Main crypto analyst Jacob Crypto Bury has weighed in on the present state of the cryptocurrency market, suggesting the trade’s multi-year bull cycle is ready to culminate.

Recognized for his important and data-driven commentary, Jacob Bury factors to an on-chain perspective indicating that Bitcoin is firmly positioned in a downtrend, a scenario he believes will result in a deeper correction within the coming yr earlier than a major bottoming-out section for digital property in 2026.

The 2026 Bear Market Outlook

In his newest market evaluation, Jacob Crypto Bury mentioned the potential for a protracted bear market taking maintain within the new yr.

Whereas acknowledging his long-term bullish view on the house, he highlighted the excessive probability that 2026 will see the market reset, following the historic four-year cycle sample for Bitcoin.

The analyst pointed on to a key technical indicator: the 50-week Transferring Common.

“If we’re down under the 50-week shifting common, successfully we’re in a downtrend. And that’s what we’re seeing proper now for Bitcoin. We’re under that 50-week shifting common. We’re in a downtrend. We’re not in a territory that feels bullish proper now.“

He famous that the 50-week shifting common is at the moment valued round $102,000. A failure to reclaim this stage would reinforce the bearish outlook.

This technical warning aligns together with his current public forecast for a major market drop. Jacob Bury not too long ago posted concerning the projected backside of the following cycle: “The trail is $60,648 for Bitcoin and $1,612 for Ethereum,” suggesting a significant correction from all-time highs will result in these decrease accumulation zones.

The analyst additional speculated on potential draw back targets for Bitcoin, indicating {that a} transfer towards the 200-week Exponential Transferring Common (EMA) may see the worth drop again to the $60,000 to $70,000 vary.

He famous this vary would symbolize a “very good accumulation vary” for long-term traders.

Insights into Bitcoin Holding Patterns

The pessimistic outlook on the near-term future is supported by the present sentiment and on-chain knowledge. The market’s general emotional state is considered one of “excessive concern,” with the Concern & Greed Index sitting at a low 25.

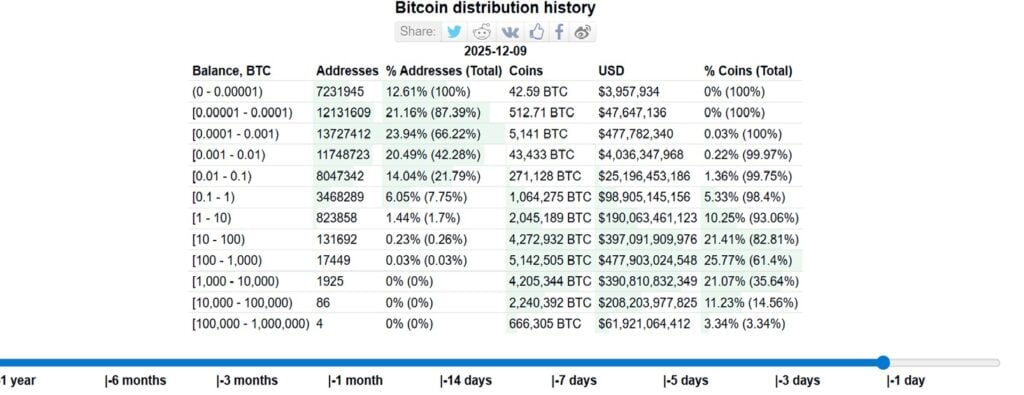

When it comes to on-chain exercise, Jacob Bury highlighted a curious pattern within the Bitcoin distribution historical past:

- Whales are Accumulating: The variety of addresses holding between 10,000 and 100,000 Bitcoin has elevated barely over the previous month.

- Retail is Promoting: Conversely, the variety of addresses holding between 1 to 10 Bitcoin has “drastically decreased,” dropping by about 6,000 addresses over a three-month interval, suggesting smaller retail holders are capitulating or taking earnings. These traits level to accumulation by bigger holders amid basic market warning.

Whereas these indicators level to heightened market stress within the close to time period, the broader atmosphere is concurrently seeing developments which will form a stronger long-term basis.

Regulatory and Business Developments

Regardless of the bearish technical and cycle forecast, Jacob Bury’s evaluation did contact on a number of bullish developments that present a robust long-term basis for the sector:

- Fee Reduce Hypothesis: Markets responded positively to expectations of a 50-basis-point fee minimize by the Federal Reserve, usually favorable for risk-on property like crypto.

- Institutional Adoption: UAE nationwide safety official Mohammed Al Shamsi said that “Bitcoin has grow to be the important thing pillar in the way forward for financing,” highlighting its rising institutional recognition alongside the position of mining because the community’s “beating coronary heart.”

- SEC Readability: The SEC’s closure of the Ondo case relating to tokenized property underneath new management indicators a possible shift towards better acceptance of tokenized securities in the USA.

In abstract, Jacob Crypto Bury is working with a break up thesis: long-term, he stays unequivocally bullish on the crypto house, however he cautions traders to organize for a multi-month interval of bearish stress resulting in a significant backside in 2026, which he views as the final word alternative for accumulation.

This text has been supplied by considered one of our business companions and doesn’t replicate Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate applications to generate revenues by way of the hyperlinks on this text.