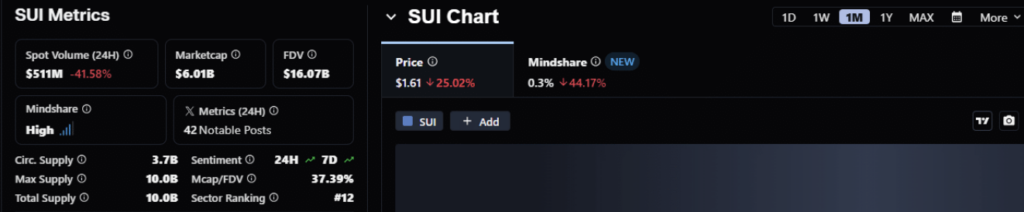

- Sui’s spot quantity dropped about 42% to $511M, displaying weaker short-term buying and selling momentum even because the long-term construction nonetheless leans bullish.

- ZenLedger’s new integration brings automated tax, accounting and audit instruments for SUI throughout 300+ exchanges and 40+ chains, boosting real-world usability.

- TVL stays regular round $923M whereas Open Curiosity jumped by $15M to about $747M, signaling cautious however rising curiosity from bigger gamers.

Sui is kinda drifting by way of a bizarre market part proper now, nearly prefer it’s caught between gears. Its spot buying and selling quantity immediately dipped onerous — roughly 42% — touchdown at about $511 million within the final 24 hours. Not nice. And truthfully, that drop says rather a lot about what short-term merchants are not doing. They’re pulling again, and the chart’s beginning to present these little cracks too.

The every day momentum that was increase only a few days in the past? Yeah… it’s fading a bit. However unusually sufficient, the larger long-term image nonetheless leans bullish for SUI, even when the close to time period feels kinda sluggish.

Nonetheless, even with the softer exercise, the Sui ecosystem simply bought a fairly significant improve — the sort that might shift vibes and perhaps, simply perhaps, nudge sentiment again in a greater course.

ZenLedger integration hits on the proper second

So, proper on time, Sui introduced by way of its official channels that ZenLedger is now integrating SUI into its platform. And this isn’t a small tweak. We’re speaking full-on tax automation, accounting options, audit workflows… the works. It covers 300+ exchanges and over 40 blockchains, making it one of the crucial full reporting stacks accessible to SUI customers proper now.

For an ecosystem making an attempt to push real-world usability and make buying and selling much less of a headache, this kinda improve couldn’t land at a greater second. Taxes are all the time a messy ache in crypto — everybody is aware of it — so fixing even a part of that friction makes SUI extra interesting for each common customers and greater institutional gamers.

Will higher utility get up the exercise?

Whereas upgrades like this are nice for long-term progress, merchants often react to faster-moving triggers: liquidity spikes, volatility, yield boosts, that form of stuff. And truthfully, SUI’s metrics aren’t precisely exploding in the mean time.

Whole Worth Locked has barely moved, slipping simply 1% within the final day to round $923 million. Which means capital within the ecosystem is holding regular… however not rising but. It’s a cautious stance from the market, not a vote of no confidence.

And even flat TVL isn’t a nasty factor — the quantity locked remains to be giant sufficient to provide long-term holders some consolation that SUI’s DeFi spine is strong.

On the institutional facet although, issues look a bit extra full of life. After the ZenLedger announcement, SUI’s Open Curiosity jumped by about $15 million inside a day. That bump pushed the full OI throughout all exchanges to roughly $747.78 million, which is a fairly first rate signal that larger gamers are paying consideration.

SUI’s in a wait-and-see zone

So proper now, SUI feels prefer it’s sitting at a type of crossroads the place fundamentals are enhancing however dealer participation is cooling off. The ZenLedger integration might assist re-ignite exercise — fewer complications often means extra confidence, and extra confidence typically results in extra buying and selling.

The long-term development nonetheless leans bullish, however within the quick run, merchants are most likely ready for both a rebound in spot quantity or recent liquidity inflows earlier than they decide to any robust transfer.

For now… it’s a endurance recreation. A barely awkward one, however nonetheless leaning optimistic.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.