Dogecoin traded quietly after the Federal Reserve delivered a broadly anticipated charge minimize, holding key assist as merchants assessed what simpler coverage means for danger property.

Information Background

- The Federal Reserve introduced a 25-basis-point minimize to its benchmark charge on Wednesday, decreasing the goal vary to three.5%–3.75%.

- Whereas the transfer marked the third minimize of the yr, policymakers signaled rising inner disagreement.

- Some members supported additional easing to guard a weakening labor market, whereas others warned that further cuts danger reigniting inflation pressures.

- The combined tone restricted rapid risk-on follow-through throughout markets, with crypto costs stabilizing quite than extending positive aspects.

- Towards this backdrop, Dogecoin continued to see regular on-chain engagement.

- Whale wallets accrued roughly 480 million DOGE over current periods, and buying and selling exercise remained elevated following the launch of spot DOGE ETFs from Grayscale and Bitwise.

- Nonetheless, ETF-related flows have to this point failed to provide sustained directional momentum.

Worth Motion Abstract

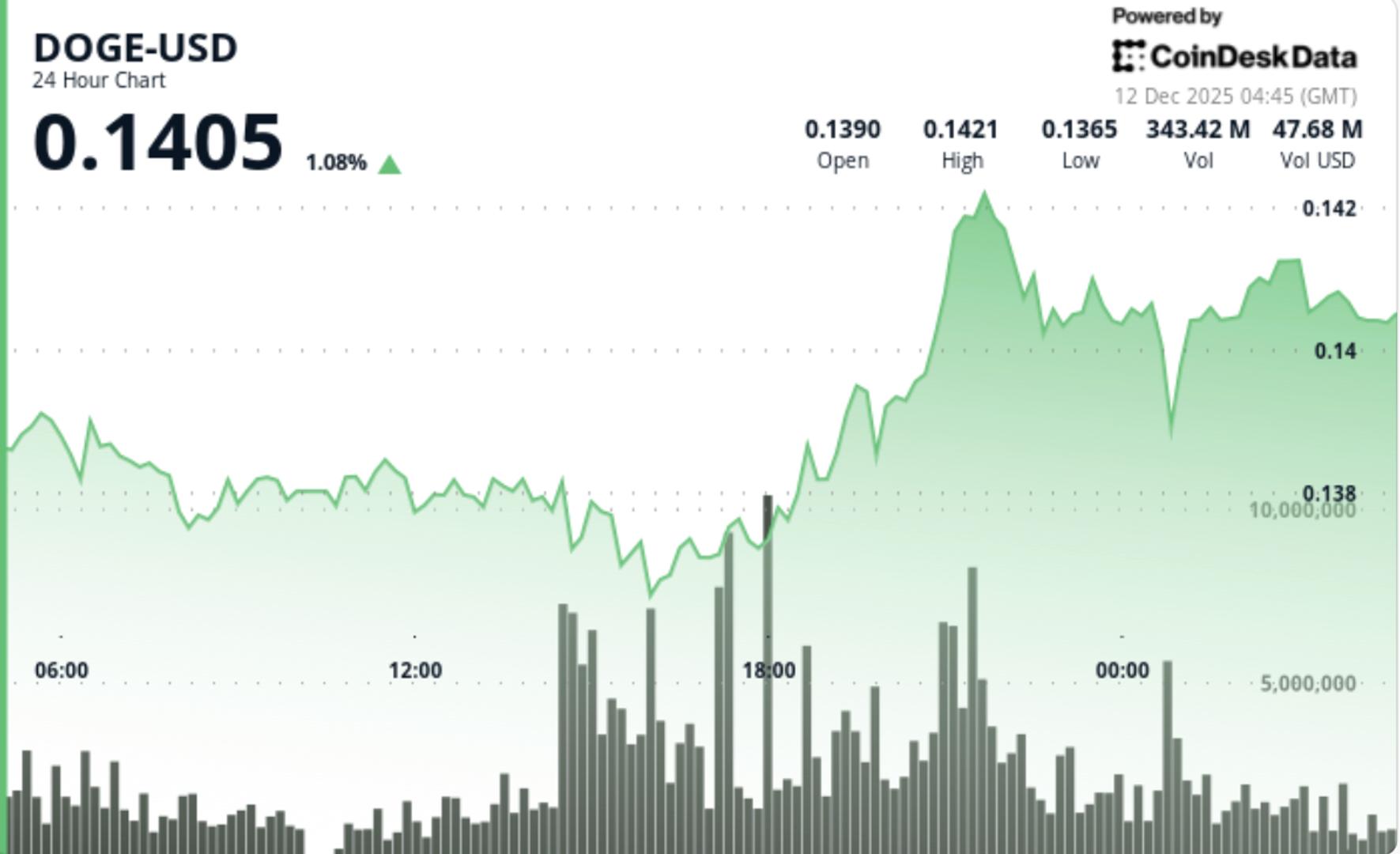

- DOGE rose 0.69% to round $0.1405 over the previous 24 hours, remaining firmly inside its multi-week $0.13–$0.15 consolidation vary.

- Worth moved between $0.1382 and $0.1408 through the session, reflecting restrained participation regardless of the macro catalyst.

- Buying and selling quantity reached roughly 651.7 million tokens, about 7% above the seven-day common, suggesting positioning quite than aggressive accumulation.

- Repeated makes an attempt to clear resistance close to $0.1425–$0.1430 had been rejected, whereas consumers continued to defend the $0.1380 space.

Technical Evaluation

- Technically, DOGE stays in a compression part. Horizontal assist close to $0.1380 has now held by way of a number of assessments, reinforcing its significance as a near-term ground.

- Momentum indicators stay impartial, according to range-bound situations quite than development improvement.

- The construction continues to resemble a pennant or volatility coil, implying {that a} sharper transfer is extra more likely to come from a breakout or breakdown than gradual drift.

- Till worth reclaims the higher boundary of the vary, upside makes an attempt are more likely to face promoting strain.

What Merchants Ought to Know

- With the Fed minimize now priced in and policymakers signaling uncertainty about additional easing, DOGE seems extra delicate to broader danger sentiment than to token-specific catalysts.

- Holding above $0.1380 retains the construction intact, however failure to reclaim $0.1420–$0.1450 suggests upside stays capped for now.

- A sustained break above that zone would open the door towards $0.16–$0.18, whereas a lack of $0.1380 would expose the decrease finish of the vary close to $0.13.

- For now, DOGE stays a consolidation commerce in a post-Fed, wait-and-see market.