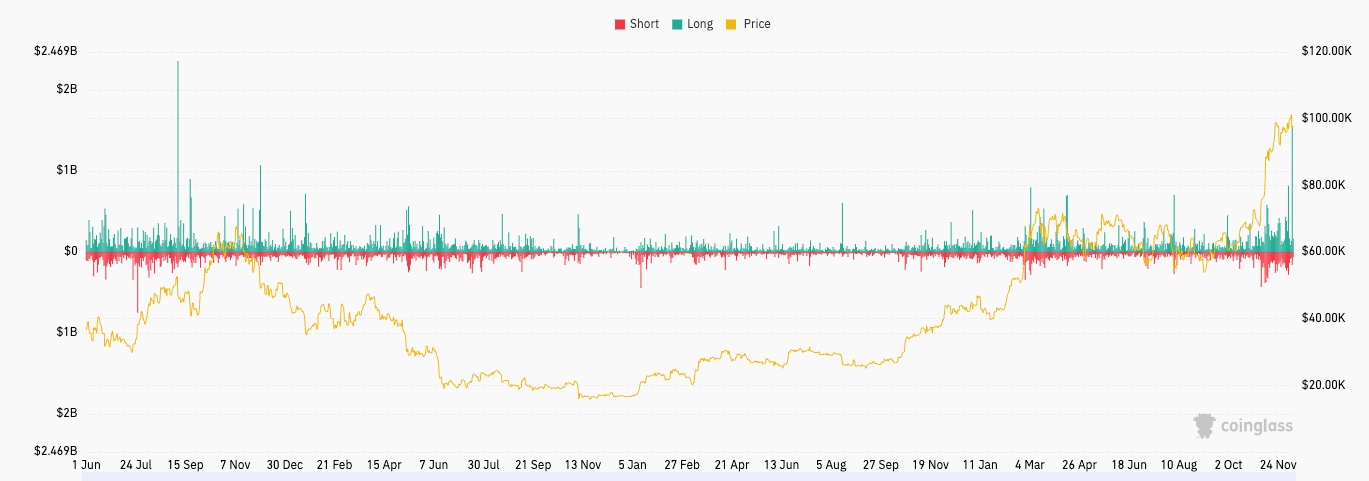

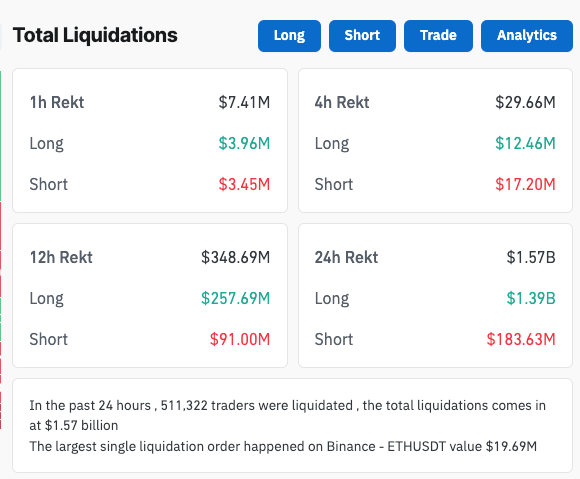

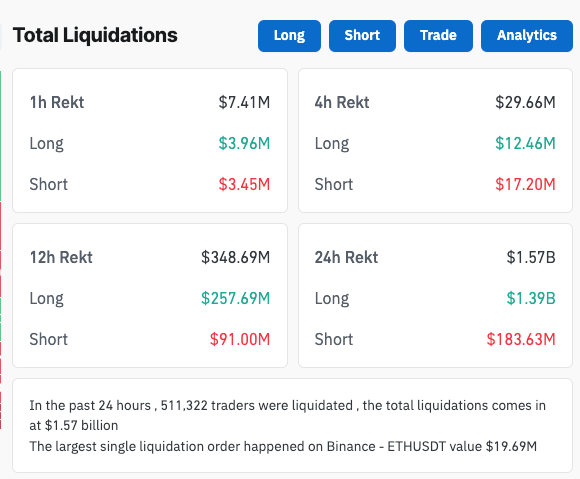

Up to now 24 hours, the crypto market noticed $1.57 billion in liquidations, the best recorded since September 2021.

Bitcoin’s drop beneath $97,000 led to $1.39 billion in longs being liquidated and simply $183.63 million in shorts. Such a excessive dominance of longs exhibits overconfidence amongst merchants anticipating Bitcoin’s value to rise previous $100,000 within the coming days.

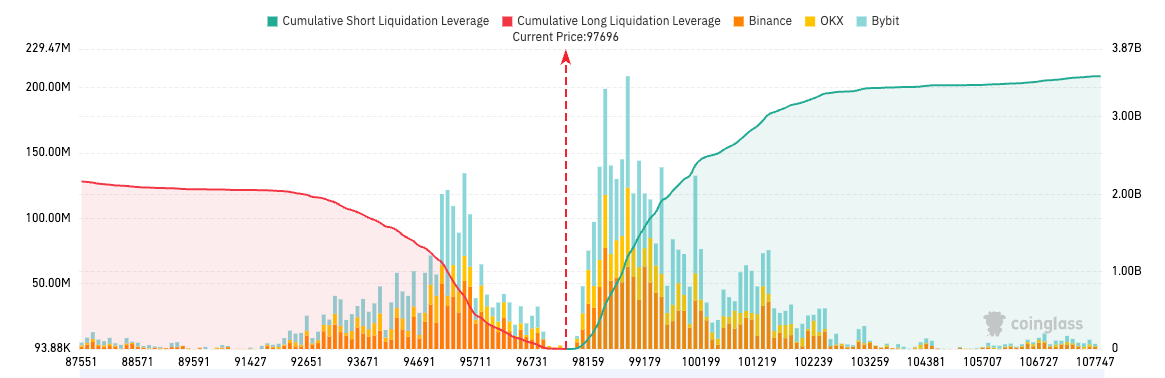

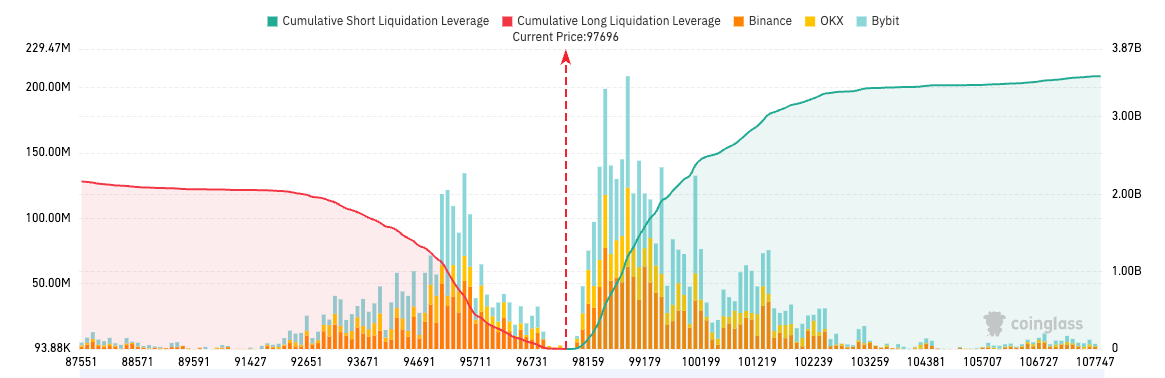

The liquidation heatmap from CoinGlass reveals concentrated liquidations across the $97,700 mark, which signifies that closely leveraged positions had been primarily clustered there.

The cumulative lengthy liquidation curve additionally steepens dramatically round this degree, exhibiting that $97,700 was a important help degree for leveraged longs. As soon as breached, it triggered cascading liquidations, additional amplifying the downward value motion that pushed BTC beneath $97,000. Shorts had been comparatively minor in contrast, with their curve remaining flat, exhibiting a scarcity of aggressive quick positioning at larger costs.

The 12-hour liquidation knowledge exhibits a considerable $91 million briefly liquidations, which occurred earlier throughout Bitcoin’s value rise earlier than the drop. This means that some merchants tried to quick a rally, solely to be liquidated as the value briefly surged earlier than falling.

The steep drop in leveraged lengthy positions at $97,000 suggests a possible short-term restoration as sell-side stress weakens.