Este artículo también está disponible en español.

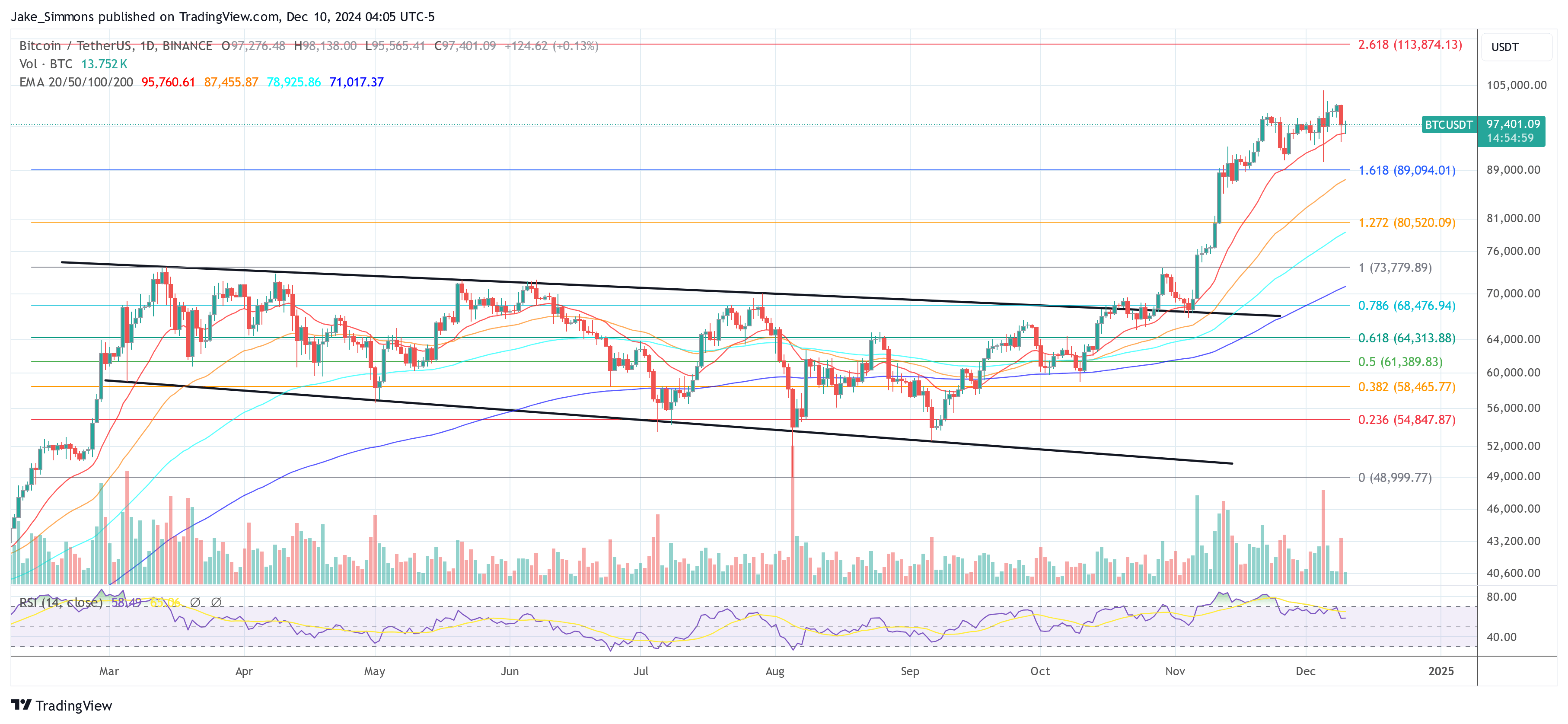

The broader crypto market skilled a serious crash on December 9. Whereas the Bitcoin value dropped from $101,109 to as little as $94,150, marking a -7% decline, the altcoin market suffered considerably extra extreme losses. Ethereum fell by as a lot as -12% at one level, XRP by -22%, Solana by -15%, Cardano by -23%, Dogecoin by -19%, and Shiba Inu by -25%.

In accordance with Coinglass information, greater than 562,000 merchants have been liquidated prior to now 24 hours, and complete liquidations reached $1.7 billion. The most important single liquidation order came about on Binance within the ETHUSDT pair, valued at $19.69 million. Of the $1.7 billion in complete liquidations, $1.55 billion concerned lengthy positions.

Notably, Bitcoin’s leverage flush was comparatively modest in comparison with that of altcoins, with $143 million in BTC longs liquidated. In contrast, ETH noticed $219 million in liquidations, SOL $57 million, DOGE $86 million, XRP $53 million, and ADA $22 million.

Throughout your complete crypto market, this represented the biggest leverage flush since April 2021, when a report $10 billion in crypto futures liquidations occurred in a single day. This surpassed the earlier report of $5.77 billion.

Associated Studying

Following the flush out, Bitcoin and most altcoins staged a pointy upward restoration, though they’ve but to return to their pre-crash ranges. Over the previous 24 hours, BTC remained down by -2.4%, ETH by -4.8%, XRP by -9.6%, SOL by -6.4%, and DOGE by -8.4%.

What Brought about The Crypto Market Crash?

In accordance with crypto analyst ltrd (@ltrd_), the underlying dynamic started with elevated promoting stress on Coinbase, the place merchants began promoting aggressively virtually an hour earlier than the key cascade. Though the final word plunge was triggered by a series response of liquidations, this extended promoting within the spot markets was crucial in pushing costs into zones the place overleveraged merchants had little alternative however to unwind.

Overheated funding charges and rising open curiosity ranges meant that when the preliminary cracks appeared, closely leveraged positions had no likelihood to flee. “How can we inform that the market was overheated? It’s easy—the Funding Price plus the rise in Open Curiosity. These two components are drivers of the present market and point out that persons are overleveraged,” ltrd defined.

When the market lastly broke down, its results have been uneven. Bitcoin displayed traits distinct from different devices, and Ethereum confirmed encouraging indicators of accumulation on the best way down, hinting {that a} main purchaser might have been benefiting from the chance.

But the actually astonishing developments occurred with XRP on Coinbase, the place, as ltrd put it, “You may see one thing loopy—the market impacts for XRP on Coinbase are mind-boggling. One thing completely unusual occurred. On a big, comparatively mature market, we witnessed a cascade of huge promote orders that brought about the market to drop by over 5%. We don’t know precisely what occurred, but it surely’s definitely uncommon.” Ltrd speculated that these monumental and irregular promote orders could have come from a major participant pressured to liquidate at any value.

Associated Studying

“It is perhaps price monitoring this example over the subsequent few days. Maybe a serious participant was pressured to promote as if there have been no tomorrow,” he mused. The consequence of such an occasion, even in supposedly deeper markets, was a swift crash that spilled over into perpetual swaps buying and selling elsewhere, triggering additional liquidations.

In accordance with ltrd, “When one thing like this occurs, it’s sometimes a cascade of unintentional orders. Market makers take in this promoting stress and hedge it, inflicting sign propagation throughout the exchanges.” Even large-cap altcoins like XRP, which have market caps on par with main US firms, nonetheless face liquidity constraints that change into obviously obvious underneath stress. “Relative to those market caps, the liquidity out there continues to be poor,” he famous, explaining how this contributes to the noticed volatility and the dramatic nature of such occasions.

As costs finally stabilized and started to bounce from their lowest factors, ltrd highlighted how this sample is frequent in overheated markets: “The following factor you all the time see in a sizzling market is a fast value reversal from the bottom level. There are an enormous variety of liquidations, restricted liquidity, and nonetheless many gamers in revenue who need to purchase the dip. Let’s see who comes out because the winner.”

Macro analyst Alex Krüger positioned your complete occasion right into a broader perspective. “Nothing’s modified. Count on costs to nonetheless go up,” he acknowledged, whereas noting that future situations, comparable to a pro-crypto US administration underneath Donald Trump, might set a extra constructive backdrop for digital property.

Though Krüger cited the opportunity of extra leverage flushes within the coming months, he considered these occasions as a normalizing pressure. “As we speak’s was a serious leverage flush out. Primarily for altcoins. Very regular in sizzling and extremely levered markets. That is how crypto baptizes newcomers and retains crypto natives disciplined,” Krüger mentioned, and added “By no means enjoyable to be caught lengthy in a leverage flush out. However that’s what that is. Funding again to the bottom line throughout the board. This time alts as properly. Count on just a few extra of this within the subsequent few months.”

At press time, Bitcoin traded at $97,401.

Featured picture from Shutterstock, chart from TradingView.com