Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth edged down over 1% previously 24 hours to commerce at $90,421 as of two:42 a.m. EST on buying and selling quantity that rose 10% to $45.1 billion.

This lower within the BTC worth comes as information from Santiment exhibits that over 403,000 Bitcoins have moved off exchanges since Dec. 7, 2024, which is roughly 2% of the crypto’s whole provide. Santiment stated that it is a optimistic signal for the market.

📊 As Bitcoin’s market worth hovers round $90K, crypto’s high market cap continues to see its provide shifting away from exchanges. Over the previous 12 months, there was:

📉 A web whole of -403.2K $BTC shifting off exchanges

📉 A web discount of -2.09% of $BTC‘s total provide shifting… pic.twitter.com/Y0JTC880Np— Santiment (@santimentfeed) December 8, 2025

The transfer represents a elementary shift from short-term buying and selling to long-term holding. When BTC is on an alternate, it’s typically thought-about on the market. Due to this fact, its elimination means that buyers are choosing self-custody.

“As Bitcoin’s market worth hovers round $90K, crypto’s high market cap continues to see its provide shifting away from exchanges,” Santiment stated.

Whereas a big portion of the Bitcoin on exchanges is heading again to hodler wallets, the crypto king has just lately logged considered one of its weakest November performances since 2018, in accordance with Presto Analysis.

📊 Information Focus 📊

Worst November For BTC Since 2018

Crypto Movement Report: November 2025

by @scopicviewFull report right here: https://t.co/mLl2jV701p pic.twitter.com/2lXS5v9tuI

— Presto Analysis (@Presto_Research) December 9, 2025

BTC posted month-to-month declines of roughly 20-25%. Thus far, Bitcoin’s worth has tried to recuperate above the $90,000 zone however has been rejected simply across the $94,000 degree. Can the worth nonetheless soar?

Bitcoin Value Trades Above Key Help Ranges, Poised For A Rally

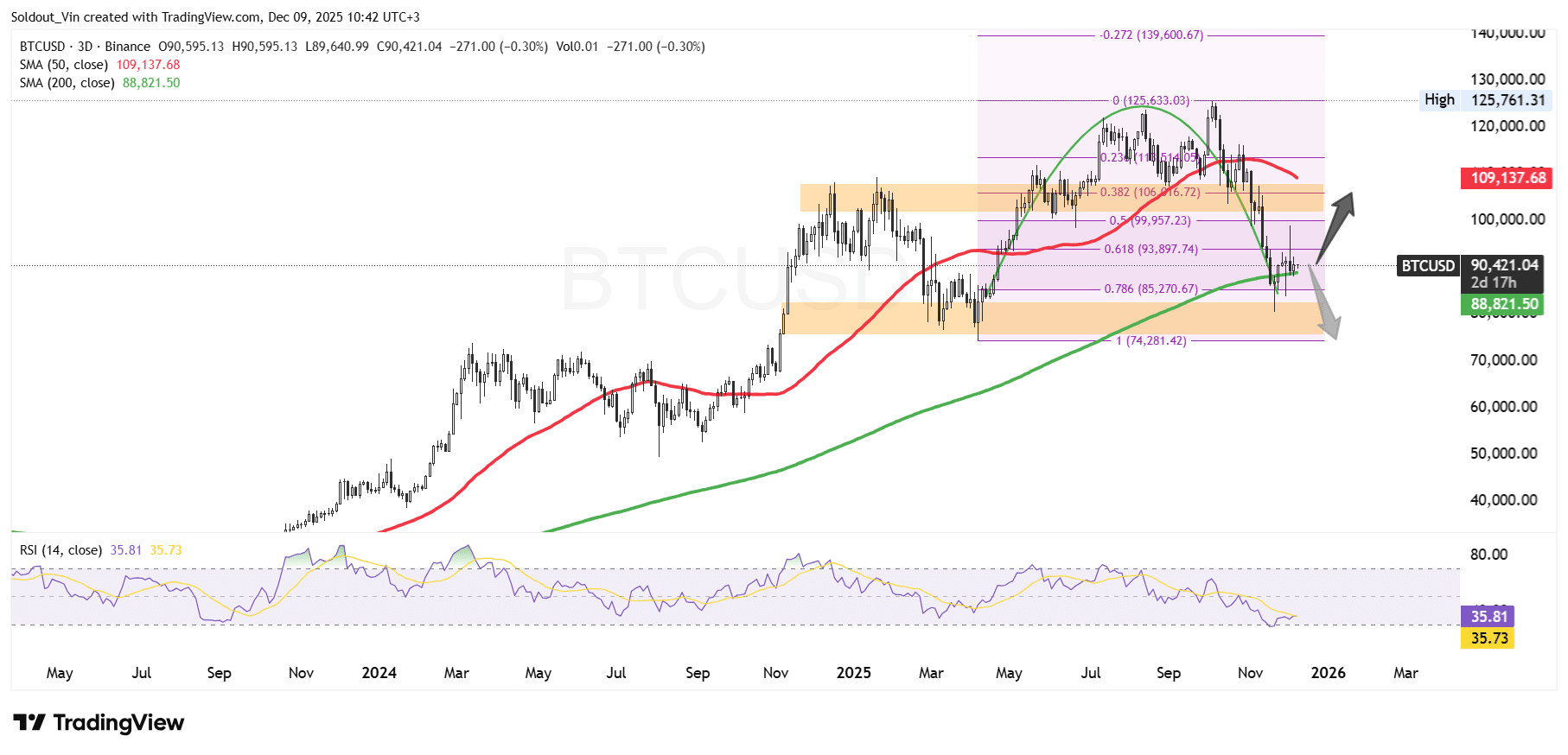

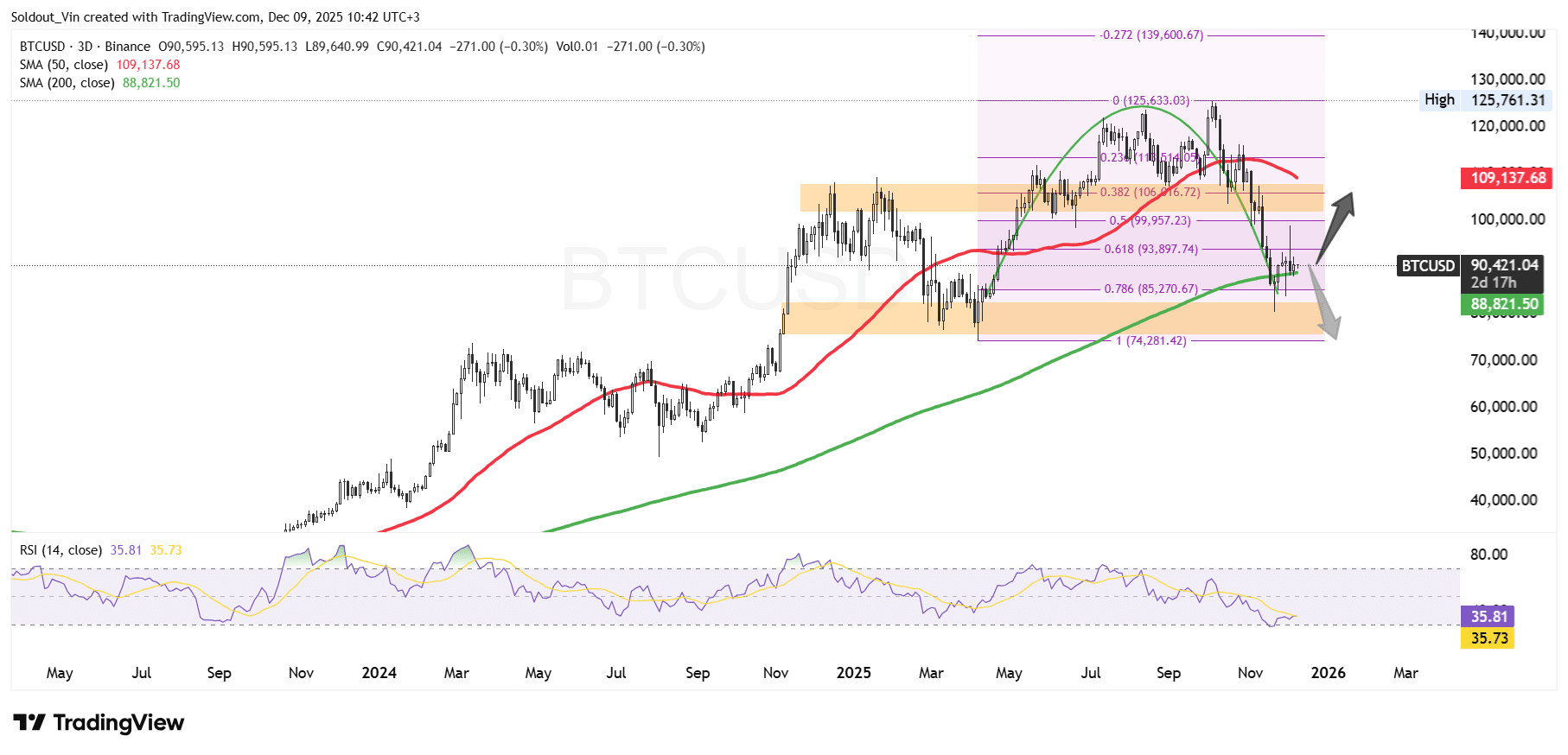

The BTC worth surged in 2025, reaching an all-time excessive of round $125,761 in October, in accordance with the Binance BTC/USD chart.

Nonetheless, sellers started reserving income after the numerous transfer, main the Bitcoin worth to type a bearish rounded high sample. This led to BTC’s worth breaching key assist ranges on the Fibonacci Retracement chart.

Thus far, the worth of Bitcoin trades effectively above the 0.786 Fib degree at $85,270 however beneath the 0.618 Fib degree at $93,897, as bulls set the worth up for a restoration.

BTC remains to be buying and selling above the 200 Easy Transferring Common (SMA) on the 3-day chart, suggesting bulls might regain full management of the asset. Nonetheless, the 50 SMA serves as the subsequent potential long-term resistance zone round $109,137.

In the meantime, the Relative Energy Index (RSI) seems to be recovering from the 30-oversold area to its present degree of 35, suggesting patrons could also be regaining management.

BTC Value Prediction

In accordance with the BTC/USD chart evaluation on the 3-day timeframe, BTC is sitting simply above the 200 SMA ($88,821), which is performing as rapid assist.

If patrons defend that degree, a rebound towards the 0.618 Fibonacci zone close to $94,000–$100,000 is feasible, with a stronger bullish extension focusing on the 50 SMA round $109,000.

A decisive breakout above that area might reopen the trail towards the earlier excessive close to $125,000.

Nonetheless, if the Bitcoin worth falls beneath the 200 SMA and fails to reclaim the 0.786 Fib degree ($85,200), draw back strain could intensify. In that state of affairs, the worth might revisit the decrease Fibonacci boundary close to $74,000, the place a bigger demand zone sits.

In accordance with Ali Martinez, an analyst on X, BTC could also be forming a bearish flag, inserting the opportunity of the crypto’s worth falling to the $70,000 assist zone.

Bitcoin $BTC: If it is a bearish flag, the goal is $70,000. pic.twitter.com/wI72dGQP6P

— Ali (@ali_charts) December 9, 2025

Total, the subsequent main transfer depends upon whether or not the worth of BTC can maintain above the 200 SMA on the 3-day chart and regain momentum towards the mid-Fibonacci cluster.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection