Bitcoin Journal

‘We’re going to purchase all of it’: Michael Saylor talks Bitcoin Technique at Bitcoin MENA Convention

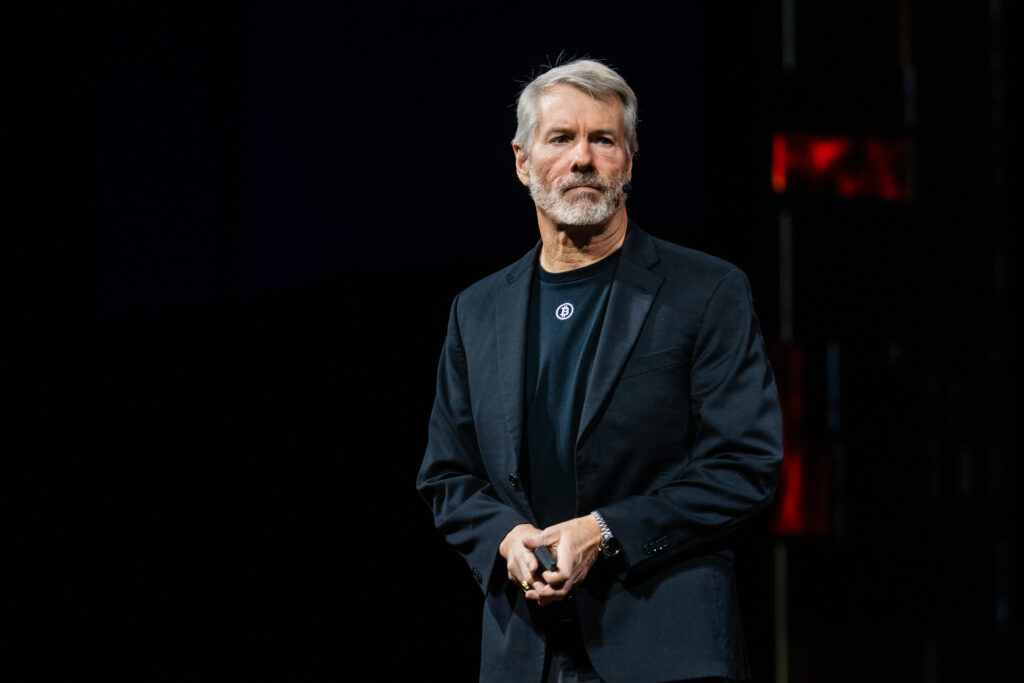

Michael Saylor, govt chairman of Technique, delivered a sweeping keynote on the Bitcoin MENA convention earlier at the moment, framing Bitcoin not simply as an investable asset, however as the muse of a brand new period in digital capital and credit score.

Talking to an viewers of sovereign wealth funds, banks, convention attendees, and buyers, Saylor outlined how his firm is leveraging Bitcoin to create the world’s first digital Treasury and construct a worldwide system of Bitcoin-backed credit score.

“Bitcoin is digital capital,” Saylor mentioned, opening his discuss.

He contrasted Bitcoin with conventional types of capital corresponding to gold, actual property, and equities, emphasizing its potential as a foundational retailer of worth within the digital financial system.

“We’re going to purchase all of it,” he declared, highlighting Technique’s ongoing acquisition program, which now totals 660,624 Bitcoin, together with 10,600 acquired final week.

The purchases, he defined, vary from $500 million to $1 billion weekly, underscoring the corporate’s aggressive accumulation technique.

Banks are assembly with Saylor to debate Bitcoin

Saylor confused the significance of latest institutional and regulatory shifts. He mentioned that over the previous yr, main U.S. banks together with Financial institution of America, Wells Fargo, JP Morgan, and Citi have moved from cautious observers to energetic contributors, providing custody options and credit score amenities tied to Bitcoin.

“All the giant banks in the US have gone from not banking Bitcoin 12 months in the past to issuing credit score in opposition to Bitcoin or Bitcoin derivatives,” he famous.

He additionally highlighted bipartisan U.S. authorities help for Bitcoin, citing figures from the Treasury, SEC, and CFTC.

Bitcoin as a yield-generating credit score

Central to Saylor’s thesis is the conversion of Bitcoin’s unstable digital capital into predictable, yield-generating credit score.

Technique has launched a collection of Bitcoin-backed credit score devices designed to supply regular money flows whereas preserving publicity to the asset’s long-term appreciation.

“You probably have a short while horizon, you purchase the credit score,” he mentioned. “In case you belief Bitcoin and have an extended horizon, you purchase the fairness.”

Saylor described how these devices work. Utilizing over-collateralization, Technique transforms Bitcoin holdings into digital credit score with decrease volatility and dependable yields.

The agency has launched merchandise like STRK, a most well-liked inventory paying an 8% dividend backed by Bitcoin, and STRF, a perpetual bond yielding 10% that funds long-term funding in digital property.

“We convert 120 months or 240 months of period into one month,” Saylor defined, emphasizing the power to ship near-immediate money flows from long-term capital.

He additionally outlined Technique’s strategy to amplifying fairness efficiency. By issuing credit score devices and reinvesting proceeds in Bitcoin, the corporate successfully enhances its Bitcoin holdings per share over time.

“Each seven years, we double our Bitcoin per share,” he mentioned.

The end result, Saylor claims, is a company construction that aligns long-term Bitcoin progress with investor returns whereas creating unprecedented liquidity in credit score markets.

Saylor framed these improvements in historic context. Simply as gold served as the muse for hundreds of years of credit score devices—from mortgages to sovereign debt—Bitcoin, he argued, will type the spine of a digital credit score system.

“If now we have digital gold, it’s very logical that the world’s going to run on digital gold-backed credit score,” he mentioned, noting the potential for Bitcoin to underpin world monetary methods.

All through his keynote, Saylor emphasised each scale and imaginative and prescient. He described a tour of the Center East, assembly buyers throughout Dubai, Bahrain, Kuwait, and Abu Dhabi, presenting a unified imaginative and prescient of digital capital and credit score.

“The chance for Treasury firms is to build up swimming pools of capital and difficulty credit score that meets regulatory necessities, integrates into the banking system, and absorbs forex danger,” he mentioned.

On the time of writing, Bitcoin is ripping previous $94,000.

This put up ‘We’re going to purchase all of it’: Michael Saylor talks Bitcoin Technique at Bitcoin MENA Convention first appeared on Bitcoin Journal and is written by Micah Zimmerman.