commerce and it allotted to bitcoin 2-to-1 over gold.

— Matt Hougan (@Matt_Hougan) December 8, 2025

With the college growing its allocation to gold to $235 million from $102 million throughout the identical interval, Hougan famous that it favored BTC by a ratio of two:1.

With BTC up over 6% within the final week, can it proceed hovering?

Bitcoin Value Poised For A Restoration Above Key Resistances

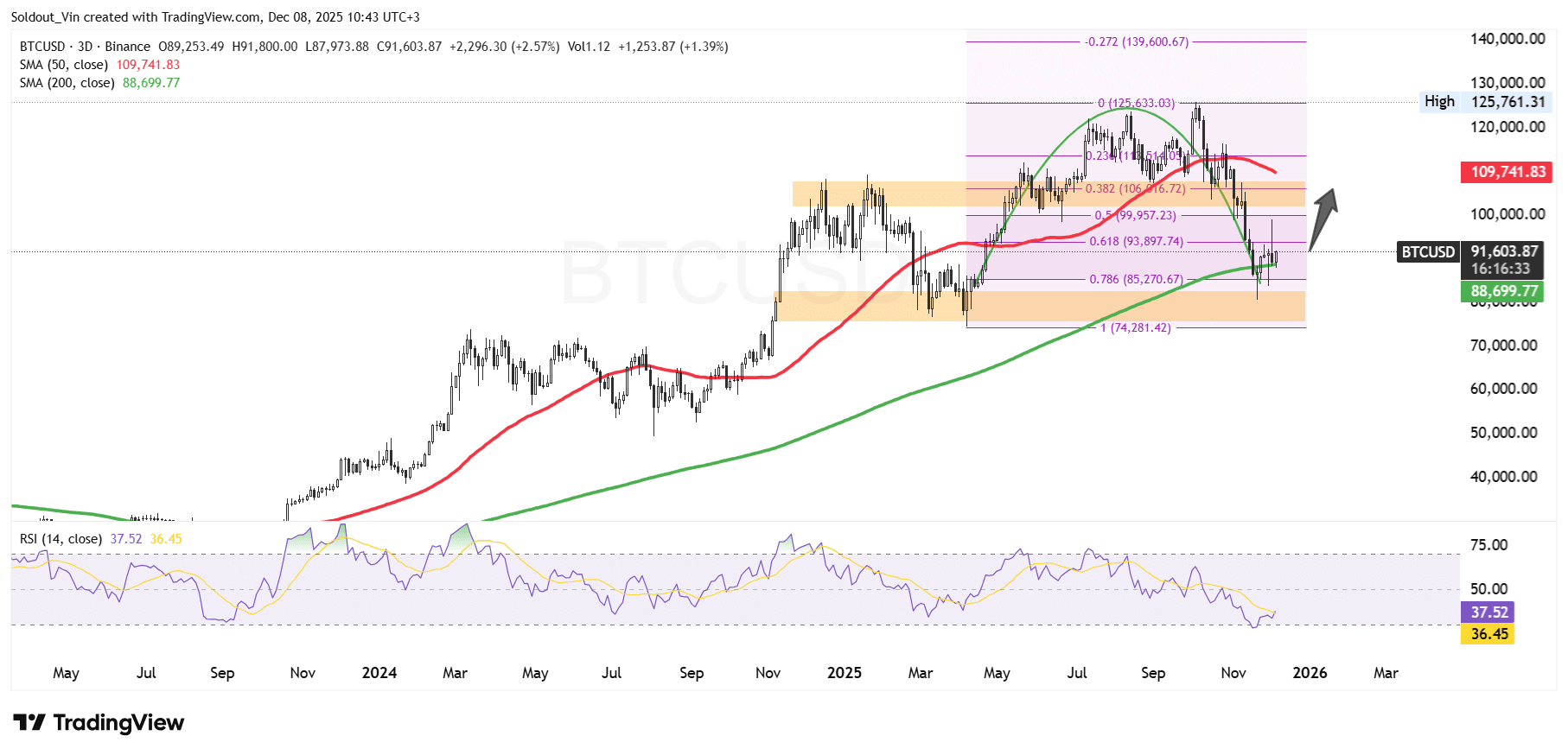

Wanting on the 3-day chart, BTC has been buying and selling inside a corrective vary since forming a rounded high at $125,761. During the last couple of weeks, BTC has been consolidating between the $85,270 (0.786 Fib) assist and the $99,957 (0.5 Fib) resistance space.

Technical indicators are exhibiting early indicators of a possible bullish transfer as Bitcoin makes an attempt to stabilize above the 200-day Easy Shifting Common (SMA), a significant long-term assist stage.

BTC not too long ago bounced from the 0.786 Fibonacci retracement, a standard deep retracement space in bull-market corrections. Value has additionally reclaimed short-term construction above $88,700, which is the extent of the 200 SMA.

In the meantime, the Relative Energy Index (RSI) has risen from oversold territory and is at present round 37, suggesting that though sellers nonetheless have momentum, bearish power is fading. A surge towards the midpoint (50) would sign that consumers are regaining management.

The 50-day SMA, nonetheless, stays above $109,700, indicating the short-term development remains to be below bearish strain however enhancing.

BTC/USD Chart Evaluation Supply: TradingView

With the value of BTC exhibiting early indicators of a momentum shift and the RSI slowly rising, a bullish short-term state of affairs might play out over the subsequent a number of candles.

If this momentum holds, the Bitcoin worth may surge in the direction of the 0.5 Fib stage ($99,900), because it targets the 0.382 Fib zone at $106,016.

Alternatively, if the Bitcoin worth is rejected on the $100k–$107k resistance zone, it may result in continued sideways motion throughout the broader corrective construction. In that case, the value of BTC might revisit the $85,270 assist.

If bears handle to overwhelm consumers, a deeper drop towards the $74,281 assist (1.0 Fib) may happen in a extra excessive state of affairs.

Associated Information

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection