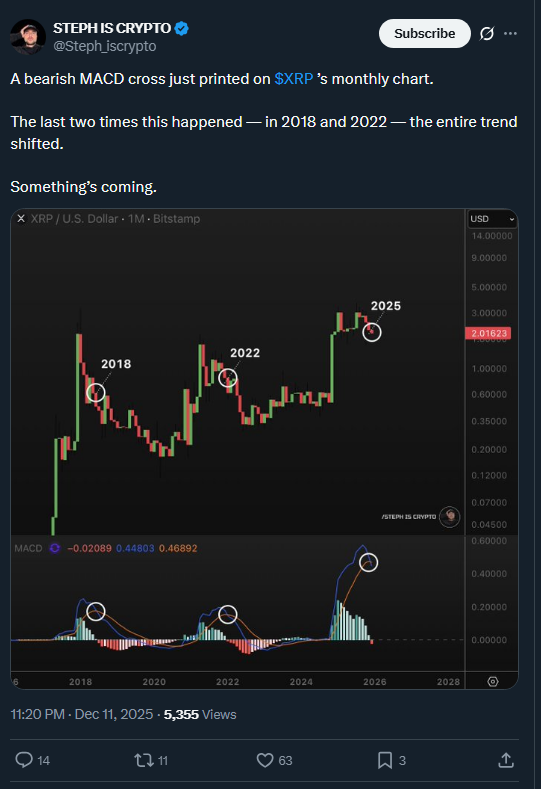

The month-to-month MACD cross prints of XRP present a bearish; the ETFs intention at 42.87 % of the liquid provide. The 2018 and 2022 traits point out a big reversal of pattern sooner or later.

The month-to-month technical indicators of XRP trigger flash alerts. The bearish MACD cross has simply emerged on the month-to-month charts. Steph_iscrypto on X says this can be a 2018 and 2022 association. These two previous occasions induced a full reversal of traits.

Supply: Steph_iscrypto

The forex is being traded when institutional demand is gaining pace. ETF merchandise grabbed near a billion {dollars} in 18 days. There are 5 spot ETF merchandise in operation on U.S. exchanges. The market construction is present process a change it has by no means seen earlier than because of the regulated merchandise.

Important modifications in momentum are introduced via technical evaluation. MACD crosses inside a month are additionally unusual. The indicator quantifies path modifications and power of the pattern. Previous bearish crosses had been these noticed in 2018 and 2022 adopted by a number of years of declines.

You may also like: XRP RSI Reset Alerts Bullish Setup as ETFs Close to $1B

The 42.87% Provide Goal Modifications The whole lot

ETF demand prioritizes liquid provide solely. On X, SMQKEDQG emphasised that 42.87% is the precise circulation of XRP. Combination provide deceives market individuals. Actual provide dynamics are outlined by the obtainable pool.

Supply: SMQKEDQG

Current ETFs are 0.75% of the overall provide. Such a proportion doesn’t seem massive on the outset. However ETFs draw solely on the 42.87% liquid pool. Each incremental provide narrows the market provide.

The arithmetic creates provide strain shortly. ETFs don’t require 100% of the combination provide. They’d simply must lower the 42.87% obtainable proportion. The liquid pool reduces as institutional inflows are made. Markets already form up provide strain at an early stage.

The OTC books maintain institutional liquidity. Institutional demand was beforehand cushioned by these reserves. OTC drains at the moment are consumed by ETFs at an accelerating tempo. The provision shock schedule condenses with the buildup enhance.

You may also like: XRP Coiling: Growth Section Imminent After Accumulation?

Historic Patterns Level to Volatility

The 2018 MACD cross was adopted by extended weak point. After that technical sign, XRP went down quite a bit. Throughout that point, market sentiment modified in direction of the acute. Comparable strain was produced within the 2022 cross.

The current market dynamics aren’t just like earlier levels. Product ETFs generate new sources of demand. Elevated institutional entry underneath regulation alters the standard dynamics. The issuers of ETFs report that the standard of inflows is extraordinarily excessive, and over 70% of the individuals are institutional traders.

Custodial accumulation accelerates the elimination of provide. Spot ETFs are thought-about to maintain the underlying asset in a deposit, the place every share purchased will result in the elimination of precise XRP in circulation. It’s a mechanism that contrasts with futures merchandise.